Daily technical highlights – (FRONTKN, PRESTAR)

kiasutrader

Publish date: Fri, 04 Jun 2021, 11:40 AM

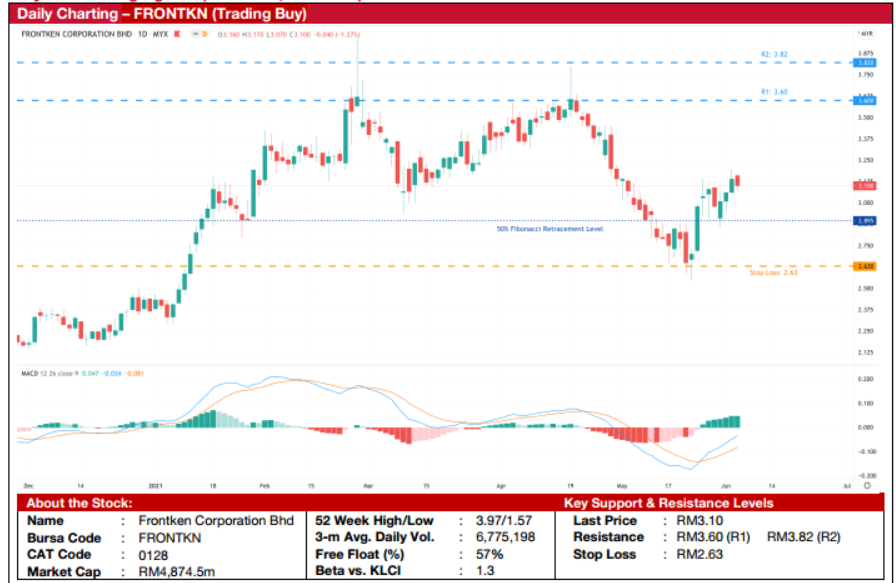

Frontken Corporation Berhad (Trading Buy)

• FRONTKN provides advanced precision cleaning and surface treatment for semiconductor process chamber parts. It also provides repair and maintenance services for the oil and gas industry. As of FY20, about 85% of its revenue came from the former while the latter (and other miscellaneous businesses) made up the remaining 15%.

• In FY20, FRONTKN achieved revenue of RM368m (+8.4% YoY) and net profit of RM82m (+18.5% YoY). Looking ahead, consensus is expecting FRONTKN to achieve net profit of RM108.7m in FY21 and RM132.7m in FY22. These translate to forward PERs of 45x this year and 37x next year, respectively.

• Moving forward, FRONTKN plans to expand its capacity in Taiwan in anticipation of increasing demand for their services relating to tools involved in the manufacturing of the latest nodes of chips. The strong demand expectations are based on their customers’ record capital expenditures in the pipeline.

• Technically speaking, after forming a double-top pattern (following its peaks in February and April), the share price broke below the neckline of RM3.10 in May and plunged further until it hit a bottom at RM2.64 in late-May.

• Since then, the stock has staged a rebound and found support on its way up along the 50% Fibonacci retracement level of RM2.90, suggesting the emergence of buying interest around that level.

• With the MACD indicator showing strengthening upward momentum, the share price could rise to challenge our resistance levels of RM3.60 (R1; 16% upside potential) and RM3.82 (R2; 23% upside potential).

• We have pegged our stop loss price at RM2.63 (15% downside risk).

Prestar Resources Berhad (Trading Buy)

• PRESTAR manufactures and supplies guardrails, trades building materials, and imports and distributes general hardware tools.

• In FY20, PRESTAR achieved net profit of RM22.2m (+570% YoY) despite a 31% drop in revenue. The rise in profit was mainly due to margin improvements, thanks to higher iron and steel prices.

• This comes as global steel prices have been rising throughout 2020 due to: (i) global supply disruptions from Covid-19 related lockdowns, (ii) strong demand recovery from the industrial sector post-lockdowns, and (iii) higher raw material prices.

• Moving forward, for the rest of FY21, PRESTAR expects to continue benefitting from robust demand for its steel products. As of April 2021, PRESTAR has seen strong orders for its steel pipes from the automotive, furniture and equipment OEMs industries.

• Technically speaking, following the sharp drop from a peak of RM1.46 in mid-May (likely due to concerns of MCO 3.0 disruptions), the share price has found support at the 61.8% Fibonacci retracement level of RM1.00.

• With the share price re-testing the support line of RM1.00 a few trading days ago before staging a subsequent rebound, the stock is poised to continue its climb ahead.

• With both the MACD and stochastic indicators currently showing bullish upward momentum, an anticipated rise in the share price could challenge our resistance levels of RM1.37 (R1; 16% upside potential) and RM1.46 (R2; 24% upside potential).

• We have pegged our stop loss price at RM1.00 (15% downside risk).

Source: Kenanga Research - 4 Jun 2021

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

More articles on Kenanga Research & Investment

Created by kiasutrader | Nov 22, 2024