Kenanga Research & Investment

Daily Technical Highlights – (FOCUSP, HEVEA)

kiasutrader

Publish date: Tue, 20 Aug 2019, 08:55 AM

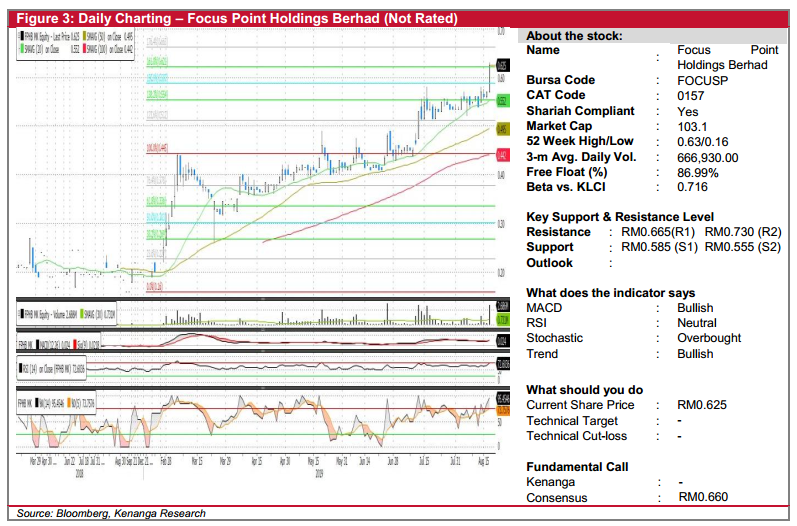

FOCUSP (Not Rated)

- FOCUSP gained 5.5 sen (+9.65%) to close at RM0.625 yesterday.

- The stock has been on a rally since Feb 2019 and we note that it has been consistently trading above its key SMAs, suggesting a sustainable uptrend.

- Yesterday’s long bullish candlestick punched above its resistance and closed at a new high. This, accompanied by exceptional trading volume, signals that the momentum is strong and the likelihood of a continuation rally.

- Expect the share to head north towards RM0.665 (R1) and RM0.730 (R2), should the first level (R1) be taken out. Conversely, support levels can be identified at RM0.585 (S1) and RM0.555 (S2).

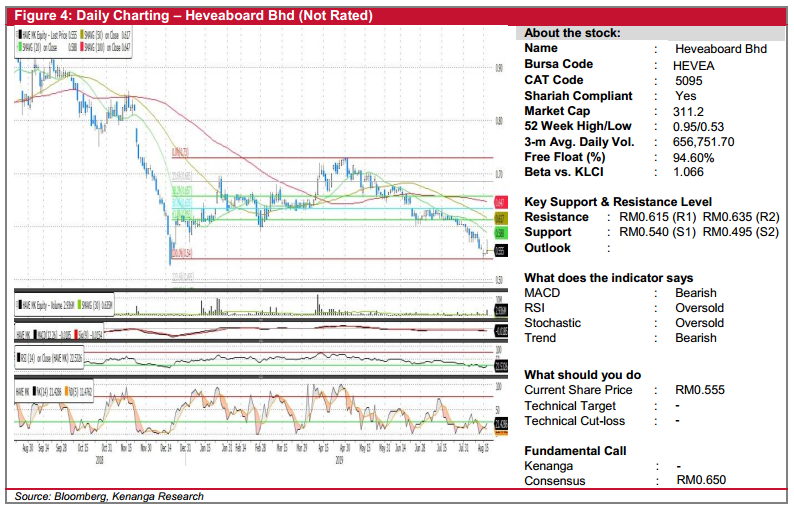

HEVEA (Not Rated)

- HEVEA gained 0.5 sen (+0.91%) to end at RM0.555 yesterday.

- Chart-wise, the share has been in a downtrend since breaking below its 100-day SMA in June 2019. Nevertheless, we believe that the share is oversold and that a technical rebound is likely to follow.

- RSI and stochastic are both exhibiting heavily oversold signals further enforcing our view of a technical rebound.

- Look out for resistances at RM0.615 (R1) and RM0.635 (R2). Meanwhile, support levels can be seen at RM0.540 (S1) and RM0.495 (S2).

Source: Kenanga Research - 20 Aug 2019

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

More articles on Kenanga Research & Investment

Discussions

Be the first to like this. Showing 0 of 0 comments