Daily Technical Highlights – (MAHSING, SLP)

kiasutrader

Publish date: Thu, 15 Oct 2020, 09:19 AM

Mah Sing Group Bhd (Trading Buy)

• MAHSING was in the news recently when the Group revealed that its plastics manufacturing division has been exploring new business opportunities to expand into healthcare related products.

• To prepare a war chest to fund its future investments (which may include the potential healthcare venture), MAHSING is planning to raise gross proceeds of up to RM100m via the issuance of 7-year Redeemable Convertible Sukuk, of which approximately RM95m has been earmarked to finance new business undertakings.

• The diversification strategy makes sense as it will complement MAHSING’s core property development business, which is currently facing challenging times given the prevailing property market glut.

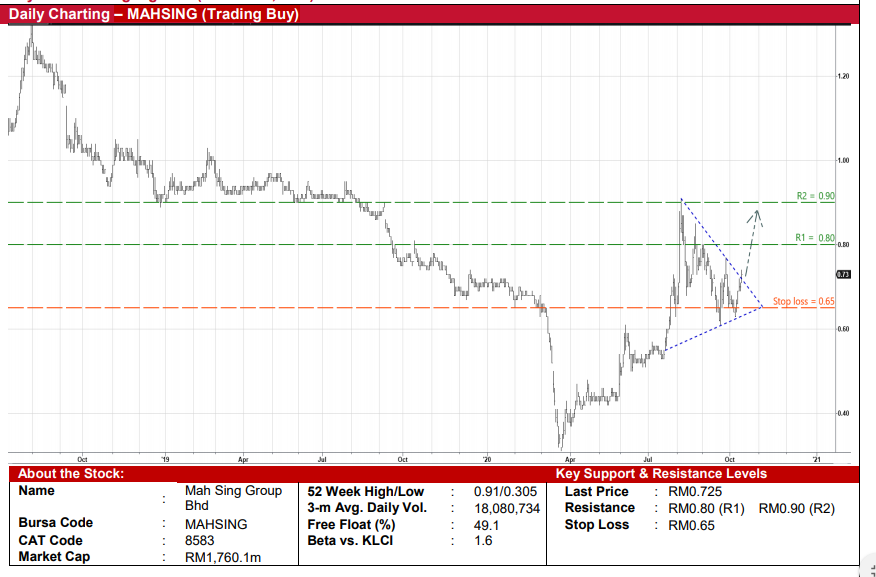

• On the chart, after pulling back from a peak of RM0.91 in early August this year, MAHSING’s share price (which was actively traded yesterday) is on the edge of breaking out from its consolidation pattern.

• A technical breakout will be imminent when the stock cuts above a downward sloping trendline, which could then lift MAHSING shares towards our resistance thresholds of RM0.80 (R1; 10% upside potential) and RM0.90 (R2; 24% upside potential).

• We have placed our stop loss level at RM0.65 (representing 10% downside risk from yesterday’s closing price of RM0.725).

SLP Resources Bhd (Trading Buy)

• SLP is a niche manufacturer of flexible plastic packaging products and films catering to the domestic and international markets. The Group plans to tap on the growing demand for flexible plastic packaging for healthcare and medical products on the back of rising hygienic awareness.

• This strategy could help offset the lower sales of other plastic packaging products amid business disruptions following the Covid-19 outbreak, as reflected in the Group’s weaker 1HFY20 earnings of RM8.1m (-31% YoY).

• Still, with business momentum anticipated to pick up in 2HFY20 and beyond, the Group will likely see overall earnings recovery ahead. SLP has been making yearly net profit of between RM19m and RM27m in the past five years.

• And with a debt-free balance sheet that is backed by cash holdings of RM76.5m (which translates to 24 sen per share or about one-quarter of its current share price), SLP is in a position to continue its generous dividend payments. Historically, DPS has ranged between 4.5 sen and 5.5 sen based on annual payouts of 41% to 81% over the last five years. Using our house FY20-FY21 DPS forecasts of 5.5 sen, the stock is presently trading at attractive dividend yields of 6.0%.

• From a technical perspective, following the crossover of a descending trendline at the end of June, the stock soared to a high of RM1.20 in mid-August before sliding to as low as RM0.855 in early October this year.

• SLP’s share price has since then swiftly recovered to close at RM0.92 yesterday, suggesting that the correction phase might be in the past already.

• On the back of renewed buying interest, the stock could climb to test our resistance hurdles of RM1.02 (R1; 11% upside potential) and RM1.12 (R2; 22% upside potential). • Our stop loss level is set at RM0.83 (or 10% downside risk).

Source: Kenanga Research - 15 Oct 2020

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

More articles on Kenanga Research & Investment

Created by kiasutrader | Nov 28, 2024