Kenanga Research & Investment

Daily Technical Highlights – (DIALOG, INARI)

kiasutrader

Publish date: Thu, 07 Feb 2019, 10:27 AM

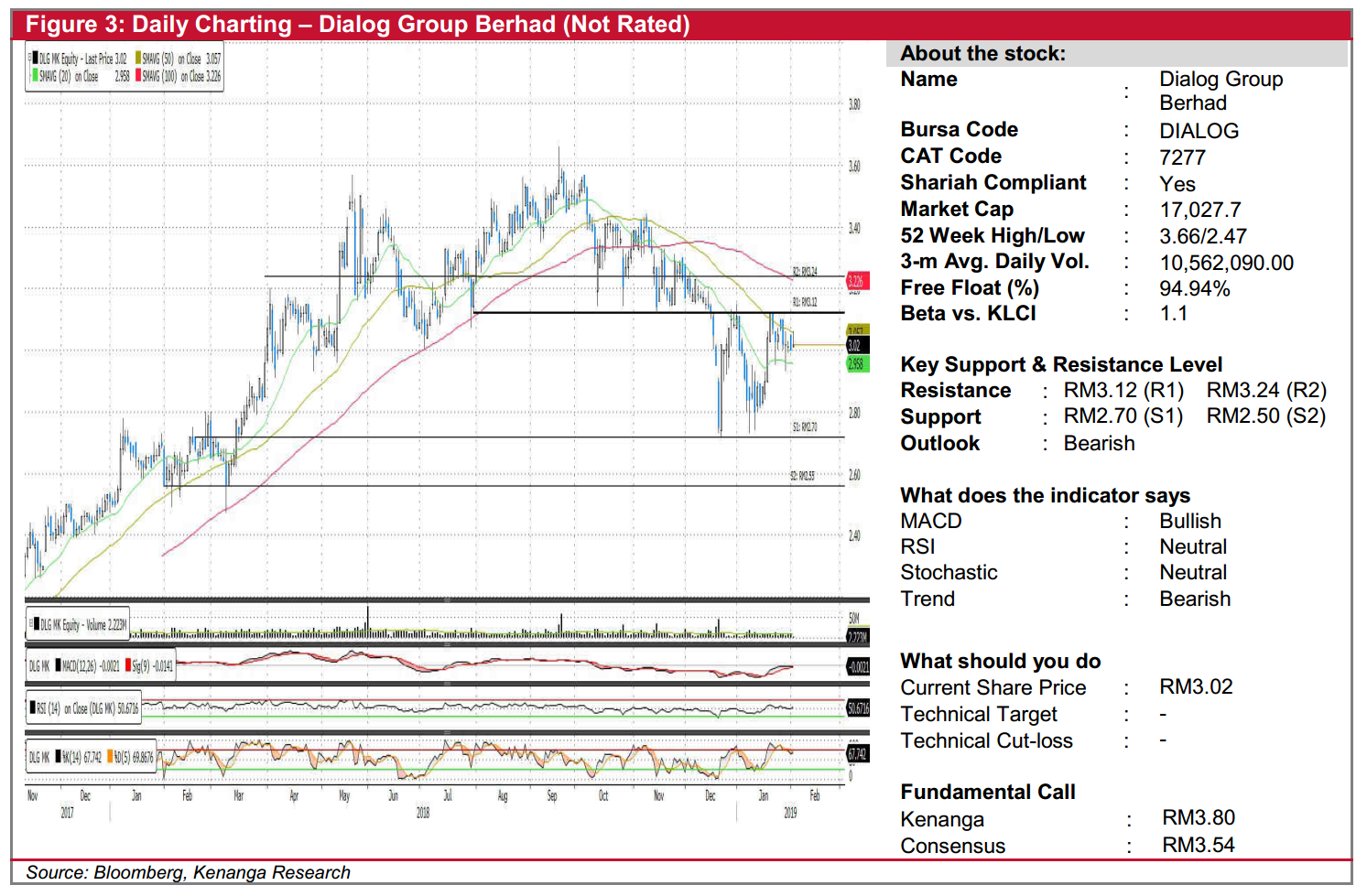

DIALOG (Not Rated)

- DIALOG rose 2.0 sen (+0.67%) to close at RM3.02.

- Chart-wise, the share failed to close above its 50-day SMA. We note that the share is currently trading below its 50 and 100- day SMAs, which have proven to be key levels.

- Shorter-term SMAs are also trading below longer-term SMAs which indicate that the downtrend is still intact. Coupled with lacklustre key momentum indicators, we believe that there may be a further downside.

- Immediate support levels can be identified at RM2.70 (S1) and RM2.55 (S2). Conversely, resistance levels can be found at RM3.12 (R1) and RM3.24 (R2).

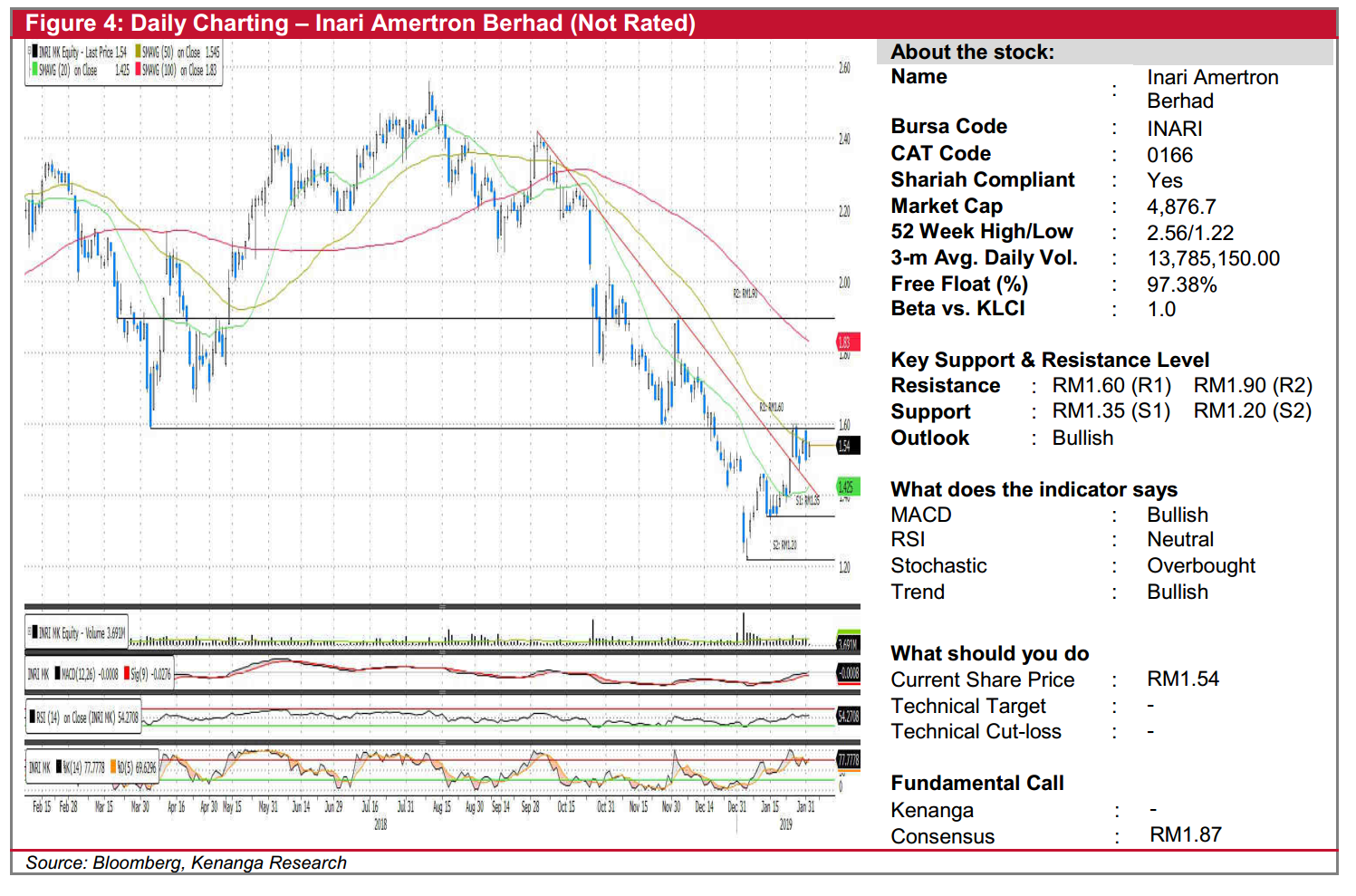

INARI (Not Rated)

- INARI gained 4.0 sen (+2.67%) on Monday to close at RM1.54.

- Chart-wise, the share has been on a downtrend from October 2018, hitting a low of RM1.23 in early January 2019 before rebounding over the past 3 weeks.

- Overall technical outlook appears bullish as it has seemingly broken out from the downtrend while key momentum indicators are all positive.

- Expect INARI to test its immediate resistance at RM1.60 (R1) where a break above will see next overhead resistance at RM1.90 (R2).

- Conversely, downside support can be found at RM1.35 (S1) and RM1.20 (S2).

Source: Kenanga Research - 7 Feb 2019

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

Market Buzz

2024-11-26

DIALOG2024-11-26

INARI2024-11-25

INARI2024-11-22

DIALOG2024-11-22

DIALOG2024-11-21

DIALOG2024-11-21

DIALOG2024-11-21

INARI2024-11-20

DIALOG2024-11-20

DIALOG2024-11-20

DIALOG2024-11-20

DIALOG2024-11-20

DIALOG2024-11-20

DIALOG2024-11-20

DIALOG2024-11-20

DIALOG2024-11-20

INARI2024-11-19

DIALOG2024-11-19

INARI2024-11-18

DIALOG2024-11-18

INARIMore articles on Kenanga Research & Investment

Discussions

Be the first to like this. Showing 0 of 0 comments