Kenanga Research & Investment

Daily Technical Highlights – (AWC, DAYANG)

kiasutrader

Publish date: Tue, 26 Feb 2019, 09:42 AM

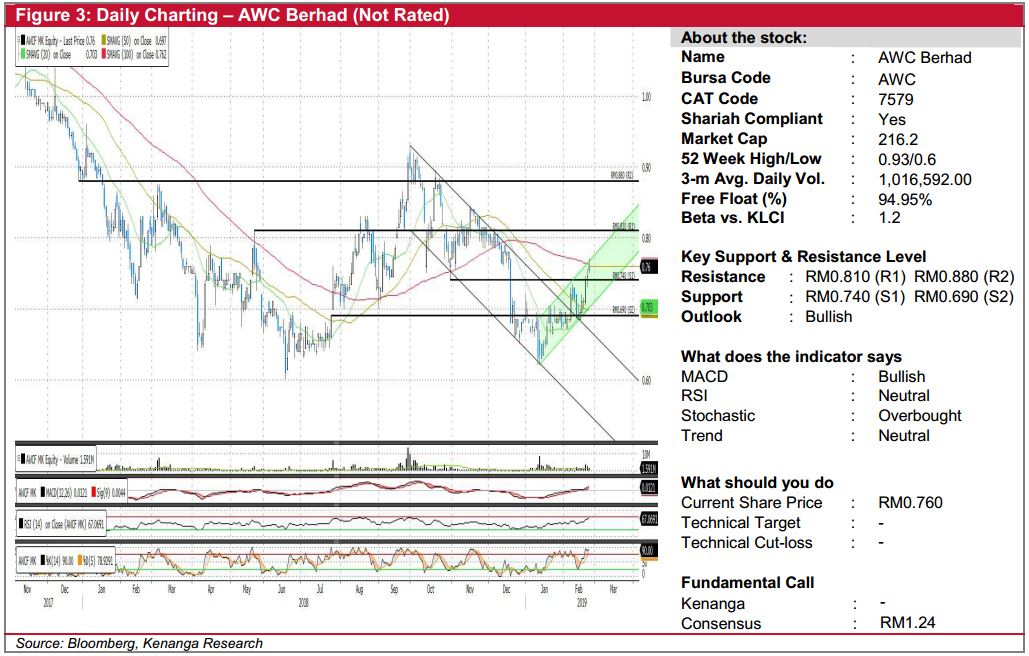

AWC (Not Rated)

- AWC gained 1.5 sen (+2.01%) to close at RM0.760 yesterday, backed by above-average trading volume.

- From a technical perspective, the share is currently trading within an ascending channel after breaking out from a 4-month descending channel in early-Feb. More notably, yesterday’s move saw the share inching closer to the 100-day SMA indicating strong buying interest.

- Positive upticks in key momentum indicators lead us to believe that there could be more room for upside. Thus, we may consider a “Trading Buy”, should AWC break above its key 100-day SMA.

- From here, we expect AWC to test its resistance at RM0.810 (R1) where a break above it would see a further rally to RM0.880 (R2).

- Immediate downside support is at RM0.740 (S1), failing which further support is located at RM0.690 (S2) below.

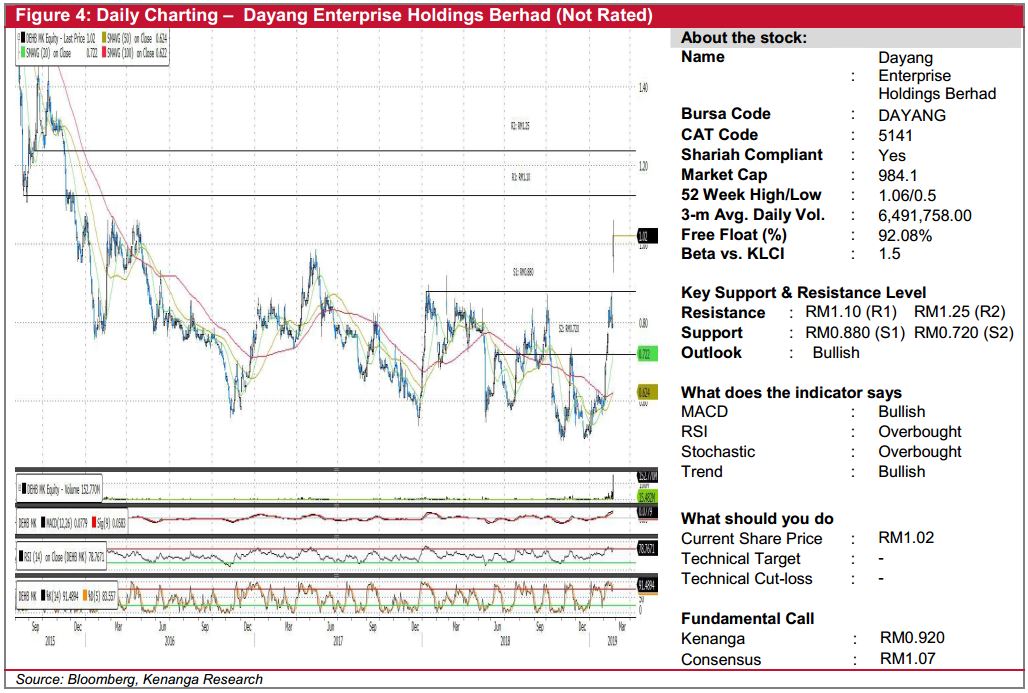

DAYANG (Not Rated)

- DAYANG rallied 22.5 sen (+28.30%) to close at RM1.02, after reporting stronger earnings that beat market’s expectations.

- Despite the longer-term technical outlook appearing very bullish, we believe the recent share price movement was overdone as both RSI and stochastic indicators are in the overbought zone.

- We think that the share is likely to retrace over the next few days to its support levels at RM0.880 (S1) before continuing its uptrend towards the RM1.10 (R1) and RM1.25 (R2) resistance levels.

- A break below S1, however, will be deemed highly negative as the next support level is found at RM0.720 (S2).

Source: Kenanga Research - 26 Feb 2019

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

More articles on Kenanga Research & Investment

Discussions

Be the first to like this. Showing 0 of 0 comments