Kenanga Research & Investment

Daily Technical Highlights – (IKHMAS, ZECON)

kiasutrader

Publish date: Fri, 26 Jul 2019, 09:23 AM

IKHMAS (Not Rated)

- Yesterday, IKHMAS fell 1.5 sen (-5.88%) to close at RM0.240.

- Chart-wise, the share has been on a rally since breaking above its 20- and 50-day SMAs in June 2019. However, yesterday’s candlestick formed spinning top, which came after a bearish doji.

- Coupled with less encouraging signals from key momentum indicators, we believe this could potentially signify a bearish reversal.

- Immediate support levels can be found at RM0.215 (S1) and RM0.190 (S2). Meanwhile, should buying momentum re emerge, resistances can be identified at RM0.290 (R1) and RM0.335 (R2).

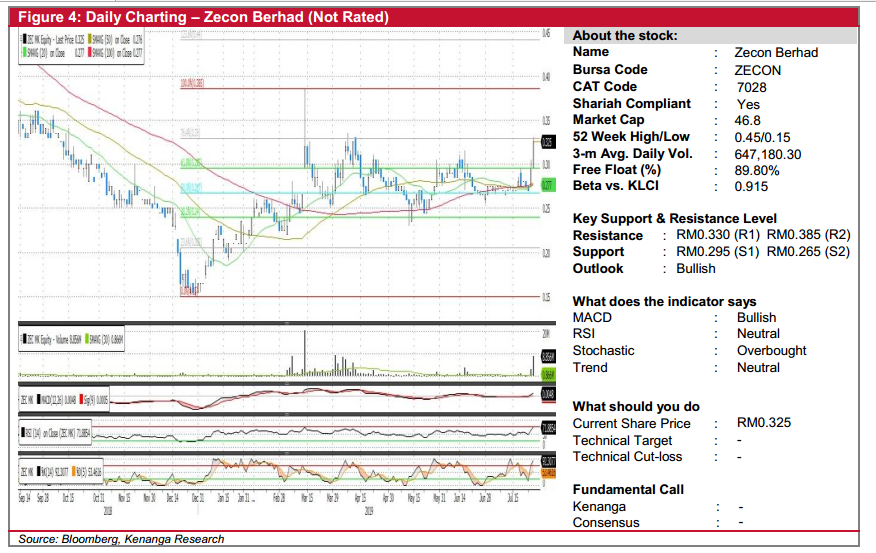

ZECON (Not Rated)

- ZECON gained 3.0 sen (+10.17%) to end at RM0.325, yesterday.

- Chart-wise, we observed the formation of two long bullish candlesticks for the past two trading days on increasing volume. After a 5-month consolidation period, we believe the share could be poised to head higher.

- Key momentum indicators have shown meaningful upticks and the share has remained above key SMAs, leading us to think that there could be more upside.

- Key resistance level to look out for is RM0.330 (R1), where a break above would see the share head north towards RM0.385 (R2).

- Conversely, support levels can be identified at RM0.295 (S1) and RM0.265 (S2).

Source: Kenanga Research - 26 Jul 2019

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

More articles on Kenanga Research & Investment

Discussions

Be the first to like this. Showing 0 of 0 comments