Daily technical highlights – (LIONIND, AEMULUS)

kiasutrader

Publish date: Fri, 26 Feb 2021, 10:08 AM

Lion Industries Bhd (Trading Buy)

• LIONIND is an investment holding company that has businesses mainly in the steel, property development and building materials sectors.

• We believe the group would benefit from record steel prices (currently hovering at 5-year high) as c.>50% of its revenue are contributed by the steel segment. At the bottomline level, the group’s steel division has turned from a loss of RM1.6m in 1QFY21 to a net profit of RM143k in 2QFY21.

• QoQ, the group’s revenue has decreased marginally to RM681.3m in 2QFY21 (-4% QoQ) due to lower sales volume on steel products. Meanwhile, the group’s core loss – after stripping out gains on settlement of secured debts (RM191.9m) and expenses incurred for corporate exercises (RM23.9m) – has widened to RM37.3m (-34% QoQ) in 2QFY21.

• Chart-wise, the stock has rallied since December last year following the completion of the “Saucer Pattern”. Since then, the stock has been treading above its 20-Day simple moving average (SMA) line. Given the prevailing positive signs from all key SMAs, we believe the stock will continue its upward momentum to trend higher ahead.

• With that, our resistance levels are set at RM1.10 (R1; +13% upside potential) and RM1.20 (R2; +24% upside potential).

• Meanwhile, our stop loss is set at RM0.840 (-13% downside risk).

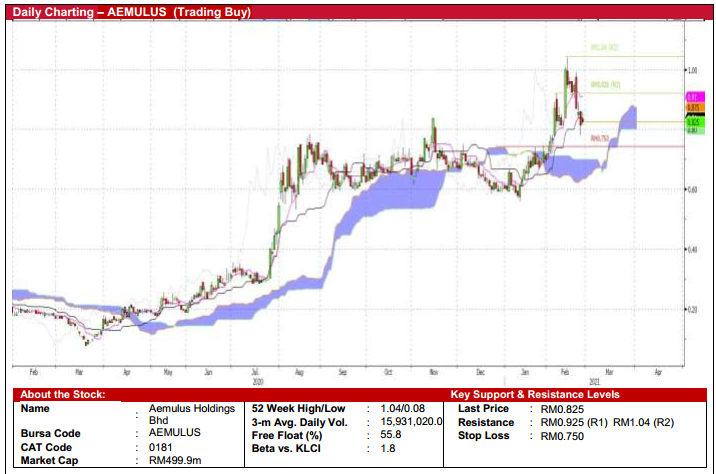

Aemulus Holdings Bhd (Trading Buy)

• AEMULUS is engaged in the designing and assembling of automated test equipment and measurement instruments. The group’s stress testers are mainly used in the RF (radio frequency) sector which is set to ride on its increased adoption for 5G applications.

• The group is benefitting from its China partnership with Tangrenmicro Intelligence as China continues to increase its selfsufficiency in the semiconductor production value chain post the US trade sanctions.

• QoQ, the group saw an increase in revenue to RM11.5m in 1QFY21 (+59% QoQ), lifted by higher orders from the Far East region for their flagship products. Meanwhile, the group’s earnings rose in tandem to RM1.5m (+50% QoQ).

• Chart-wise, the stock made a Kumo Breakout in early February this year to hit an all-time high of RM1.04. Ichimoku-wise, with the stock continues to trade above the bullish Kumo clouds, we believe the upward trajectory could extend moving forward.

• With that, our key resistance levels are set at RM0.925 (R1; +12% upside potential) and RM1.04 (R2; +26% upside potential).

• Meanwhile, our stop loss is pegged at RM0.750 (-9% downside risk).

Source: Kenanga Research - 26 Feb 2021

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

More articles on Kenanga Research & Investment

Created by kiasutrader | Nov 28, 2024