Daily technical highlights – (DPHARMA, DKSH)

kiasutrader

Publish date: Tue, 05 Jan 2021, 09:04 AM

Duopharma Biotech Bhd (Trading Buy)

• DPHARMA – which is involved in the pharmaceutical sector – is poised to benefit from the impending rollout of Malaysia’s Covid-19 vaccination program after the government has picked the company to undertake the fill-and-finish processes for the supply of Covid-19 vaccines in the country.

• Meanwhile, the government intends to finalise the national vaccination plan (scheduled to start in February) this Thursday, which would map out a comprehensive plan on the implementation mechanism including the transportation and storage of the vaccines.

• The Group – which has delivered rising annual profits for the past three years with an increase from RM27m in FY16 to RM55m in FY19 – posted net earnings of RM42.4m (-2% YoY) in the nine-month period ended September 2020.

• Going forward, consensus is projecting DPHARMA to register net profit of RM70m in FY December 2021 and RM80m in FY December 2022, translating to forward PERs of 32.1x this year and 28.1x next year.

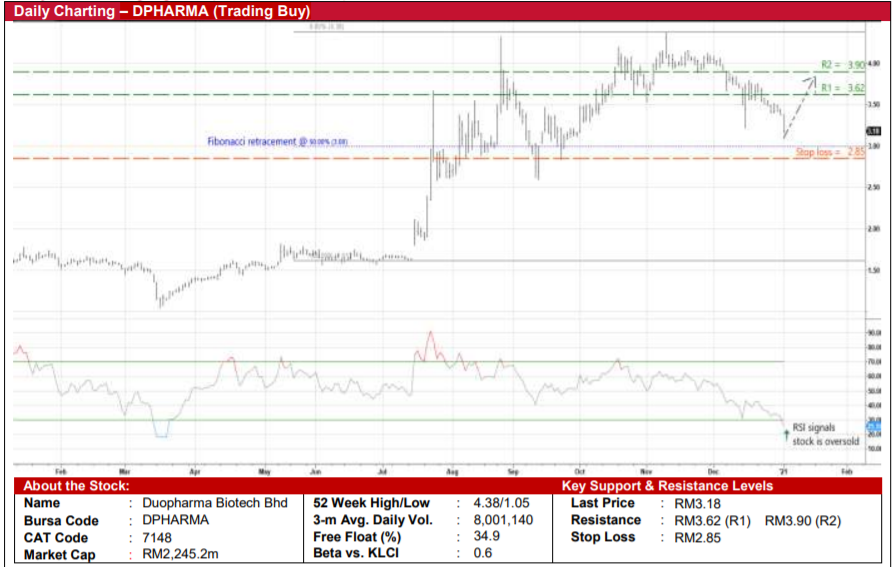

• On the chart, the ongoing share price correction – which has fallen 27% from a high of RM4.38 in November last year to close at RM3.18 yesterday – offers an opportunity for investors to accumulate DPHARMA shares on weakness.

• Technically speaking, the stock’s uptrend (started from a trough of RM1.61 in mid-July last year) remains intact with the 50% Fibonacci retracement line providing immediate downside support.

• On the back of an anticipated share price reversal from the oversold RSI territory, the stock could rebound to our resistance thresholds of RM3.62 (R1; 14% upside potential) and RM3.90 (R2; 23% upside potential).

• We have pegged our stop loss price at RM2.85 (or 10% downside risk).

DKSH Holdings (M) Bhd (Trading Buy)

• DKSH offers a tailor-made, integrated portfolio of sourcing, marketing, sales, distribution and after-sales services, providing business partners with expertise as well as on-the-ground logistics in the fields of: (a) consumer goods (i.e. fast moving consumer goods and food services); (b) healthcare (ranging from pharmaceuticals, over-the-counter, consumer health, medical devices and diagnostics); and (c) performance materials (such as specialty chemicals, food and beverage, pharmaceutical and personal care).

• With a network coverage serving more than 220 clients and 19,000 end-customers across Malaysia, DKSH is a proxy to the market growth opportunities in these areas. Reflecting its stable business model, the Group has remained profitable with net earnings ranging between RM37m and RM52m over the last five years.

• Based on consensus numbers, DKSH (which made net profit of RM31.6m representing a 45% YoY jump in the nine-month ended September 2020) is projected to post net earnings of RM54m in FY December 2021 and RM62m in FY December 2022, thus valuing the stock at forward PERs of 10.0x this year and 8.7x next year.

• From a technical perspective, its share price – which saw increased trading activity in recent days – will probably extend the uptrend pattern after bouncing up from a trough of RM1.68 in March last year.

• With the stock’s upward trajectory supported by the 100-day SMA line and an ascending trendline, DKSH could ride on the positive momentum to climb to our resistance levels of RM3.85 (R1; 12% upside potential) and RM4.00 (R2; 16% upside potential).

• Our stop loss price is set at RM3.10 (or 10% downside risk from its last traded price of RM3.44).

Source: Kenanga Research - 5 Jan 2021

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

More articles on Kenanga Research & Investment

Created by kiasutrader | Dec 20, 2024

Created by kiasutrader | Dec 19, 2024

Discussions

Fcpo now Rm3980

The story of, 2021 will gravitate to palm oil bull run

2021-01-06 11:18

banu3119

In that case dpharma will move on, right. How about bintai counter ?? Will bintai also move up

2021-01-06 00:05