Kenanga Research & Investment

Daily technical highlights – (INARI, SEACERA)

kiasutrader

Publish date: Thu, 07 Mar 2019, 09:48 AM

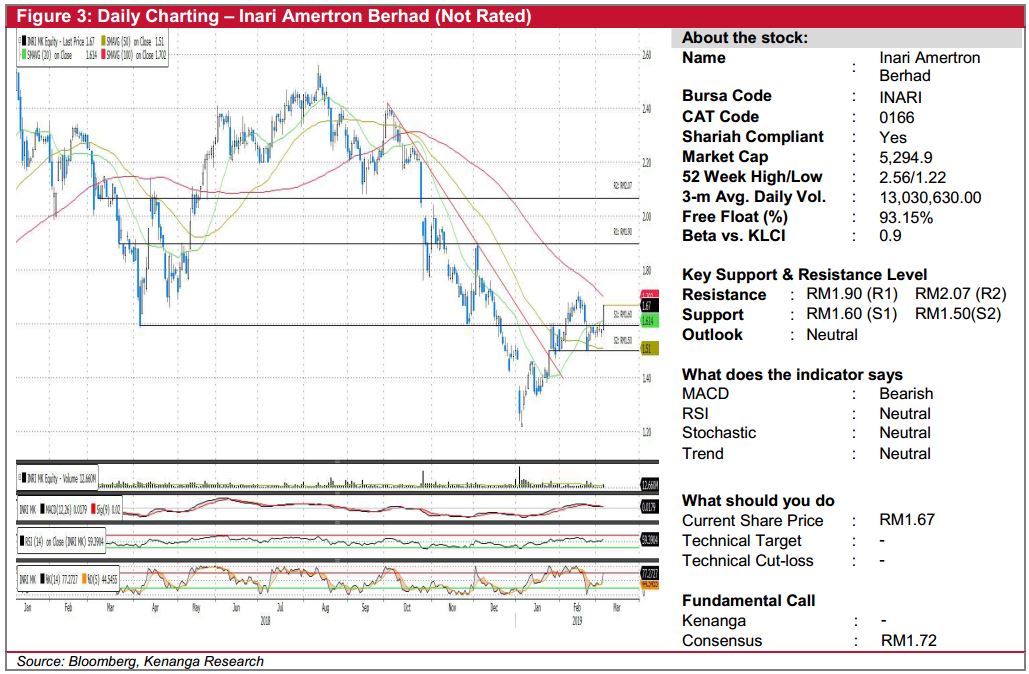

INARI (Not Rated)

- INARI gained 9.0 sen (5.70%) to close at RM1.67 yesterday.

- Chart-wise, the share formed a long bullish candlestick to close above its 20-day SMA indicating buying interest. The share seems to be hovering close to its 100-day SMA, which represents a key level. Key momentum indicators are also showing increasing positive signals.

- Should buying momentum continue, we expect the share to continue higher to test its first resistance at RM1.90 (R1) and further at RM2.07 (R2), should the first level be taken out.

- Conversely, any downside bias should see support at RM1.60 (S1) and further below at RM1.50 (S2).

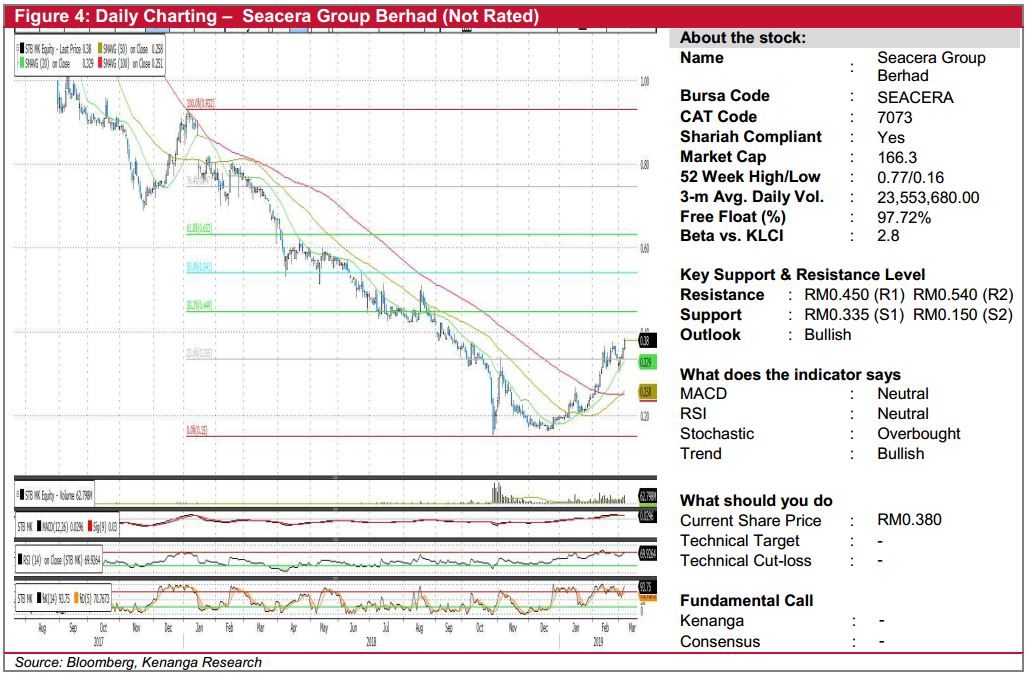

SEACERA (Not Rated)

- SEACERA rose 2.0 sen (+5.56%) to close at RM0.380 yesterday.

- The share continues to display bullish momentum after the formation of a “Golden Cross” a few days back when its 50-day SMA crossed above 100-day SMA.

- Notably, the share has been trading on the back of stronger-than-average trading volume.

- Should the buying momentum persist, we expect the share to test resistance at RM0.450 (R1) and RM0.540 (R2).

- Conversely, downside supports are identified at RM0.335 (S1) and RM0.150 (S2).

Source: Kenanga Research - 7 Mar 2019

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

More articles on Kenanga Research & Investment

Discussions

Be the first to like this. Showing 0 of 0 comments