Kenanga Research & Investment

Daily Technical Highlights – (MAGNI, KAWAN)

kiasutrader

Publish date: Fri, 12 Jul 2019, 08:52 AM

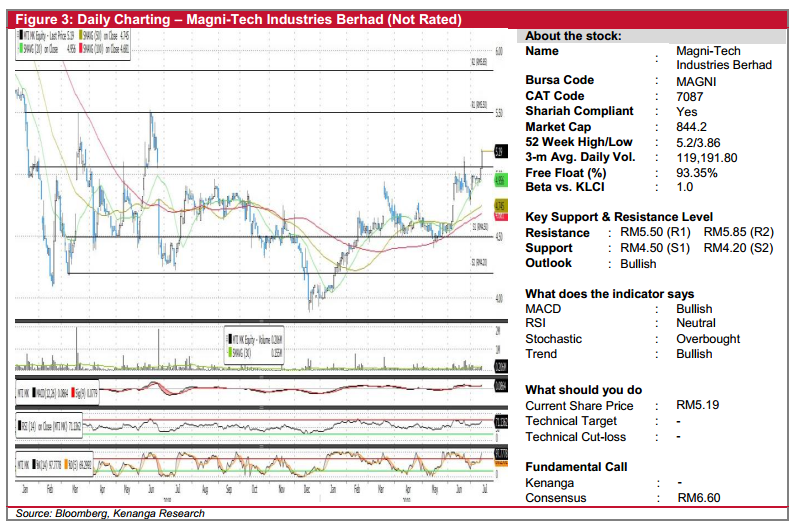

MAGNI (Not Rated)

- Yesterday, MAGNI gained 14.0 sen (+2.77%) to close at RM5.19.

- We note that the share managed to break through and hold above its key resistance level at RM5.00, following two consecutive long white candlesticks for the past two days.

- Given its RSI indicator, which is still trading within the neutral zone, we believe that the share may be able to trend higher as it is far from the overbought territory.

- Should the bullish momentum persist, resistance levels can be identified at RM5.50 (R1) and RM5.85 (R2).

- Conversely, downside supports can be found at RM4.50 (S1) and RM4.20 (S2).

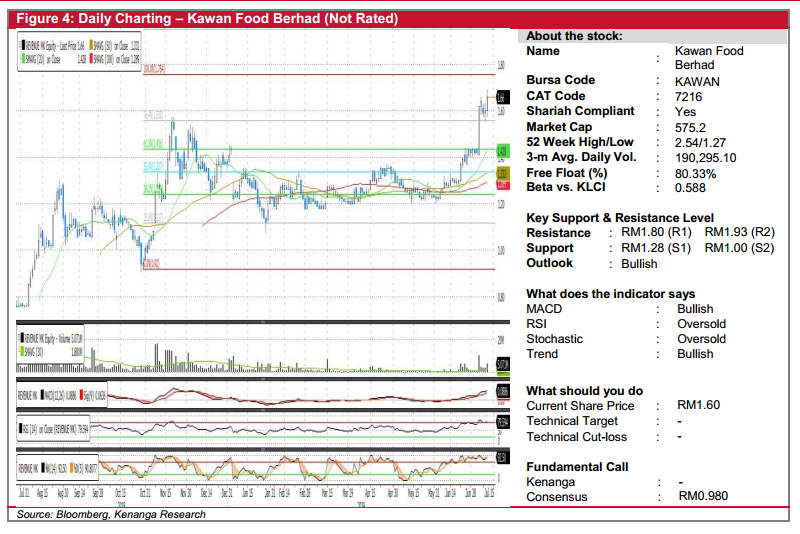

KAWAN (Not Rated)

- KAWAN rose 8.0 sen (+5.26%) to end at RM1.60.

- Chart-wise, the share has been rebounding since June’19, which saw it currently trading above all of its key SMAs.

- Coupled with a bullish MACD crossover, we believe that the share may continue trending upwards.

- Expect the share to test resistance levels at RM1.80 (R1) and RM1.93 (R2).

- Conversely, key support level can be identified at RM1.28 (S1) and RM1.00 (S2).

Source: Kenanga Research - 12 Jul 2019

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

Market Buzz

2024-11-25

KAWAN2024-11-25

KAWAN2024-11-25

MAGNI2024-11-25

MAGNI2024-11-25

MAGNI2024-11-22

MAGNI2024-11-22

MAGNI2024-11-22

MAGNI2024-11-22

MAGNI2024-11-21

KAWAN2024-11-21

KAWAN2024-11-21

KAWAN2024-11-20

KAWAN2024-11-20

KAWAN2024-11-19

MAGNI2024-11-19

MAGNI2024-11-18

MAGNI2024-11-18

MAGNI2024-11-15

MAGNI2024-11-15

MAGNIMore articles on Kenanga Research & Investment

Discussions

Be the first to like this. Showing 0 of 0 comments