Daily technical highlights – (SCGBHD, HTPADU)

kiasutrader

Publish date: Wed, 02 Jun 2021, 12:10 PM

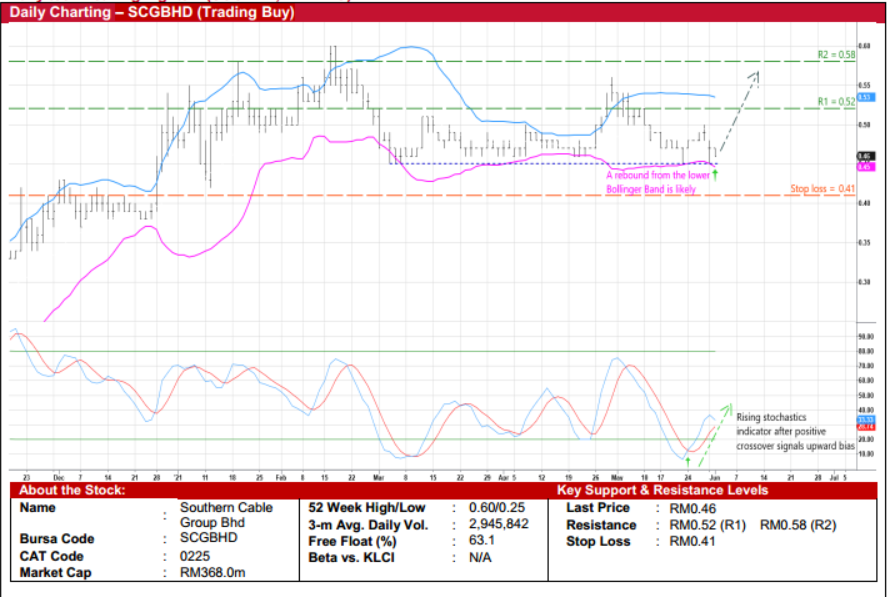

Southern Cable Group Bhd (Trading Buy)

• As a manufacturer of cables and wires that are used for power distribution and transmission, communications as well as control and instrumentation applications, SCGBHD is a proxy to the recurring capex spending by infrastructure players such as Tenaga Nasional, Telekom Malaysia and Petronas

. • Backed by a 3-year track record of annual net profit ranging between RM21m and RM29m, the company (which was only listed in mid-October last year) is in the midst of transferring its listing status from the ACE Market to the Main Market in the second half of 2021. This will boost the appeal of SCGBHD shares to a wider group of investors going forward.

• And continuing the consistent earnings momentum, the group registered net profit of RM3.6m (-24% QoQ) in 1QFY21 while its balance sheet is backed by marginal net cash holdings of RM6.5m as of end-March this year.

• On the chart, after slipping from a recent high of RM0.56 in end-April to close at RM0.46 yesterday, the stock will probably stage a technical rally by bouncing up from a support level (that stretches back to early March this year) to pull away from the lower Bollinger Band.

• The bullish stochastics signal – which was triggered when the %K line crossed over the %D line in an oversold area recently – also indicates that the share price is expected to shift higher ahead.

• Riding on the positive momentum, the stock could advance towards our resistance thresholds of RM0.52 (R1; 13% upside potential) and RM0.58 (R2; 26% upside potential).

• We have pegged our stop loss price at RM0.41 (which represents 11% downside risk).

Heitech Padu Bhd (Trading Buy)

• HTPADU is an information technology (IT) systems provider that specialises in development and maintenance of information & communication technology (ICT) systems and infrastructure for public and private sectors, offering complete end-to-end, customised solutions to its clients.

• In early March this year, the group has entered into a joint venture agreement with Regal Orion Sdn Bhd (whose owners are Japanese IT specialist investors) for the construction of a world class, Tier IV, next generation green data centre at an unused portion of land owned by HTPADU in Shah Alam. Upon completion (with Phase 1 scheduled to be ready in 2024), the group would be entitled to a net profit share of 20%, which would then provide a recurring income stream for the group.

• For the latest financial year ended December 2020, the group reported higher net profit of RM11.0m (+48% YoY)

. • Technically speaking, the chart is indicating that HTPADU shares will likely shift higher ahead as: (i) the MACD line is on the edge of crossing over the signal line, (ii) the RSI has started to reverse from an oversold position, and (iii) the recent appearance of hammer candlesticks represents a bullish signal.

• With that, the stock could climb towards our resistance targets of RM1.41 (R1; 15% upside potential) and RM1.52 (R2; 24% upside potential).

• Our stop loss price is set at RM1.09 (or 11% downside risk from the last traded price of RM1.23).

Source: Kenanga Research - 2 Jun 2021

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

More articles on Kenanga Research & Investment

Created by kiasutrader | Nov 22, 2024