Kenanga Research & Investment

Daily Technical Highlights – (JHM, SEALINK)

kiasutrader

Publish date: Fri, 28 Jun 2019, 09:23 AM

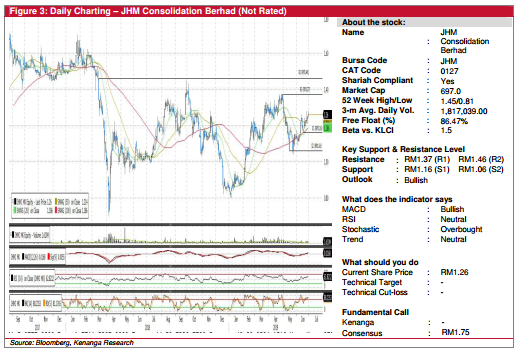

JHM (Not Rated)

- JHM gained 1.0 sen (+0.80%) to close at RM1.26 yesterday.

- Chart-wise, the share has been on a rally since May, which saw it currently trading above all of its key SMAs.

- In tandem with a bullish MACD crossover, we believe that there may still be room for upside.

- Expect the share to trend higher and test resistances at RM1.37 (R1) and RM1.46 (R2).

- Conversely, downside support can be identified at RM1.16 (S1) and RM1.06 (S2).

SEALINK (Not Rated)

- Yesterday, SEALINK rose 2.0 sen (+12.12%) to end at RM0.185, backed by stronger-than-average trading volume.

- Of late, the share appears to be bottoming-out from its sell-down that started in April. Notably, the two latest long white candlesticks also helped to share to punch through its longer-term SMAs.

- Coupled with healthy key momentum indicators, we believe that the buying momentum may persist, which shall see the share trending up towards its resistance levels at RM0.200 (R1) and RM0.225 (R2).

- Conversely, supports can be found at RM0.150 (S1) and RM0.135 (S2).

Source: Kenanga Research - 28 Jun 2019

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

More articles on Kenanga Research & Investment

Bond Market Weekly Outlook - Local yields may rise moderately ahead of US jobs report

Created by kiasutrader | Nov 29, 2024

- Ringgit Weekly Outlook Fairly balanced risks, but potential USD rebound looms over risk assets

Created by kiasutrader | Nov 29, 2024

Discussions

Be the first to like this. Showing 0 of 0 comments