Kenanga Research & Investment

Daily Technical Highlights – (ORION, MFLOUR)

kiasutrader

Publish date: Tue, 26 Mar 2019, 11:12 AM

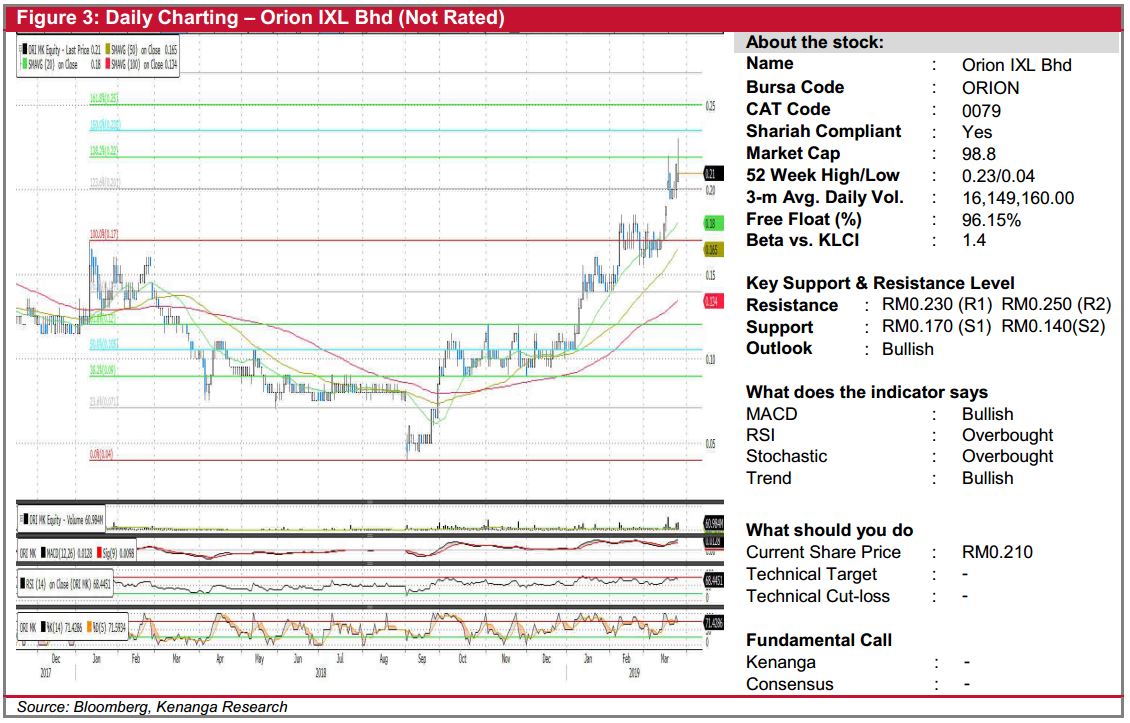

ORION (Not Rated)

- ORION declined by 0.5 sen (-2.33%) to close at RM0.210 yesterday.

- Chart–wise the share has been on an uptrend since early-September as buying interest resumed and brought the share to trade above all key SMAs.

- Coupled with the healthy key SMAs and higher-than-average trading volume, we believe the share could trend higher should buying momentum persist.

- Overhead resistance can be identified at RM0.230 (R1) and RM0.250 (R2).

- Conversely, key support levels are at RM0.170 (S1) and RM0.140 (S2).

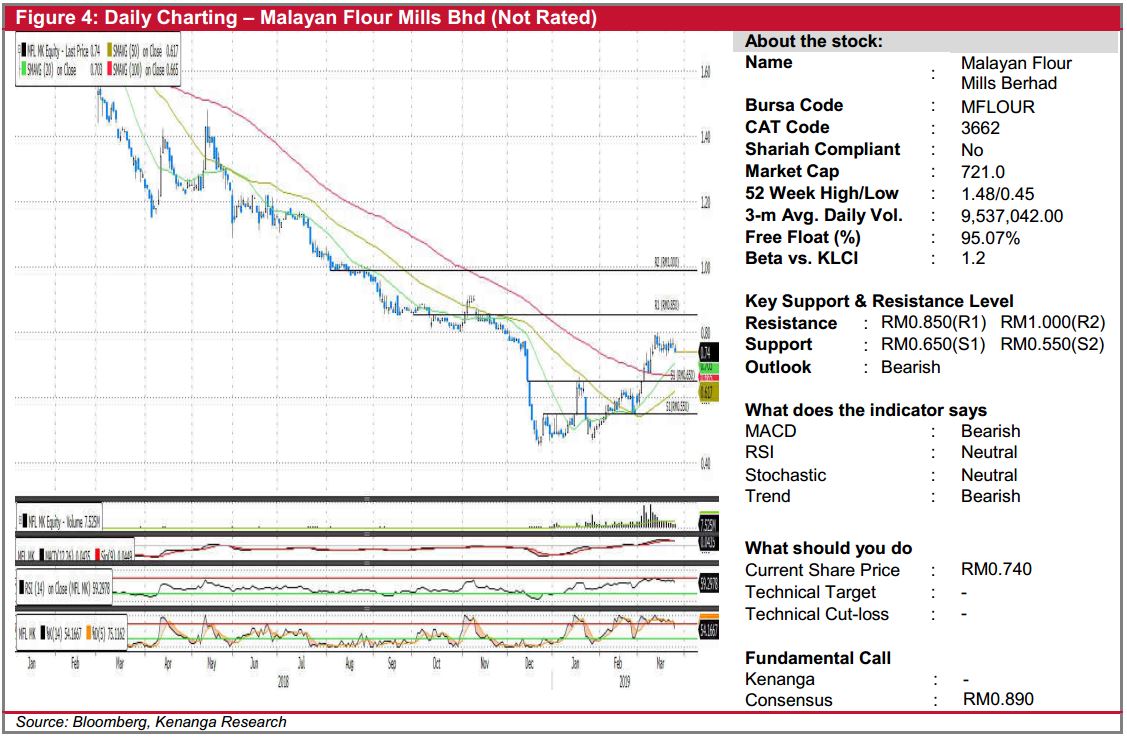

MFLOUR (Not Rated)

- Yesterday, MFLOUR fell 2.5 sen (-3.27%) to close at RM0.740.

- Chart-wise, we observed that MFLOUR could be entering into a retracement phase after the occurrence of a bearish MACD crossover on last Friday.

- We believe there may be more downsides as key momentum indicators such as RSI and Stochastic remain lacklustre after coming off from the overbought levels.

- Should selling momentum persist, we expect the share to retrace back to its support levels at RM0.650 (S1) and RM0.550 (S2).

- Conversely, resistance levels can be found at RM0.850 (R1) and RM1.000 (R2).

Source: Kenanga Research - 26 Mar 2019

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

More articles on Kenanga Research & Investment

Discussions

Be the first to like this. Showing 0 of 0 comments