Kenanga Research & Investment

Daily technical highlights – (SENDAI, ORNA)

kiasutrader

Publish date: Tue, 12 Mar 2019, 08:53 AM

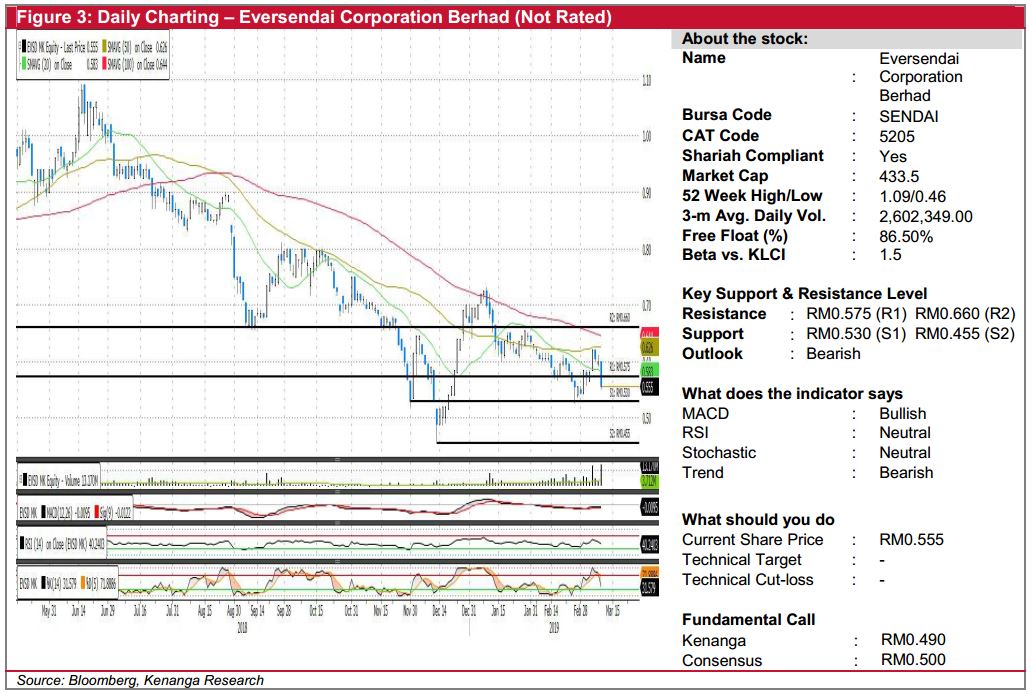

SENDAI (Not Rated)

- SENDAI fell 4.5 sen (-7.50%) yesterday to close at RM0.555 on higher-than-average trading volume.

- Chart-wise, the share formed a long bearish candlestick which decisively broke below its 20-day SMA after a failed test of its 50-day SMA, which indicates the possibility of a downtrend continuation.

- Coupled with lacklustre signals from key momentum indicators, we believe the share could potentially head lower.

- Should selling pressure continue, we believe that RM0.530 (S1) and RM0.455 (S2) should offer some supports.

- Conversely, any upside should see resistances at RM0.575 (R1) and RM0.660 (R2).

ORNA (Not Rated)

- ORNA increased by 3.0 sen (+2.91%) to close at RM1.06 yesterday.

- Technically, yesterday’s bullish candlestick could suggest a trend reversal.

- Momentum indicators appear encouraging as displayed by the MACD bullish crossover and minor upticks seen in RSI and Stochastic.

- From here, follow-through buying may bring the share to meet resistance at RM1.10 (R1) with a decisive take down will see the index on a higher note at RM1.20 (R2).

- However, failure to do so, the share may retreat back to immediate support level RM1.00 (S1) and RM0.880 (S2) further down.

Source: Kenanga Research - 12 Mar 2019

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

More articles on Kenanga Research & Investment

Discussions

Be the first to like this. Showing 0 of 0 comments