Kenanga Research & Investment

Daily Technical Highlights – (HIBISCS, JHM)

kiasutrader

Publish date: Tue, 07 May 2019, 09:19 AM

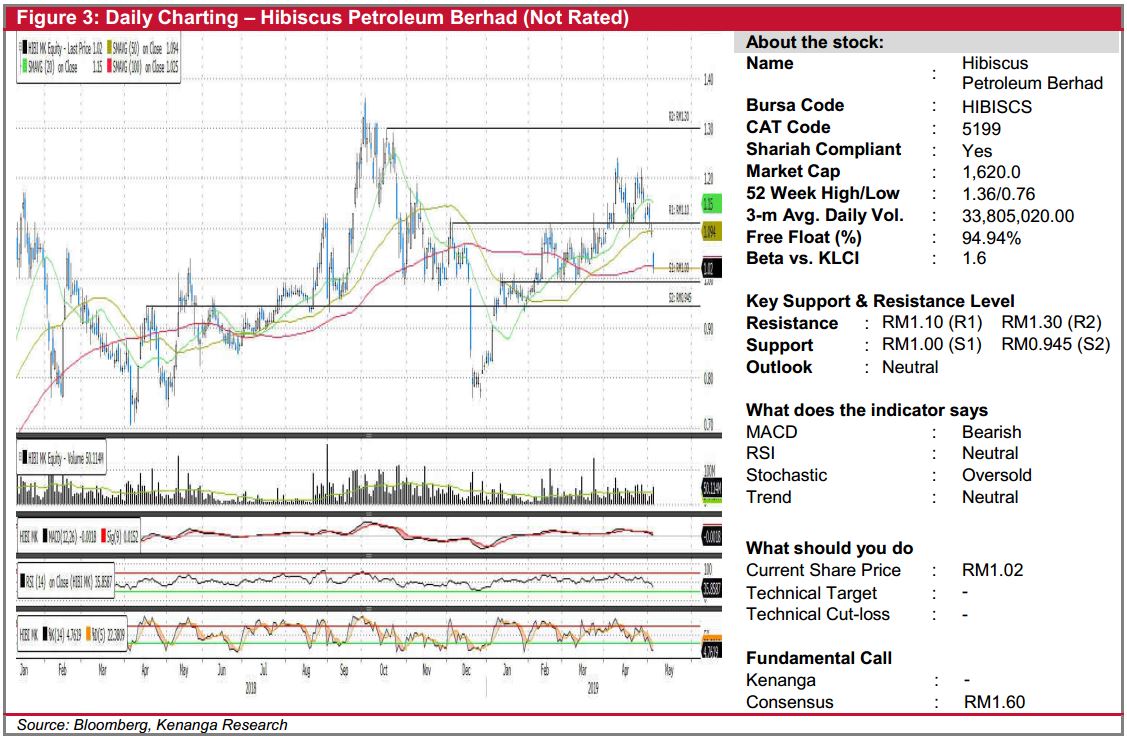

HIBISCS (Not Rated)

- Yesterday, HIBISCS fell 7.0 sen (-6.42%) to close at RM1.02.

- The share has retraced close to its 100-day SMA, which has proven to be a significant level. Coupled with heavily oversold stochastic signal and a diving RSI indicator, we believe the stock could stage a technical rebound.

- A technical rebound will lift the stock higher towards RM1.10 (R1), where a decisive break above would then see further momentum carrying it to RM1.30 (R2).

- Conversely, downside risk should be fairly limited with support levels at RM1.00 (S1) and RM0.945 (S2).

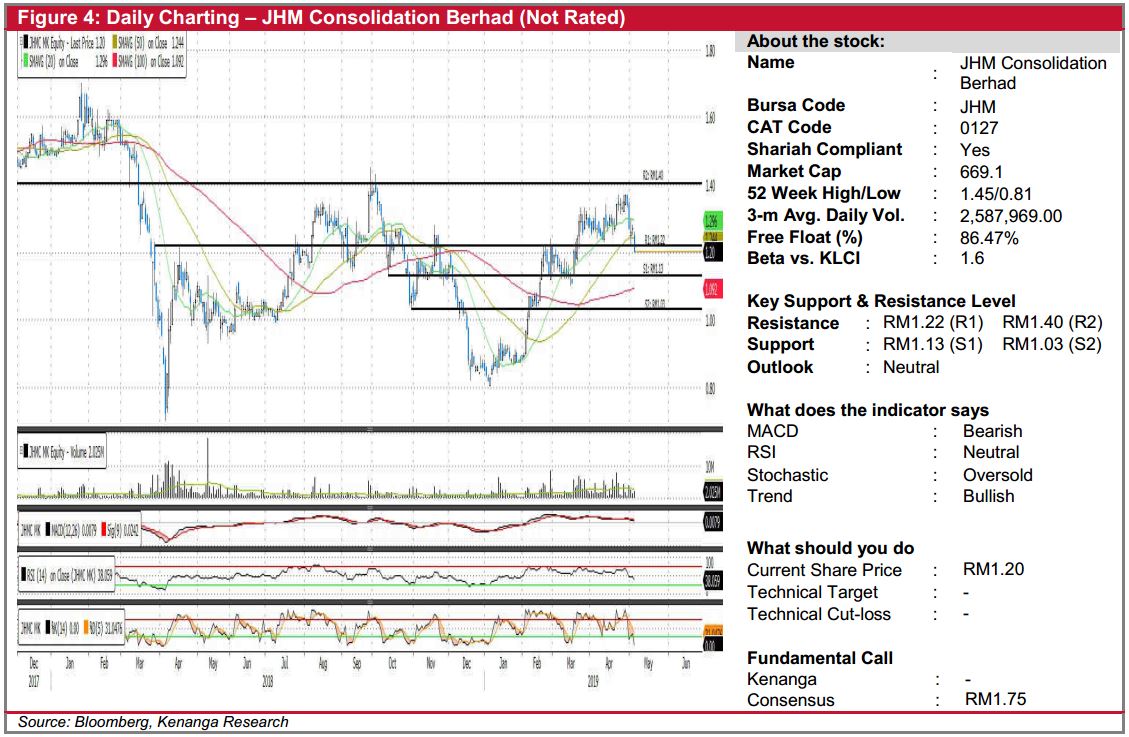

JHM (Not Rated)

- JHM lost 7.0 sen (-5.51%) yesterday to end at RM1.20.

- Chart-wise, the share seems to be undergoing a retracement after a short rally since Jan-19.

- Notably, we observed a bearish divergence between JHM’s price and RSI indicator since mid-March 2019. Along with its recent bearish candlestick which broke below its 50-day SMA, signifying strong selling pressure, we believe the retracement could yet be over.

- Expect support at RM1.13 (S1) and lower at RM1.03 (S2). On the other hand, emergence of strong buying momentum could take the share towards RM1.22 (R1) and RM1.40 (R2).

Source: Kenanga Research - 7 May 2019

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

More articles on Kenanga Research & Investment

Discussions

Be the first to like this. Showing 0 of 0 comments