Kenanga Research & Investment

Daily Technical Highlights – (NOTION, PADINI)

kiasutrader

Publish date: Tue, 21 Jan 2020, 10:02 AM

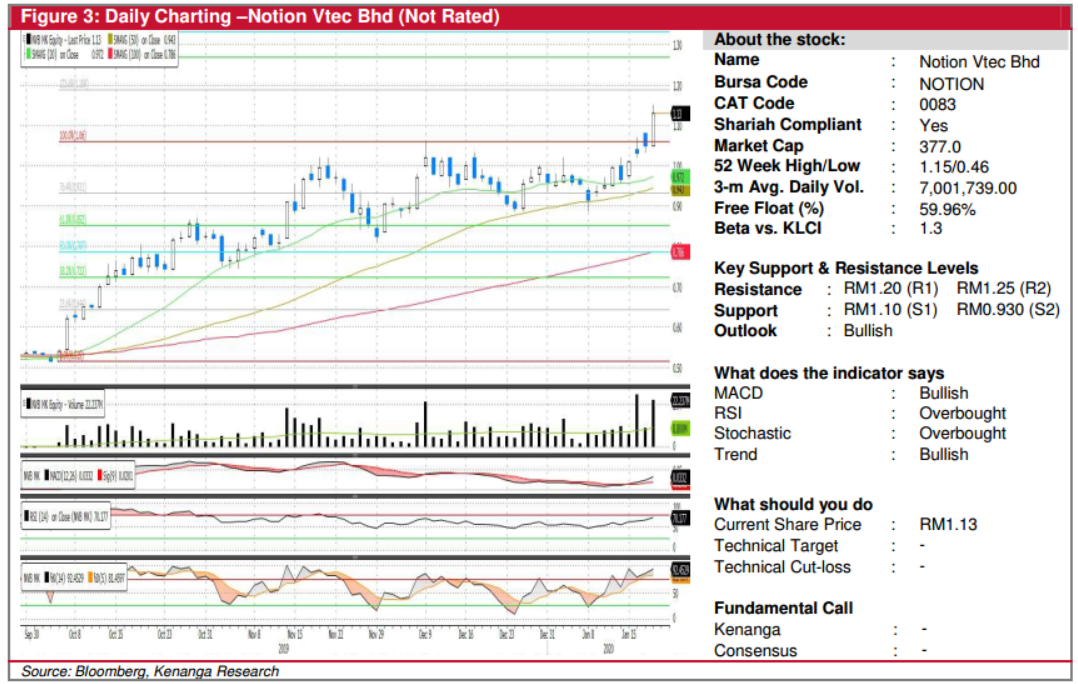

NOTION (Not Rated)

- NOTION gained 8.0 sen (+7.62%) to close at RM1.13 yesterday.

- Chart-wise, the share has been on an uptrend since October last year.

- Yesterday, the stock continued to close higher above all key-SMAs backed by above-average trading volume. Given an uptick in RSI and bullish MACD crossover, we expect the stock to trend higher.

- From here on, overhead resistance can be seen at RM1.20 (R1) and RM1.25 (R2).

- Conversely, downside supports can be identified at RM1.10 (S1) and RM0.930 (S2).

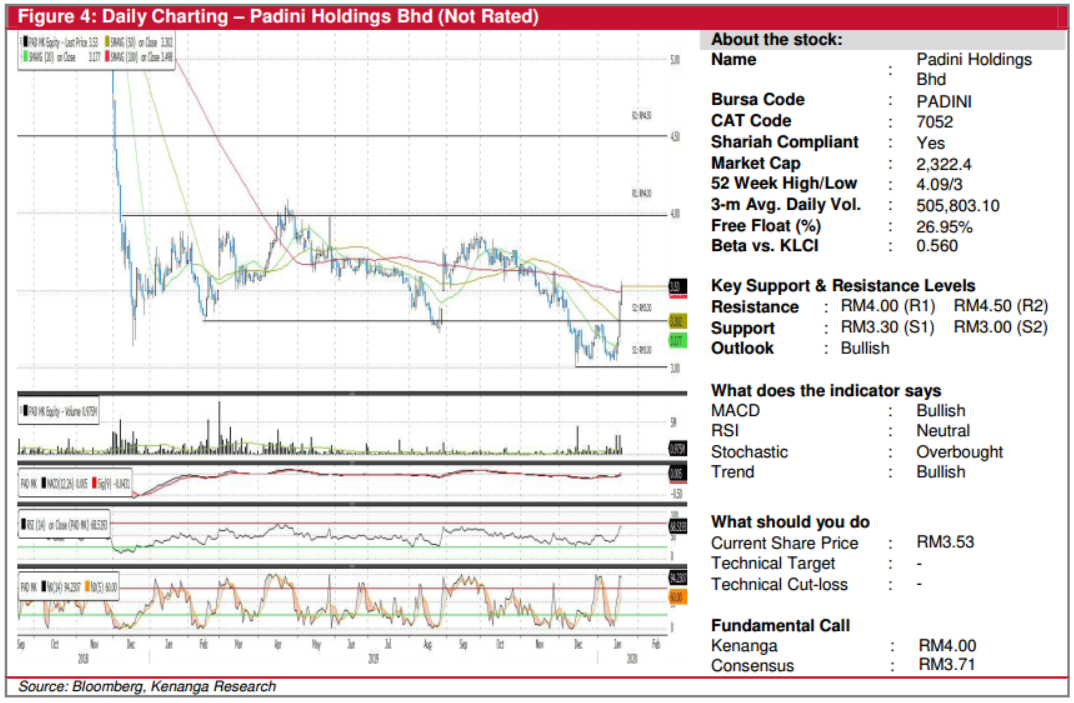

PADINI (Not Rated)

- PADINI gained 11.0 sen (+3.22%) to close at RM3.53 yesterday.

- Chart-wise, the stock has experienced a trend reversal since the formation of a double bottom last year.

- Yesterday’s candlestick marked the third bullish candlestick, indicating strong buying interest. Given an uptick in key technical indicator, we expect the share to trend higher.

- Should buying momentum persist, the stock is expected to test overhead resistance at RM4.00 (R1) and RM4.50 (R2).

- Conversely, support levels can be identified at RM3.30 (S1) and RM3.00 (S2).

Source: Kenanga Research - 21 Jan 2020

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

More articles on Kenanga Research & Investment

Bond Market Weekly Outlook - Local yields may rise moderately ahead of US jobs report

Created by kiasutrader | Nov 29, 2024

- Ringgit Weekly Outlook Fairly balanced risks, but potential USD rebound looms over risk assets

Created by kiasutrader | Nov 29, 2024

Discussions

Be the first to like this. Showing 0 of 0 comments