Kenanga Research & Investment

Daily Technical Highlights – (CBIP, BPURI)

kiasutrader

Publish date: Thu, 10 Jan 2019, 08:39 AM

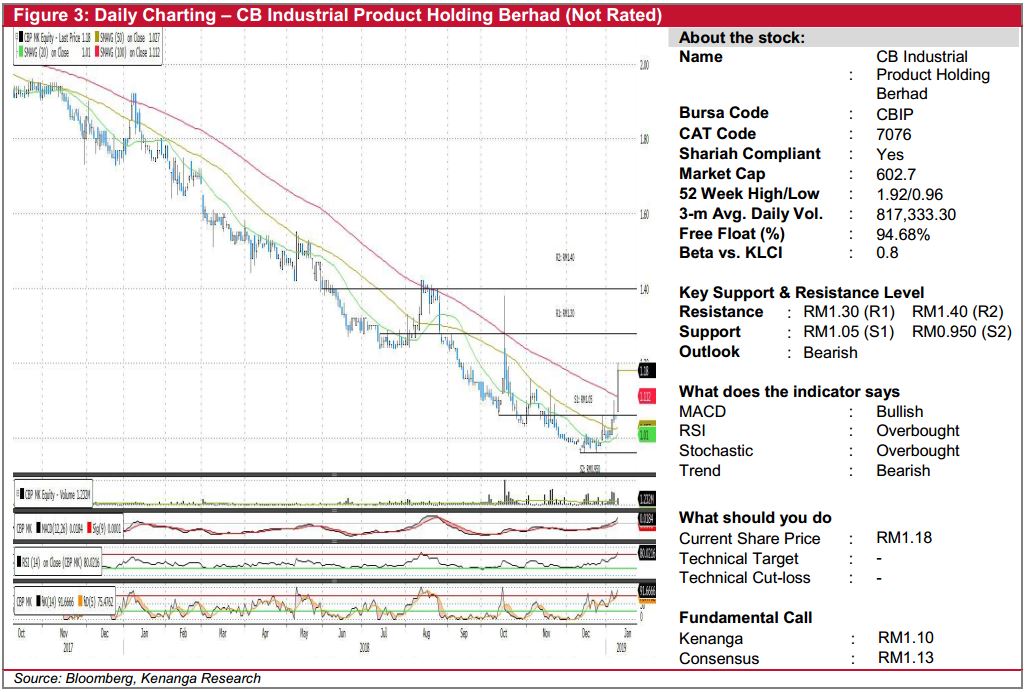

CBIP (Not Rated)

- CBIP gained 12.0 sen (+11.32%) to close at RM1.18.

- Technically, the share had been on a downtrend since November 2017. Despite yesterday’s gain, the underlying downtrend is still firmly intact.

- We also believe that yesterday’s move was overdone as both RSI and stochastic indicator are in the overbought zone.

- Expect the share to retrace back to its support level at RM1.05 (S1) and RM0.950 (S2).

- Should it be able to break above RM1.30 (R1) resistance level, we may then see a bullish run as next resistance is identified at RM1.40 (R2).

BPURI (Not Rated)

- BPURI surged 3.5 sen (+14.89%) to close at RM0.270 on the back exceptional trading volume with 22.7m shares exchanging hand-9 folds to its 20-day average.

- Yesterday’s close indicates a breakout from its prior resistance level of RM0.250 resulting in a bullish “Marubozu” candlestick.

- Technical outlook appears positive at this juncture underpinned by encouraging momentum indicators as displayed by the bullish MACD and strong upwards trending seen in RSI and Stochastic.

- We look towards RM0.275 (R1) with a decisive breakout will see the share advancing towards RM0.300 (R2).

- Conversely, immediate support can be at RM0.215 (S1), and further down at RM0.200 (S2).

Source: Kenanga Research - 10 Jan 2019

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

More articles on Kenanga Research & Investment

Discussions

Be the first to like this. Showing 0 of 0 comments