Kenanga Research & Investment

Daily Technical Highlights – (HARTA, TOPGLOV)

kiasutrader

Publish date: Thu, 23 May 2019, 08:57 AM

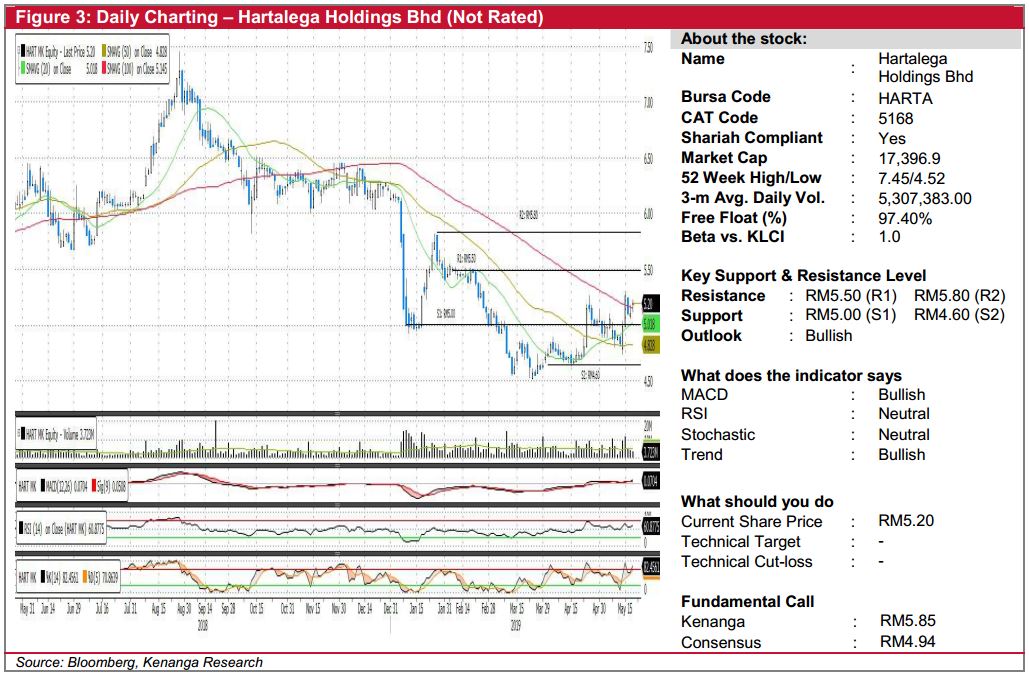

HARTA (Not Rated)

- HARTA gained 10.0 sen (+1.96%) to close at RM5.20.

- Chart-wise, the share has been on a gradual uptrend lately after experiencing sell down that started since mid of 2018.

- More notably, HARTA is now above all its key SMAs while other key technical indicators are looking bullish.

- From here, we expect the share to test its next resistance level of RM5.50 (R1) en route to RM5.80 (R2).

- Any retracements towards RM5.00 (S1) would be a good entry point for interested investors while a break below RM4.60 (S2) will be deemed highly negative.

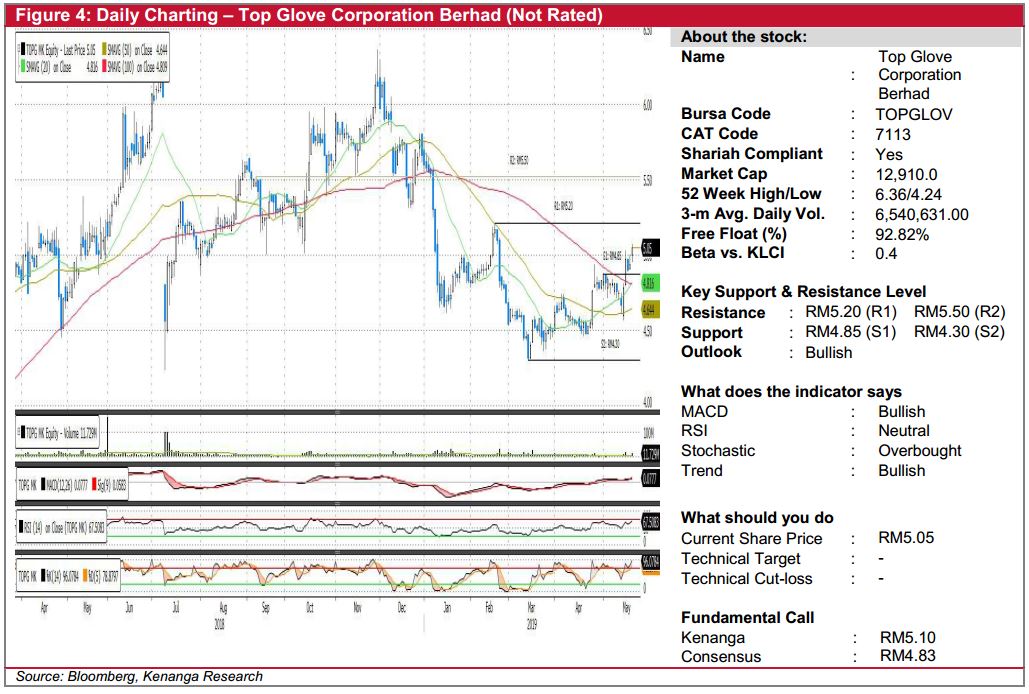

TOPGLOV (Not Rated)

- TOPGLOV went up 11.0 sen (+2.23%) to end at RM5.05.

- The share appears to have rebounded from its previous downtrend.

- With all key indicators appearing to be bullish, we believe that the share is likely to stage more upward movement.

- Should there are follow-through buying activities, the stock may swing higher to RM5.20 (R1) and even RM5.50 (R2).

- Conversely, downside supports are identified at RM4.85 (S1) and RM4.30 (S2).

Source: Kenanga Research - 23 May 2019

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

Market Buzz

2024-11-26

HARTA2024-11-26

HARTA2024-11-26

TOPGLOV2024-11-26

TOPGLOV2024-11-25

TOPGLOV2024-11-25

TOPGLOV2024-11-25

TOPGLOV2024-11-25

TOPGLOV2024-11-25

TOPGLOV2024-11-25

TOPGLOV2024-11-22

HARTA2024-11-22

TOPGLOV2024-11-22

TOPGLOV2024-11-22

TOPGLOV2024-11-21

HARTA2024-11-21

HARTA2024-11-21

HARTA2024-11-20

TOPGLOVMore articles on Kenanga Research & Investment

Discussions

Be the first to like this. Showing 0 of 0 comments