Kenanga Research & Investment

Daily Technical Highlights – (JTIASA, MBMR)

kiasutrader

Publish date: Wed, 17 Apr 2019, 08:45 AM

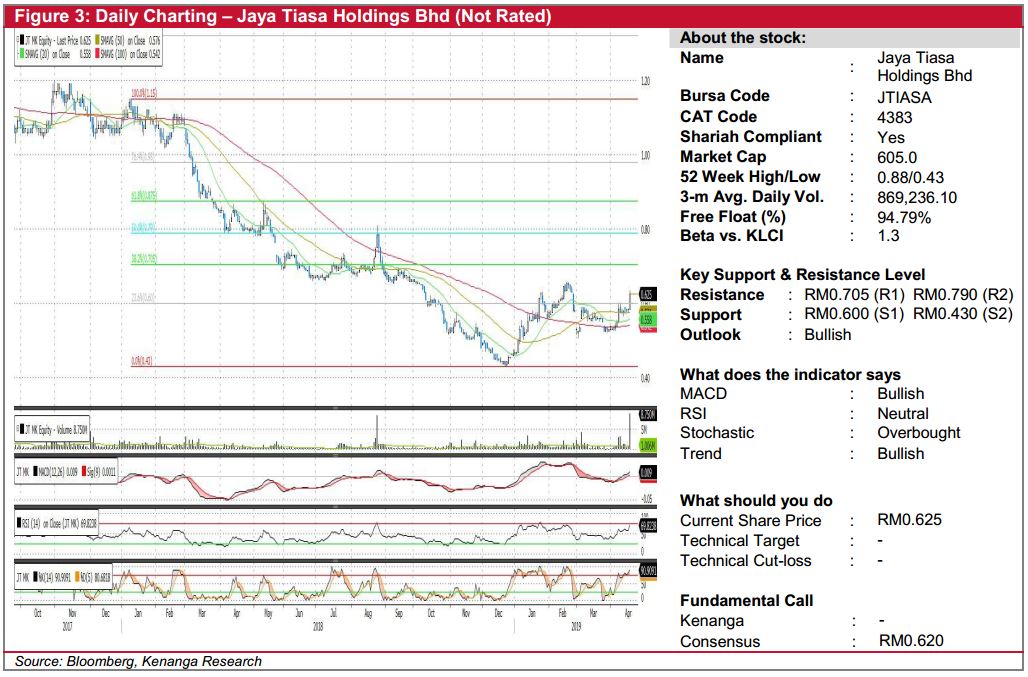

JTIASA (Not Rated)

- JTIASA gained 4.0 sen (+6.84%) to close at RM0.625 yesterday.

- Chart-wise, the share appears to be staging a rebound after down trending since early 2018.

- Key momentum indicators are bullish now. Moreover, yesterday’s move was supported by strong trading volume, which makes us believe that there is more upside.

- From here, we expect follow-through buying that may see the share rally to its resistances at RM0.705 (R1) and even RM0.790 (R2).

- On the other hand, any negative news is likely to see retracement towards RM0.600 (S1) and possibly RM0.430 (S2).

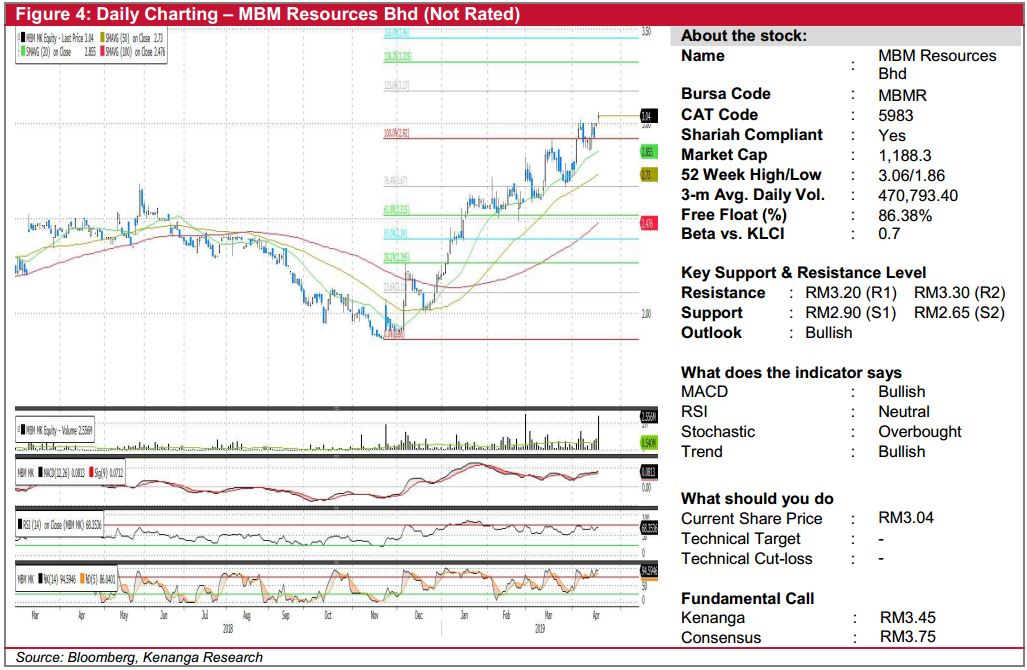

MBMR (Not Rated)

- MBMR gained 4.0 sen (+1.33%) yesterday to close at RM3.04.

- The share had been on a rally since December 2018 and the primary uptrend still appears intact.

- There is no sign of any tapering momentum yet while volume had been high, possibly indicating more upside.

- Continuous buying momentum is likely to see the share go higher to its resistance at RM3.20 (R1) and RM3.30 (R2).

- Any short term retracement towards its immediate support at RM2.90 (S1) would be a good entry point while a break below RM2.65 (S2) will be highly negative.

Source: Kenanga Research - 17 Apr 2019

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

More articles on Kenanga Research & Investment

Discussions

Be the first to like this. Showing 0 of 0 comments