Kenanga Research & Investment

Daily Technical Highlights – (TECFAST, LONBISC)

kiasutrader

Publish date: Tue, 04 Jun 2019, 08:44 AM

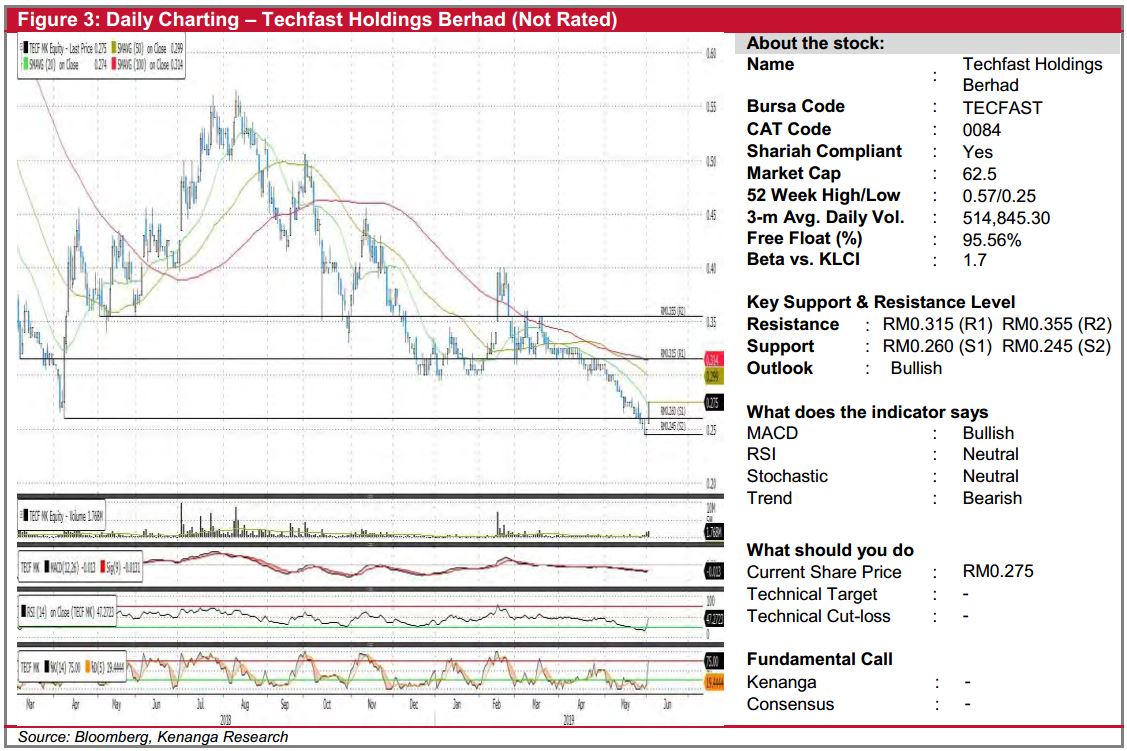

TECFAST (Not Rated)

- TECFAST gained 2.5sen (+10.00%) to close at RM0.275 yesterday.

- The stock has been on a downtrend since breaking below its 100-day SMA in Feb-19. Yesterday’s candlestick formed a long bullish candlestick accompanied by exceptional trading volume, which signifies strong buying interest.

- Coupled with encouraging signals from the key momentum indicators, we believe the underlying bullish momentum could continue.

- Resistance levels can be identified at RM0.315 (R1) and RM0.355 (R2).

- On the other hand, key support levels can be found at RM0.260 (S1) and RM0.245 (S2).

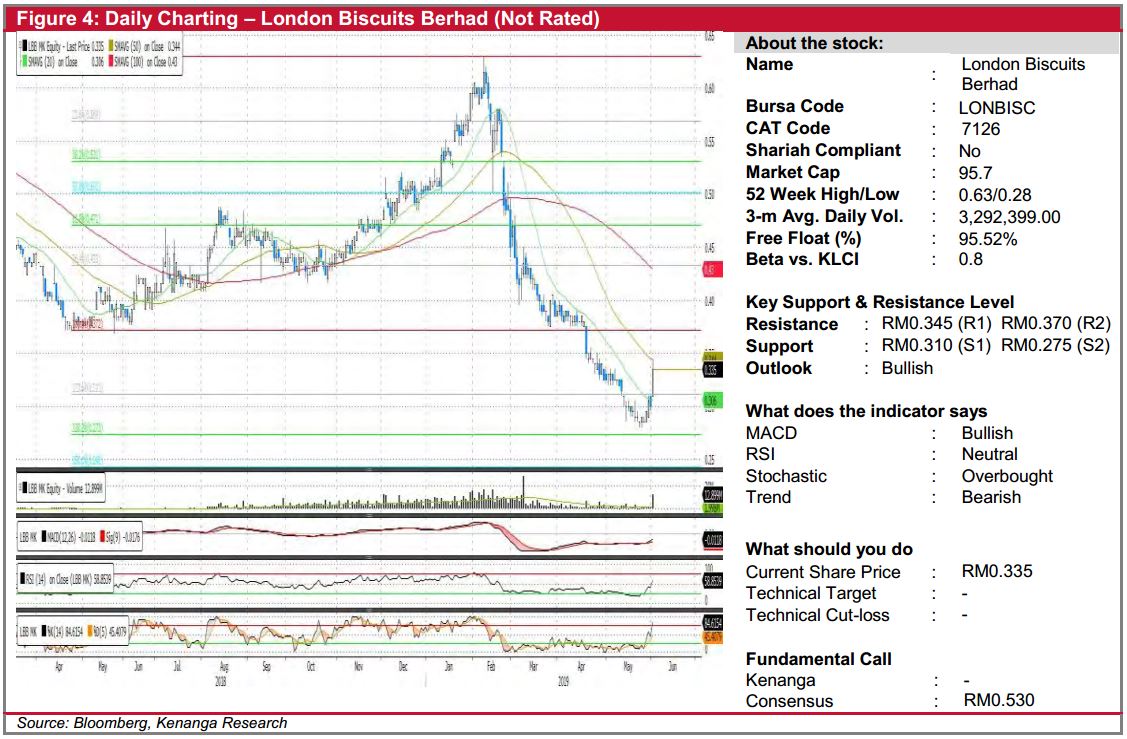

LONBISC (Not Rated)

- LONBISC gained 3.5sen (+11.67%) to end at RM0.335, yesterday.

- Chart-wise, the stock has been on a sharp downtrend after breaking below its 20-day SMA in Feb-19. Yesterday’s candlestick convincingly broke above the 20-day SMA and is now testing its 50-day SMA.

- RSI is showing meaningful upticks but remains in the neutral zone. Nonetheless, this still indicates potential room for upside.

- Expect the stock to test its immediate resistance at RM0.345 (R1), close to its 50-day SMA and higher at RM0.370 (R2), should the first level be taken out. Conversely, downside supports can be seen at RM0.0.310 (S1) and RM0.275 (S2).

Source: Kenanga Research - 4 Jun 2019

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

Market Buzz

More articles on Kenanga Research & Investment

Discussions

Be the first to like this. Showing 0 of 0 comments