Kenanga Research & Investment

Daily Technical Highlights – (INARI, DBHD)

kiasutrader

Publish date: Fri, 22 Mar 2019, 09:04 AM

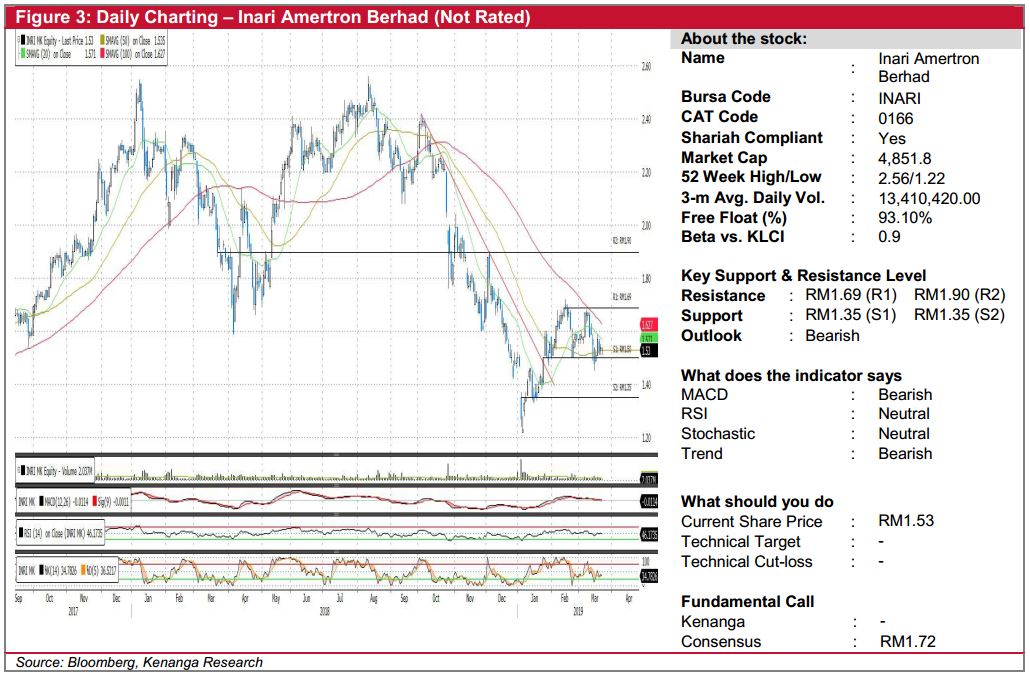

INARI (Not Rated)

- INARI slipped 1.0 sen (-0.65%) to close at RM1.53 yesterday.

- Chart-wise, INARI seems to be undergoing a consolidation after a short rally in Jan-19. We note that it is still trading below its 100-day SMA, which has proven to be a key level. Until INARI breaks above its 100-day SMA, we believe it could continue lower given lacklustre signals from key momentum indicators.

- Support levels can be identified at RM1.50 (S1) and lower at RM1.35 (S2), should the first support level be taken out.

- Conversely, we look towards RM1.69 (R1) and RM1.90 (R2) as resistances.

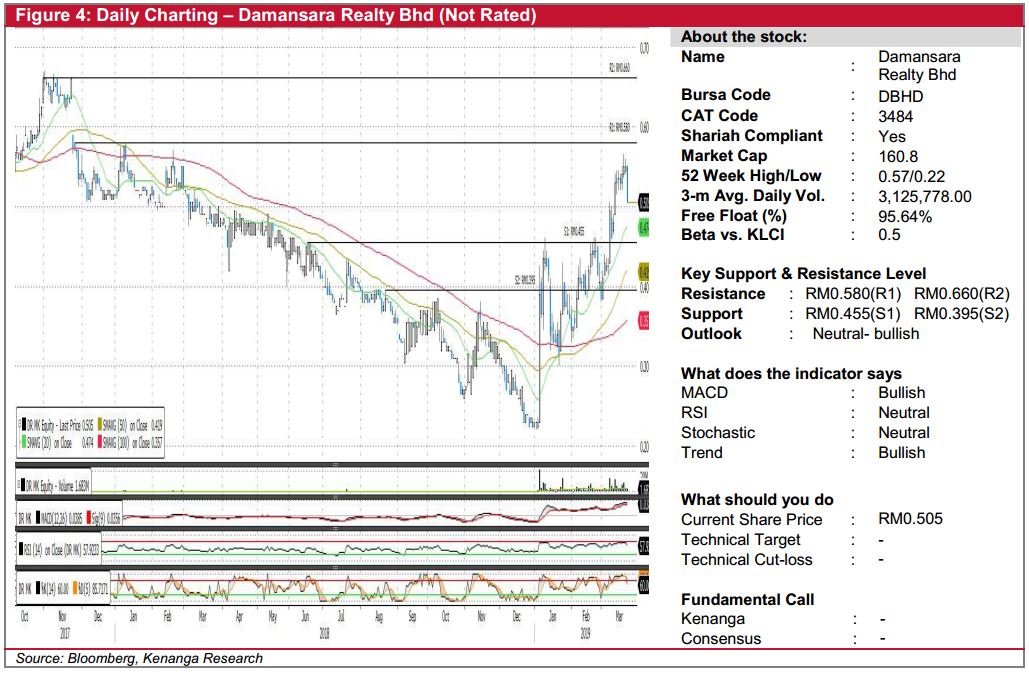

DBHD (Not Rated)

- Yesterday, DBHD fell 4.5 sen (-8.18%) to close at RM0.505.

- Since the beginning of this year, the share has been on an uptrend on the back of higher-than-average trading volume.

- Despite primary uptrend still being intact, we believe the share is likely to undergo a short-term retracement as shown by yesterday’s long bearish candle and uninspiring key momentum indicators.

- Expect the share to retrace back to its support levels at RM0.455 (S1) and RM0.395 (S2).

- Conversely, resistance levels can be found at RM0.580 (R1) and RM0.660 (R2).

Source: Kenanga Research - 22 Mar 2019

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

More articles on Kenanga Research & Investment

Discussions

Be the first to like this. Showing 0 of 0 comments