Kenanga Research & Investment

Daily Technical Highlights – (ASDION, STAR)

kiasutrader

Publish date: Thu, 21 Mar 2019, 10:11 AM

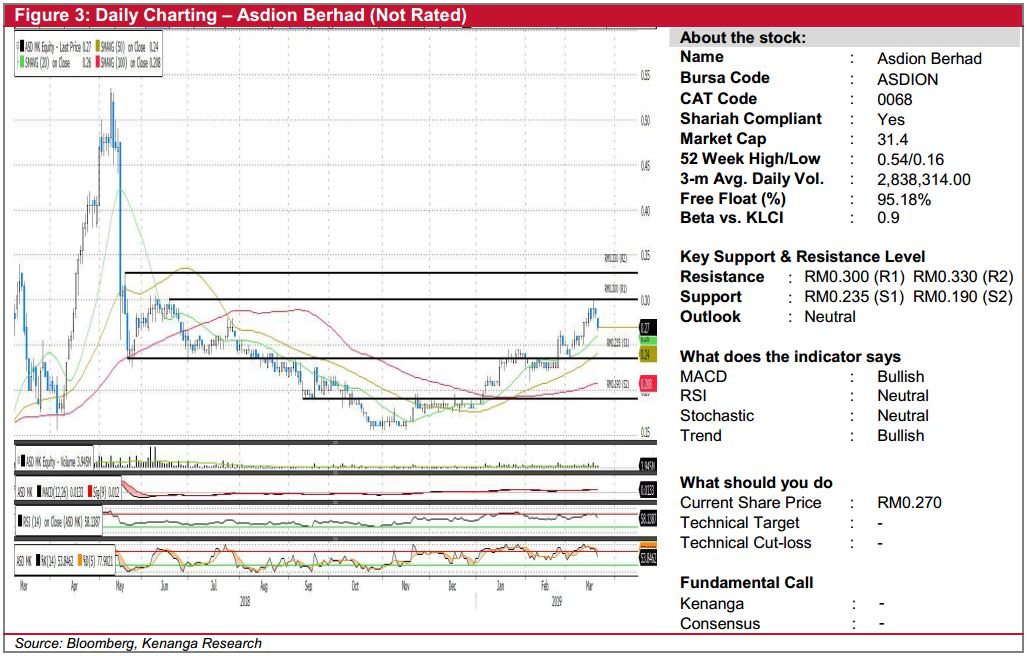

ASDION (Not Rated)

- ASDION fell 1.5 sen (-5.26%) to close at RM0.270 yesterday.

- Chart-wise, we observed that ASDION could be entering into a declining trend after a “Doji” candlestick on Monday. We believe there may be more downsides as key momentum indicators like RSI and Stochastic have started coming off from overbought levels.

- Should selling momentum persist, we expect the share to head lower with support levels identified at RM0.235 (S1) and further below at RM0.190 (R2). Conversely, resistance levels can be seen at RM0.300 (R1) and RM0.330 (R2).

STAR (Not Rated)

- STAR gained 2.0 sen (+2.53%) to close at RM0.810 yesterday.

- Notably STAR technical picture is now improving with price currently hovering above all key SMAs.

- Momentum indicators appear leaning on the upside as displayed by the upward trending in MACD and minor upticks seen in RSI and Stochastic.

- Should follow through-buying continue, we expect the share to trend towards RM0.900 (R1) with a decisive breakout seeing higher resistance towards RM1.00 (R2).

- Conversely, immediate support level can be found at RM0.775 (S1) and RM0.620 (S2) further down.

Source: Kenanga Research - 21 Mar 2019

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

Market Buzz

More articles on Kenanga Research & Investment

Bond Market Weekly Outlook - Local yields may rise moderately ahead of US jobs report

Created by kiasutrader | Nov 29, 2024

- Ringgit Weekly Outlook Fairly balanced risks, but potential USD rebound looms over risk assets

Created by kiasutrader | Nov 29, 2024

Discussions

Be the first to like this. Showing 0 of 0 comments