Kenanga Research & Investment

Daily Technical Highlights – (KAREX, HEVEA)

kiasutrader

Publish date: Thu, 11 Apr 2019, 12:26 PM

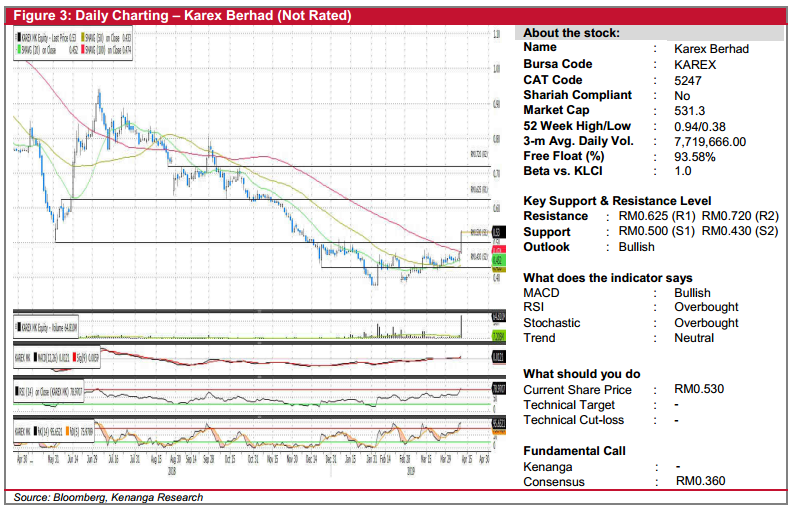

KAREX (Not Rated)

- KAREX gained 6.0 sen (+12.77%) to close at RM0.530 yesterday.

- Since mid-Mar 2019, the share has been consolidating close to its key SMAs. Yesterday’s candlestick punched above the 100-day SMA, which could signify a shift in momentum.

- There are notable upticks from key momentum indicators as well and we believe that a “Golden-Cross” could soon follow.

- Should buying momentum continue, we look towards resistances at RM0.625 (R1) and RM0.720 (R2).

- Conversely, resistance can be found at RM0.500 (S1) and RM0.430 (S2).

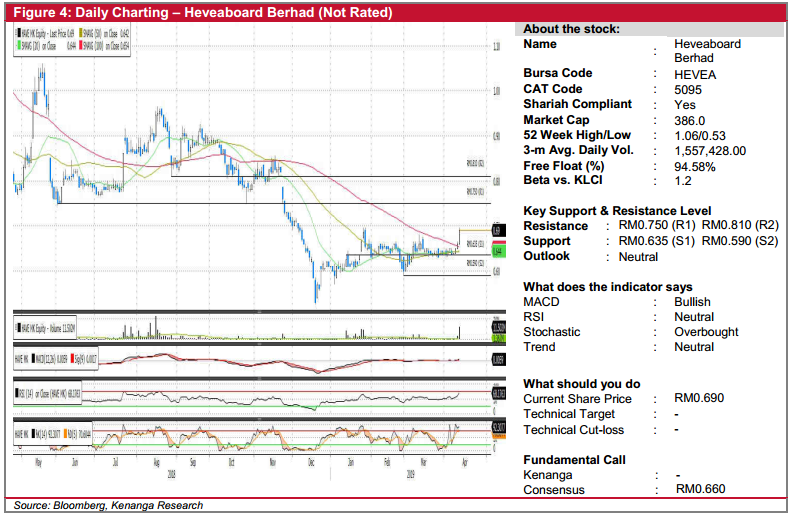

HEVEA (Not Rated)

- HEVEA gained 3.0 sen (+4.54%) yesterday to close at RM0.690.

- Chart-wise, the share has been consolidating since January 2019 and yesterday’s move saw a decisive close above the 100-day SMA.

- This, coupled with exceptional trading volume, leads us to believe that there could be some follow-through buying.

- Should follow-through buying occur, we opine that the share should head towards its resistance levels at RM0.750 (R1) and RM0.810 (R2).

- Support levels, on the other hand, can be identified at RM0.635 (S1) and RM0.590 (S2).

Source: Kenanga Research - 11 Apr 2019

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

More articles on Kenanga Research & Investment

Discussions

Be the first to like this. Showing 0 of 0 comments