Kenanga Research & Investment

Daily Technical Highlights – (HIBISCS, NAIM)

kiasutrader

Publish date: Tue, 09 Apr 2019, 08:41 AM

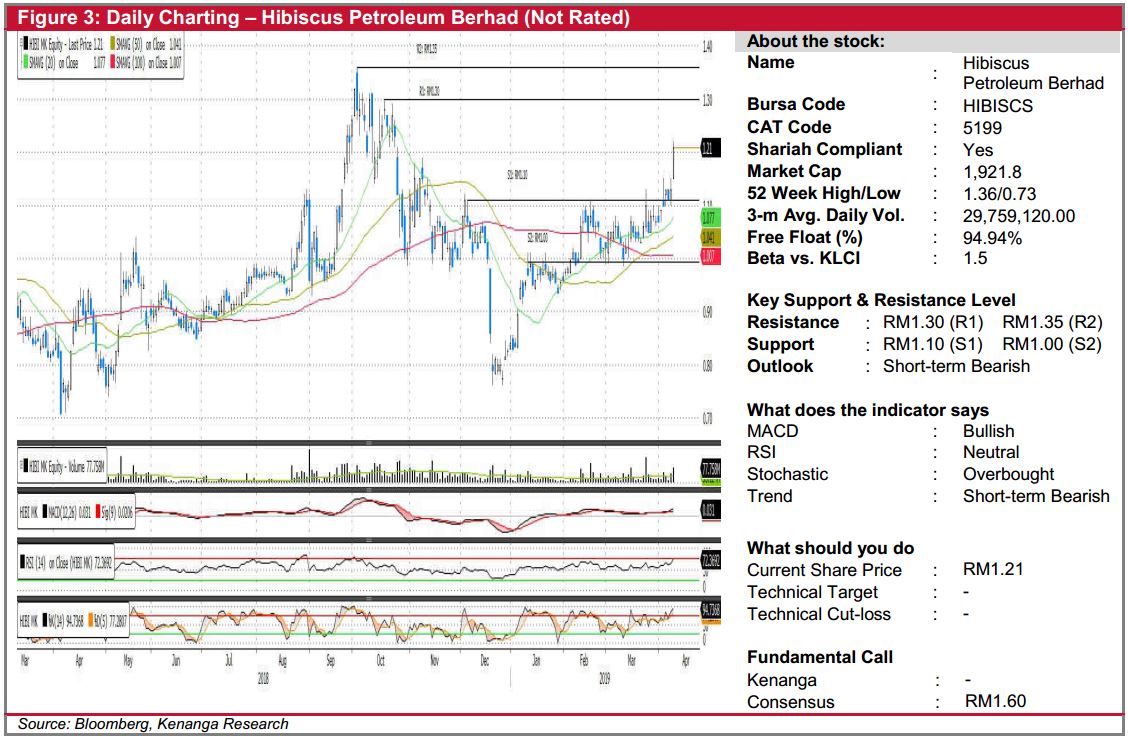

HIBISCS (Not Rated)

- HIBISCS gained 8.0 sen (+7.08%) to close at RM1.21 yesterday. We note that in general, the KLENG (Bursa Malaysia Energy Index) was also rallying and recorded gains of 2.08%.

- Longer-term technical outlook is positive as the uptrend is firmly intact while the share is also trending above all key SMAs.

- However, we do not discount a possibility of short-term retracement as the stochastic indicator is in the overbought zone.

- Should the share retrace to its support at RM1.10 (S1), investors can buy on weakness while a break below RM1.00 (S2) would be deemed highly negative.

- Conversely, resistance can be found at RM1.30 (R1) and RM1.35 (R2).

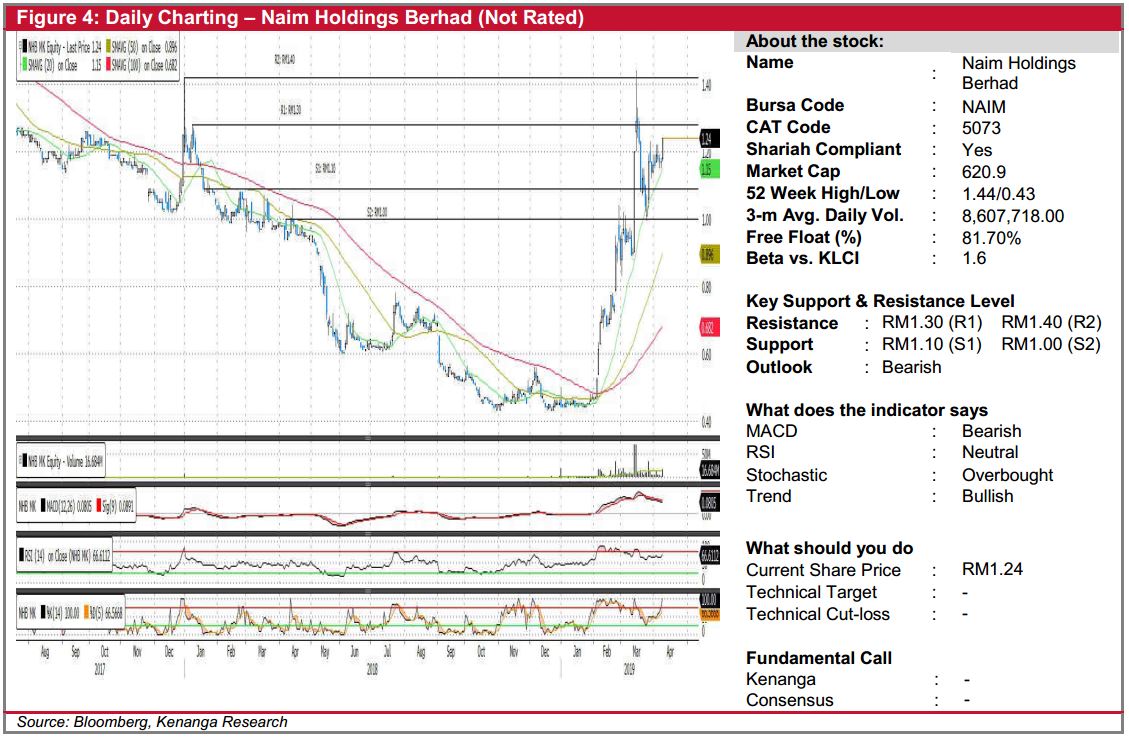

NAIM (Not Rated)

- NAIM recorded gains of 5.98% (+7.0 sen) yesterday to close at RM1.24.

- Since the start of February 2019, the share had posted a strong rally, making gains of close to two folds.

- However, technical indicators are appearing to turn slightly bearish as indicated by the down trending of the MACD indicator while stochastic indicator is in the overbought zone.

- The share may fall back to its supports at RM1.10 (S1) and even RM1.00 (S2).

- Should the positive momentum continue, resistance can be found at RM1.30 (R1) and RM1.40 (R2).

Source: Kenanga Research - 9 Apr 2019

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

More articles on Kenanga Research & Investment

Discussions

Be the first to like this. Showing 0 of 0 comments