Kenanga Research & Investment

Daily Technical Highlights – (PUC, INARI)

kiasutrader

Publish date: Tue, 16 Apr 2019, 09:23 AM

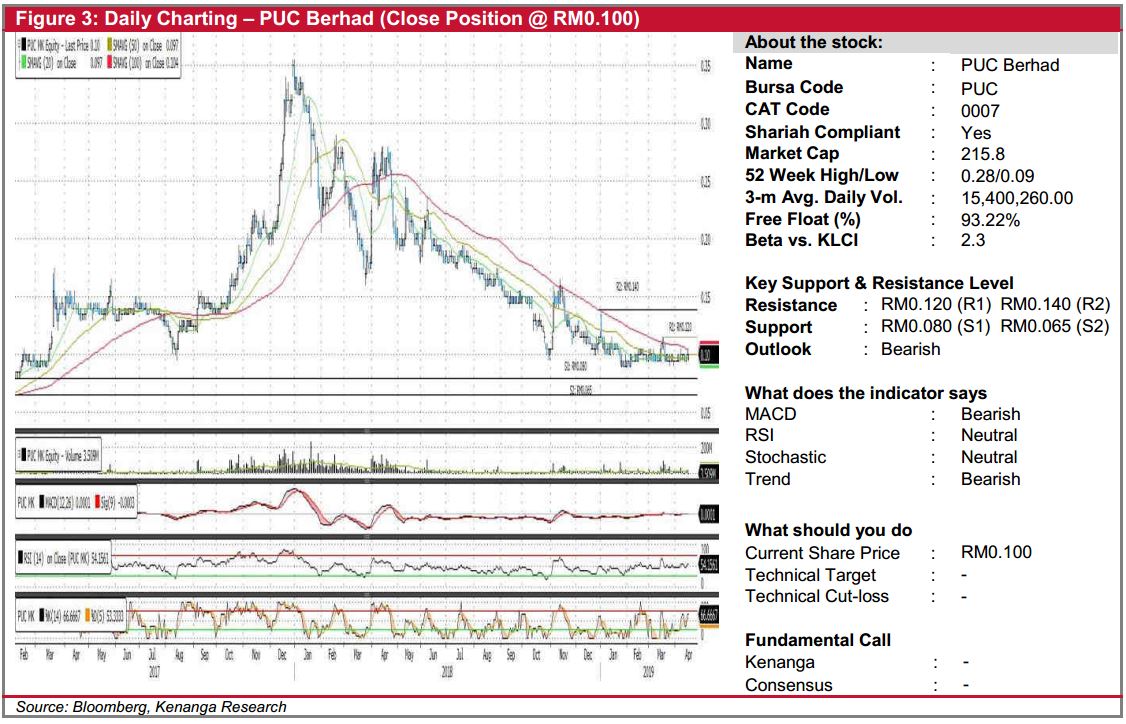

PUC (Close Position @ RM0.100)

- PUC closed flat at RM0.100 yesterday. Since our ‘Trading Buy’ call on 13 November 2018, the share has not performance as per our expectation and continued to trade below the 100-day SMA.

- The current overall technical outlook appears lacklustre as key momentum indicators do not show any sign of a potential bullish reversal.

- From here, the share may continue to trend lower to its support at RM0.080 (S1) and RM0.065 (S2). Should there be any positive catalyst for the stock, resistance levels can be found at RM0.120 (R1) and RM0.140 (R2).

INARI (Not Rated)

- INARI gained 11.0 sen (+6.63%) to close at RM1.77, backed by strong trading volume.

- Yesterday’s move saw the share broke out from the RM1.65 resistance level which it has been testing over the past two months.

- Overall technical outlook is bullish with the share trending above all key SMAs while the MACD line had also crossed above the Signal line.

- From here, expect the share to test its immediate resistance at RM1.90 (R1) and possibly RM2.00 (R2).

- Should the share retrace back to its resistance-turned-support of RM1.65 (S1), interested investor can put their money in while a break below RM1.50 (S2) will be deemed highly negative.

Source: Kenanga Research - 16 Apr 2019

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

More articles on Kenanga Research & Investment

Discussions

Be the first to like this. Showing 0 of 0 comments