Kenanga Research & Investment

Daily Technical Highlights – (IKHMAS, FAJAR)

kiasutrader

Publish date: Tue, 23 Apr 2019, 09:06 AM

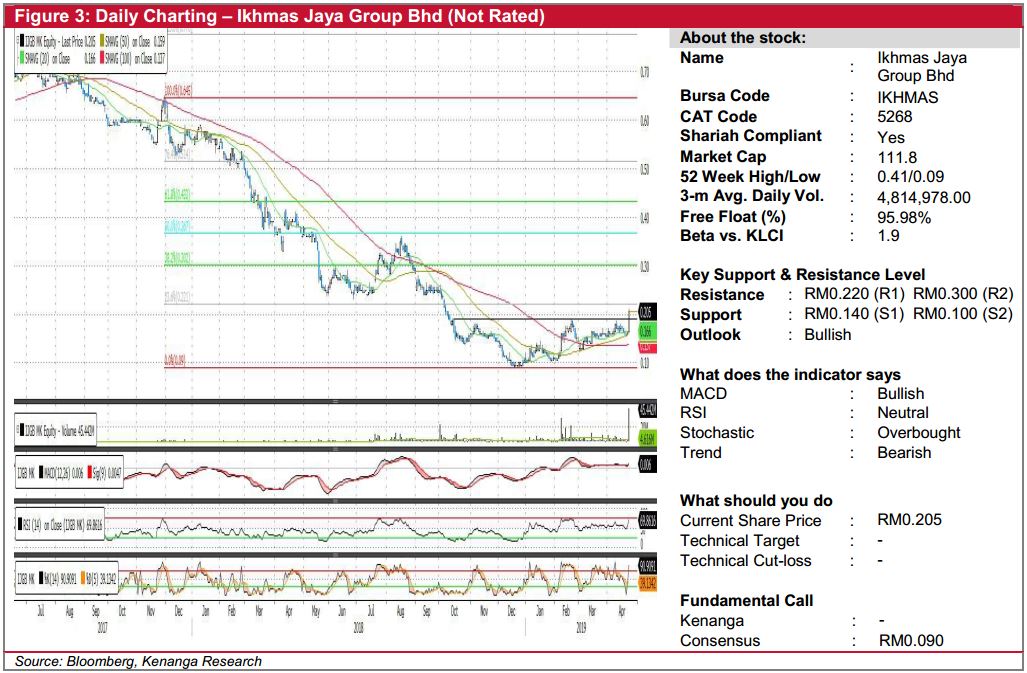

IKHMAS (Not Rated)

- IKHMAS gained 4.0 sen (+24.24%) to close at RM0.205 yesterday, on the back of stronger-than-average trading volume with 45.4m shares exchanging hand- more than 9 folds to its 20-day average.

- Technically, the share has broken out from the crucial RM0.190 resistance level, potentially to signal more possible upward movement.

- Momentum indicators are mostly positive as displayed by strong upticks in RSI and Stochastic while MACD rising above its signal and Zero-line.

- Follow-through momentum could see the share price trending higher towards resistances at RM0.220 (R1) and RM0.300 (R2).

- Conversely, downside support level can be found closer to its 100-day SMA, RM0.140 (S1) and RM0.100 (S2).

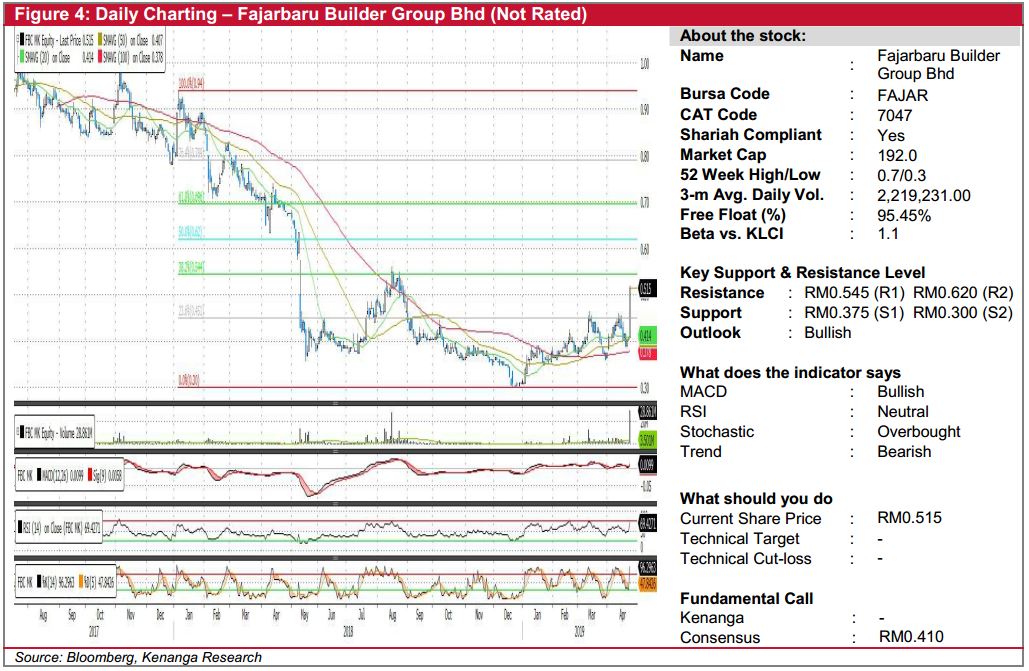

FAJAR (Not Rated)

- FAJAR gained 11.0 sen (+27.16%) to close at RM0.515 accompanied by explosive trading volume with 28.9m shares exchanging hand- 8 folds to its 20-day average.

- Yesterday’s move saw the share decisively closing above all key SMAs with a formation of long bullish candlestick.

- Momentum indicators appear leaning on the upside with upticks seen in RSI and Stochastic and bullish MACD.

- From here, we expect the share to advance towards resistance at RM0.545 (R1) where a break above R1 would see next resistance at RM0.620 (R2).

- Failing to break R1 would then see immediate support closer to its 100-day SMA RM0.375 (S1) and RM0.300 (S2) further down.

Source: Kenanga Research - 23 Apr 2019

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

More articles on Kenanga Research & Investment

Discussions

Be the first to like this. Showing 0 of 0 comments