Daily technical highlights – (ASTRO, REVENUE)

kiasutrader

Publish date: Fri, 28 May 2021, 10:45 AM

Astro Malaysia Holdings Bhd (Trading Buy)

• As Malaysia’s leading content and entertainment company, ASTRO recently launched its third subscription-based video-ondemand streaming service via a strategic partnership with Walt Disney Company to stream Disney+ Hotstar in Malaysia. This new streaming package consists of over 800 films and over 18,000 episodes of popular series, namely from Disney, Marvel, Pixar and Star Wars, which are highly enjoyed by a wide array of viewers.

• We believe that this partnership would enable ASTRO to further grow its subscriber base and contribute to the group’s income stream going forward.

• After posting net profit of RM539.8m (-18% YoY) in FY Jan 2021, consensus is expecting ASTRO to make net profit of RM537m in FY22 and RM570m in FY23, which translate to forward PERs of 10.7x and 10.1x, respectively.

• Chart-wise, ASTRO’s share price has declined from a high of RM2.94 around the end of October 2017 to a low of RM0.705 in March 2020 (-76%) but has gained 24% YTD to close at RM1.10 yesterday.

• Technically speaking, the stock has been treading above the middle band of the Donchian Channel, which signals the presence of steady buying support.

• With the share price plotting higher highs and higher lows from its March 2020 trough, we anticipate the stock will continue its upward trajectory ahead.

• Riding on the positive momentum, our resistance thresholds for ASTRO are set at RM1.26 (R1; 15% upside potential) and RM1.35 (R2; 23% upside potential).

• We have set our stop loss price at RM0.97 (or 12% downside risk from the last traded price of RM1.10).

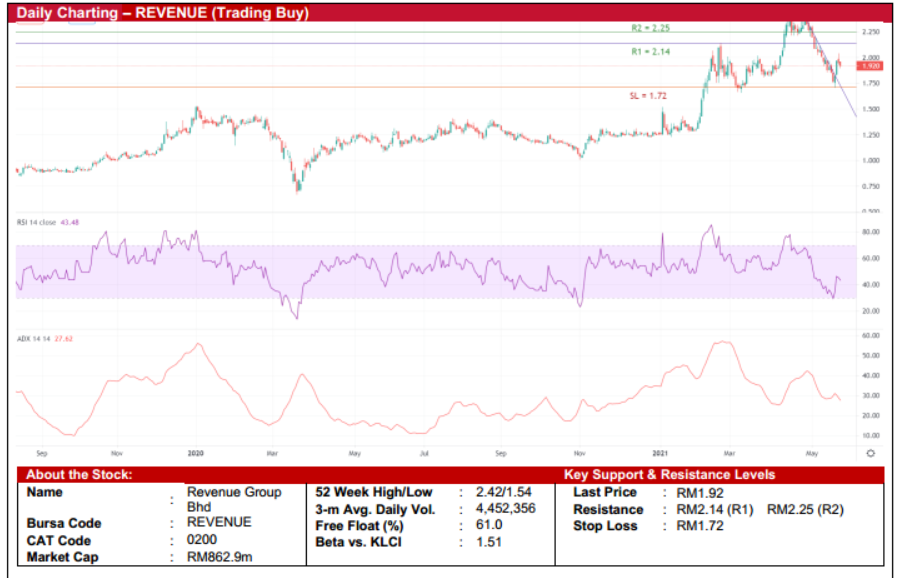

Revenue Group Bhd (Trading Buy)

• REVENUE’s products and services are divided into three segments, namely the deployment of: (i) Electronic Data Capture (EDC) terminals, (ii) electronic transaction processing, and (iii) solutions and services related to payments infrastructure.

• The group is positioned uniquely with clients from various industries ranging from banks, non-bank institutions, physical store merchants, online store merchants and e-money payment schemes.

• Hence, REVENUE is poised to capture the fast-growing electronic payments market in Malaysia, riding on the vision of the government’s Malaysia Digital Economy (MyDigital) blueprint to go cashless by 2022.

• The group’s 2QFY21 net income rose to RM4.0m (+17% QoQ), taking the first half’s net profit to RM6.1m, down 3.1% YoY.

• On the chart, the stock has pulled back from RM2.38 at the end of April before closing at RM1.92 yesterday. • Following the slide, the stock could bounce up ahead as the RSI reverses from the oversold area.

• Further, after rising from a recent low of RM1.71, the positive price momentum will likely continue given the current ADX reading of above 20 (which measures the strength of the trend).

• With that, the stock could advance to challenge our resistance targets of RM2.14 (R1; 11% upside potential) and RM2.25 (R2; 17% upside potential).

• Our stop loss price is set at RM1.72 (or 10% downside risk from yesterday’s close of RM1.92)

Source: Kenanga Research - 28 May 2021

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

More articles on Kenanga Research & Investment

Created by kiasutrader | Nov 22, 2024