Daily Technical Hightlights - (GDEX, AEON)

kiasutrader

Publish date: Wed, 23 Sep 2020, 10:13 AM

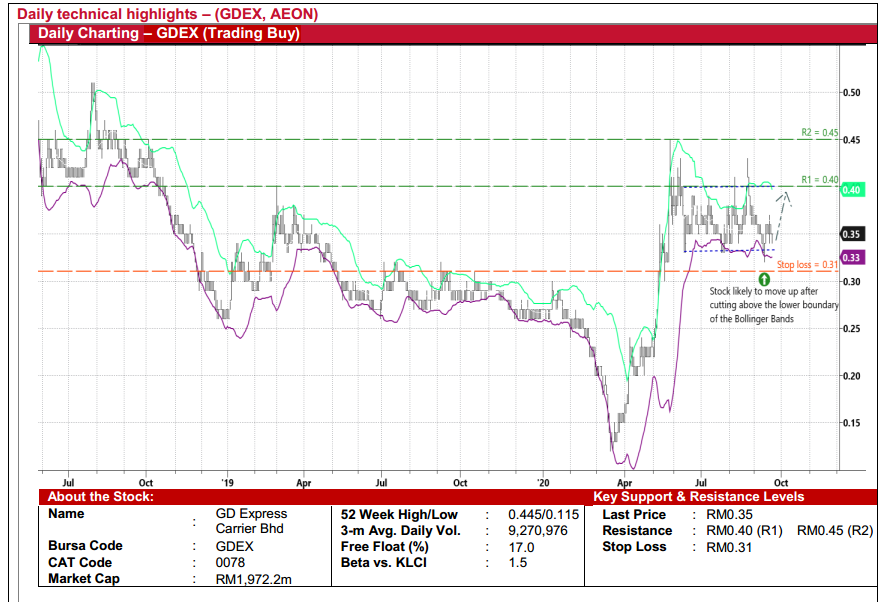

GD Express Carrier Bhd (Trading Buy)

• GDEX – in the business of providing express delivery services and logistics services – stands to benefit from the pick-up in e-commerce activities as demand for courier services (on the back of more on-line purchases) is expected to increase in the wake of the Covid-19 pandemic.

• The Group has delivered consistent annual net earnings ranging between RM24m and RM37m over the last five financial years. Its latest FY ended June 2020, however, was affected by the Covid-19-related disruptions, the absence of gain on redemption of convertible bonds (FY19: RM8m) and the accounting impact on lease recognition (RM17.7m). These factors consequently caused its net profit to slide to RM18.8m (-42% YoY).

• Its balance sheet remains healthy with net cash holdings & short-term funds of RM237.2m (or 4.2 sen per share) as of endJune 2020. The Company has been using some of the cash pile to buy back its own shares in the open market.

• On the chart, GDEX’s share price – following its pullback from a high of RM0.445 in late May – is currently in a sideways trading pattern.

• After bouncing up from the bottom of its consolidation range recently, the stock is eager to climb further. This is supported by the share price crossing over the lower boundary of the Bollinger Bands.

• We have set our resistance thresholds at RM0.40 (R1; 14% upside potential) and RM0.45 (R2; 29% upside potential).

• Our stop loss level is pegged at RM0.31 (or 11% downside risk).

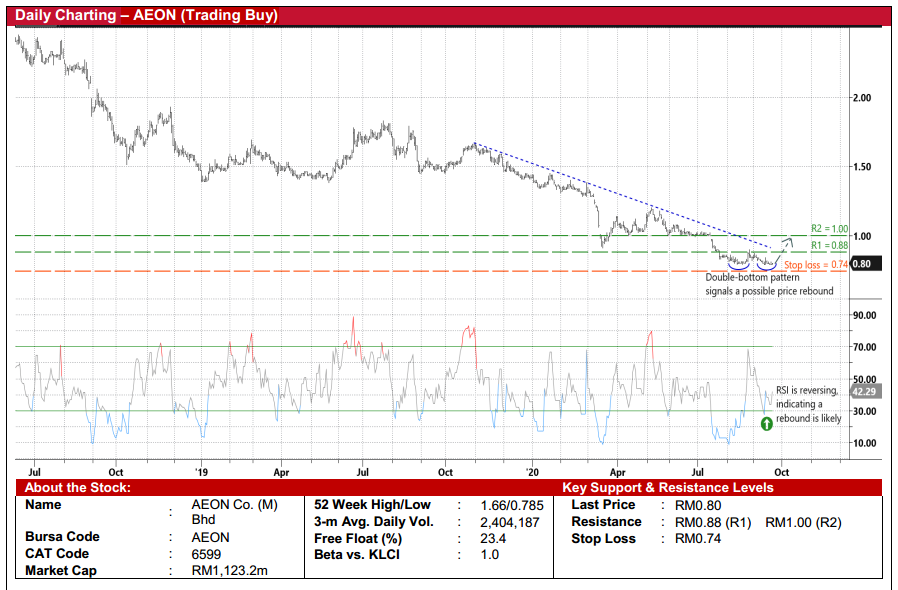

AEON Co. (M) Bhd (Trading Buy)

• AEON shares could be due for a technical rebound after sliding to multi-year lows. The stock will probably bounce up from a double-bottom formation on the chart.

• Furthermore, with the RSI indicator already reversing from an oversold territory, this will likely push the share price to stage a recovery ahead.

• On the back of the positive momentum, the stock is expected to test our resistance target of RM0.88 (R1) initially. Beyond R1, should the shares overcome a descending trendline, the next resistance barrier to be challenged stands at RM1.00 (R2).

• This represents upside potentials of 10% and 25%, respectively. On the other hand, our stop loss level of RM0.74 implies downside risk of 8%.

• From a fundamental perspective, amid a competitive landscape in the retailing industry, AEON’s bottomline has risen steadily year-on-year from RM91m in FY16 to RM109m in FY19.

• However, for the first half of FY20, the Group made a net loss of RM2.1m (versus 1HFY19’s net profit of RM52.1m) as its business activities were hit by the Covid-19 lockdowns and impairment of trade receivables.

• Consensus is currently forecasting AEON to register net profit of RM61m in FY20 and RM93m in FY21. This translates to forward PERs of 18x and 12x, respectively.

• At yesterday’s closing price of RM0.80, the stock offers dividend yield of 4.3% based on consensus FY20 DPS estimate of 3.4 sen. In comparison, AEON has paid out yearly DPS of 4 sen in the last three years.

Source: Kenanga Research - 23 Sept 2020

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

More articles on Kenanga Research & Investment

Created by kiasutrader | Nov 28, 2024