Kenanga Research & Investment

Daily Technical Highlights – (PADINI, ANNJOO)

kiasutrader

Publish date: Fri, 01 Mar 2019, 11:13 AM

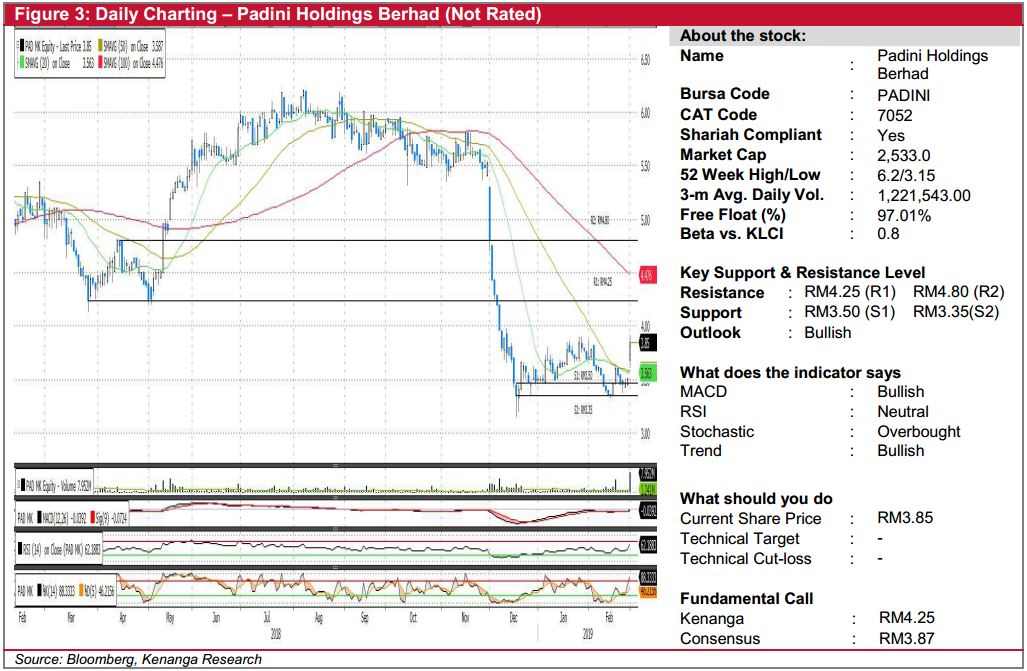

PADINI (Not Rated)

- Yesterday, PADINI rose 34 sen (+9.69%) to close at RM3.85.

- Chart-wise, the share seems to be undergoing a bullish momentum as evidenced by the formation of three consecutive white candle sticks for the past few days.

- Notably, the share decisively closed above its 20-day and 50-day SMAs yesterday, likely posing for more upside possibilities.

- Expect the share to test resistance at RM4.25 (R1) and RM4.80 (R2).

- Conversely, downside risks are identified at RM3.50 (S1) and RM3.35 (S2).

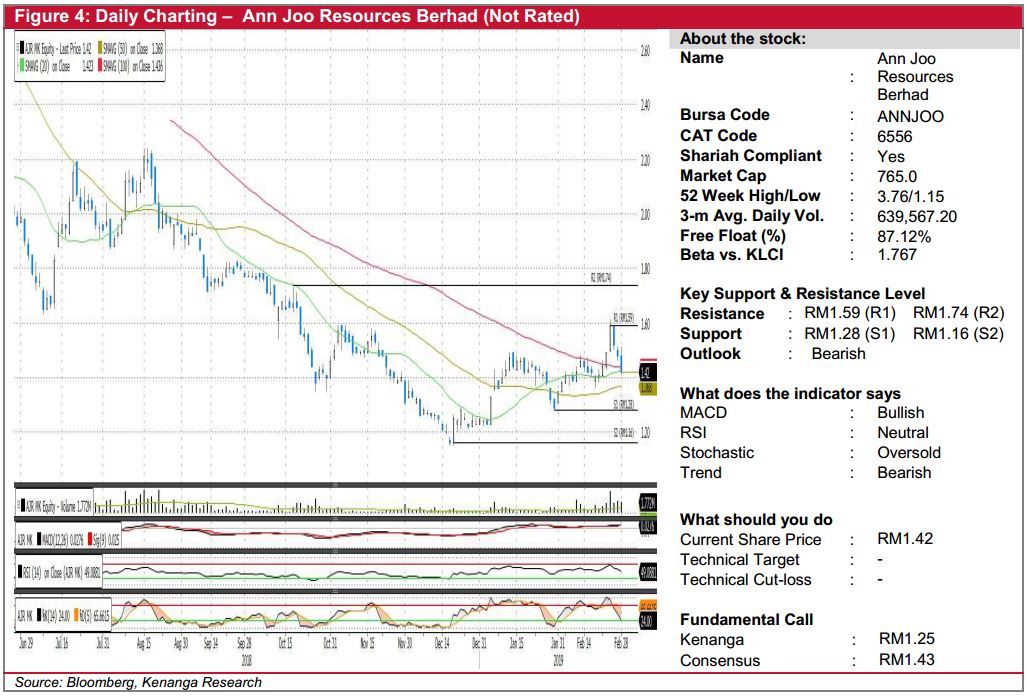

ANNJOO (Not Rated)

- ANNJOO fell 6 sen (-4.05%) to close at RM1.42 yesterday.

- After trading lower for three consecutive days, the share finally close below its 20-day and 100-day SMAs yesterday, possibly signalling more downwards sentiment.

- Should selling momentum persist, it is expected that the share to only find supports at RM1.28 (S1) and RM1.16 (S2).

- Conversely, resistance levels can be identified at RM1.59 (R1) and RM1.74 (R2).

Source: Kenanga Research - 1 Mar 2019

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

More articles on Kenanga Research & Investment

Discussions

Be the first to like this. Showing 0 of 0 comments