Kenanga Research & Investment

Daily Technical Highlights – (GAMUDA, PRTASCO)

kiasutrader

Publish date: Wed, 16 Jan 2019, 11:47 AM

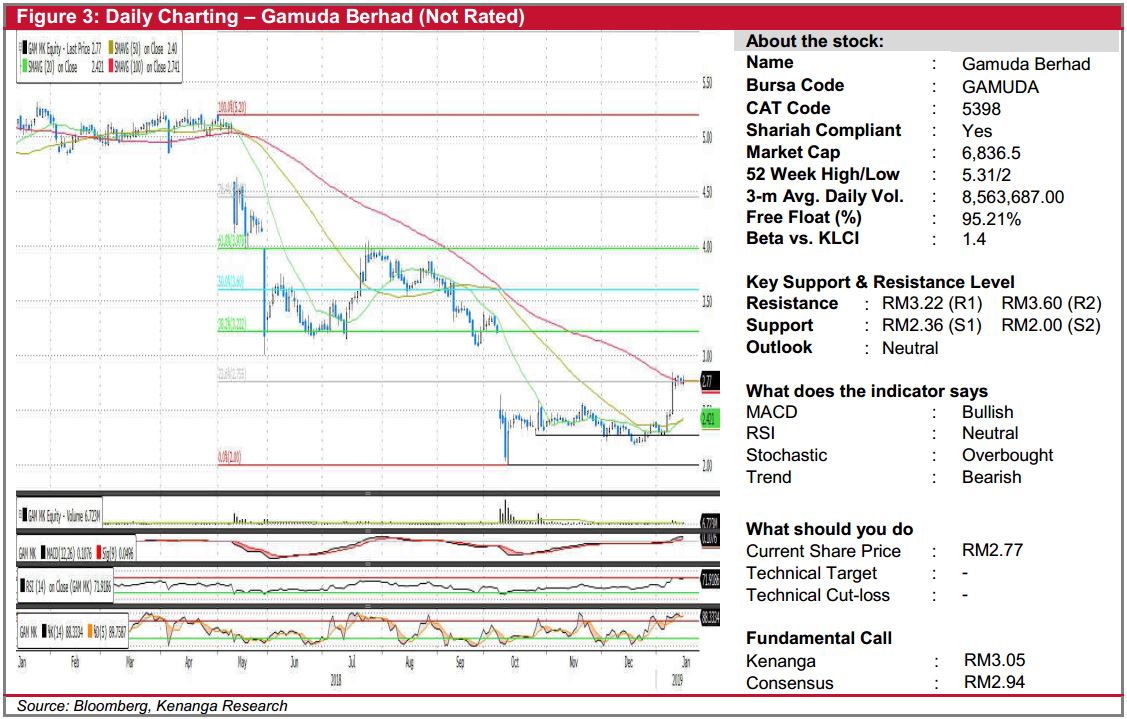

GAMUDA (Take Profit @ RM2.77)

- GAMUDA gained 1.0 sen (+0.36%) to close marginally higher at RM2.77 yesterday.

- Since our ‘Trading Buy’ call in Oct-2018, the share has plateaued and has just recent seen a rally in early January, reaching a high of RM2.84.

- We observe that the share is testing its 100-day SMA for the first time since breaking below it in May-2018 and therefore, we expect some form of resistance. Coupled with both RSI and Stochastic indicators near overbought levels, we opt to take profit for now to lock in our gain of 14.5%.

- Should buying momentum continue, we look towards RM3.22 (R1) and RM3.60 (R2) as resistance levels. Conversely, support levels can be identified at RM2.36 (S1) and RM2.00 (S2) which could serve as attractive re-entry points.

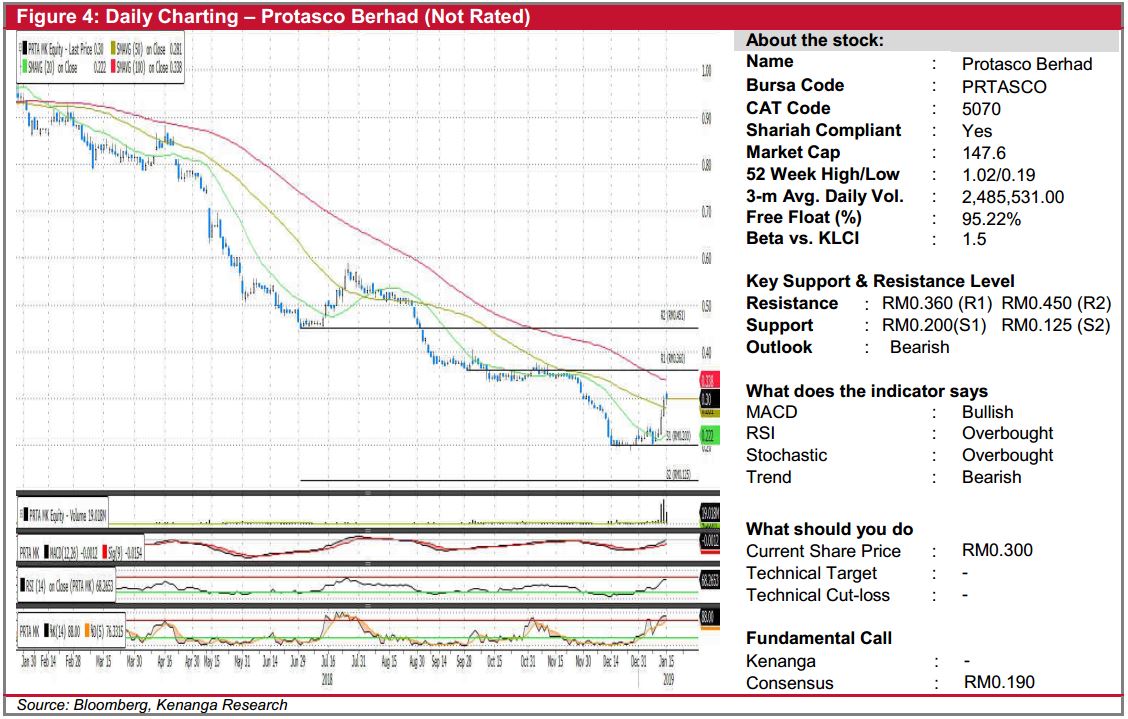

PRTASCO (Not Rated)

- PRTASCO rose 0.5 sen (+1.70%) to close at RM0.300 yesterday.

- Chart-wise, despite closing higher yesterday, we note that the share is about to test its 100-day SMA, which has historically shown to be a sturdy resistance.

- Both stochastic indicators and RSI are hovering near the overbought levels. As the share rarely trades above overbought RSI levels, we believe there may be limited upside possibilities.

- Should buying momentum continue, resistance levels can be found at RM0.360 (R1) and RM0.450 (R2). Meanwhile, support levels can be identified at RM0.200 (S1) and RM0.125 (S2)

Source: Kenanga Research - 16 Jan 2019

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

Market Buzz

2024-11-26

GAMUDA2024-11-26

GAMUDA2024-11-25

GAMUDA2024-11-25

GAMUDA2024-11-25

GAMUDA2024-11-23

GAMUDA2024-11-22

GAMUDA2024-11-22

GAMUDA2024-11-22

GAMUDA2024-11-22

GAMUDA2024-11-21

GAMUDA2024-11-21

GAMUDA2024-11-21

GAMUDA2024-11-20

GAMUDA2024-11-20

GAMUDA2024-11-20

GAMUDA2024-11-20

GAMUDA2024-11-19

GAMUDA2024-11-19

GAMUDA2024-11-19

GAMUDA2024-11-19

GAMUDA2024-11-19

GAMUDA2024-11-18

GAMUDA2024-11-18

GAMUDA2024-11-18

GAMUDA2024-11-18

GAMUDA2024-11-15

GAMUDA2024-11-15

GAMUDA2024-11-15

GAMUDA2024-11-15

GAMUDAMore articles on Kenanga Research & Investment

Discussions

Be the first to like this. Showing 0 of 0 comments