Kenanga Research & Investment

Daily Technical Highlights – (ECONBHD,PENTA)

kiasutrader

Publish date: Wed, 07 Aug 2019, 10:02 AM

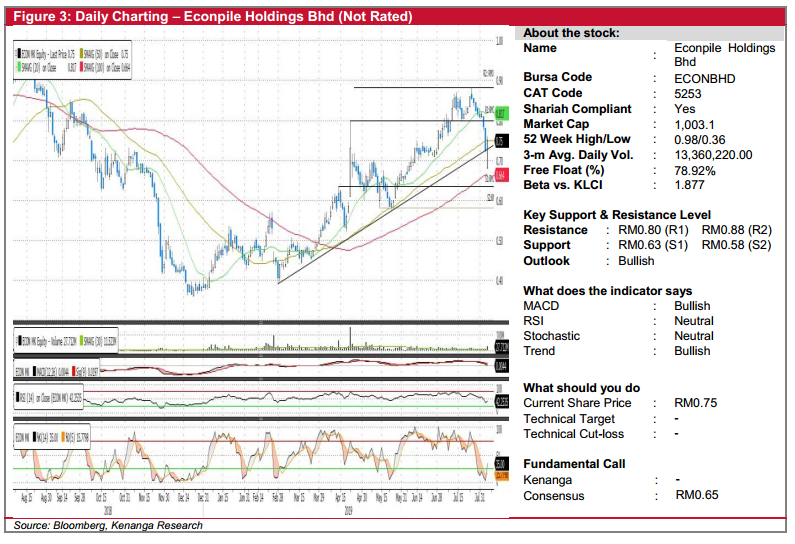

ECONBHD (Not Rated)

- Yesterday, ECONBHD gain 2.5 sen to close at RM0.75.

- Chart-wise, the share had formed a minor “Double-Top” chart pattern during July 2019 and the share price continued to trend lower and eventually broken below the upward trend line. However, it managed to hold and to close above the trend line yesterday coupled with heavier-than-average trading volume, signalling the emergence of strong buying momentum.

- Should the share continue its upward movement, the resistance levels can be found at RM0.80 (R1) and RM0.88 (R2).

- Conversely, support levels can be identified at RM0.63 (S1) and RM0.58 (S2).

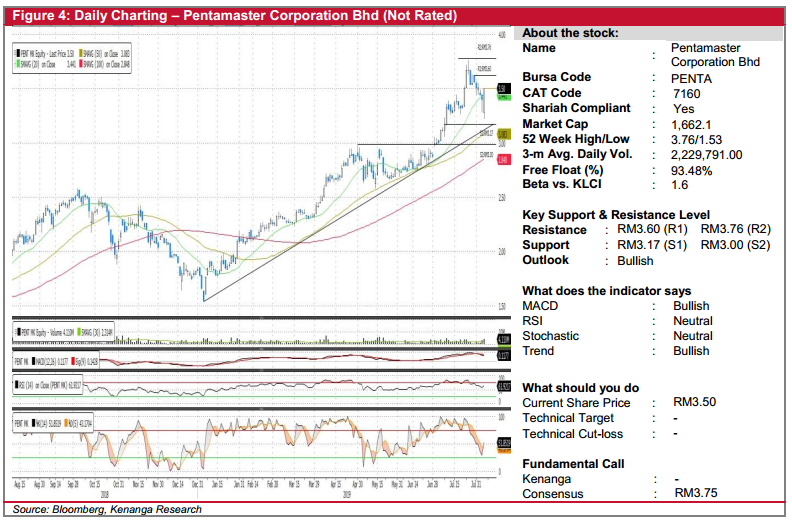

PENTA (Not Rated)

- PENTA gain 10.0 sen (+2.94%) to end at RM3.50 yesterday.

- Chart-wise, the share has been trading down for few trading days, mainly due to profit taking reason after it hit the historical high at RM3.76.

- Yesterday, the share has rebounded, forming a “ Marubozu” candle coupled with higher-than-average trading volume. All in, we believe that the share could move higher and outlook remains bullish.

- Should the share continue its upward movement, the resistances can be found at RM3.60 (R1) and RM3.76 (R2).

- Conversely, support levels can be identified at RM3.17 (S1) and RM3.00 (S2).

Source: Kenanga Research - 7 Aug 2019

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

More articles on Kenanga Research & Investment

Discussions

Be the first to like this. Showing 0 of 0 comments