Daily technical highlights – (KRONO, MBSB)

kiasutrader

Publish date: Wed, 09 Jun 2021, 09:48 AM

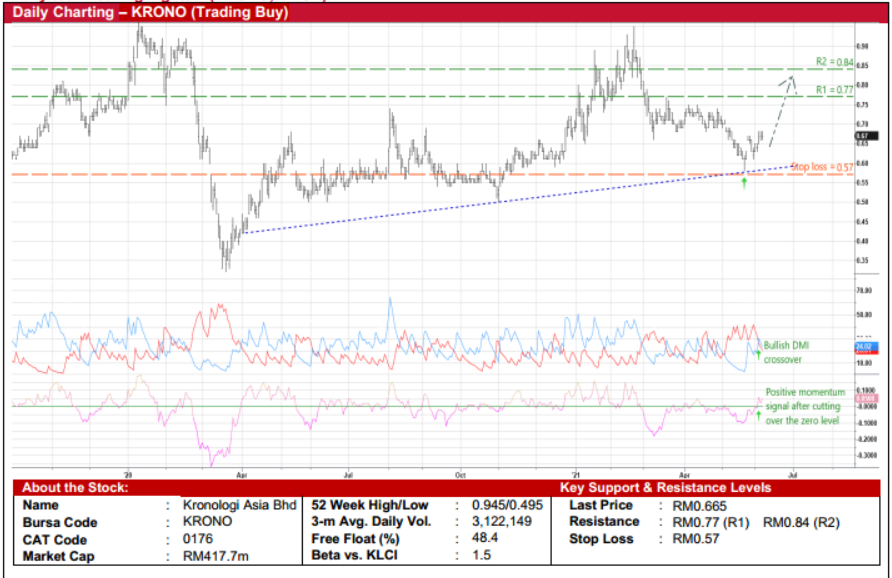

Kronologi Asia Bhd (Trading Buy)

• KRONO is a leading provider of technology and solutions services specializing in: (i) enterprise data management (EDM),and (ii) cloud and hybrid as-a-service (AAS), with a widening geographical presence in Malaysia, Singapore, Thailand,Philippines, Indonesia, India, Taiwan, Hong Kong and China.

• In late May this year, KRONO announced the purchase of the remaining 83.3% stake in Quantum China Limited (QCL) forRM150m to be paid in an equal proportion of cash and shares. The acquisition of QCL – which is principally involved in the EDM infrastructure technology business providing data storage, protection and archival solutions to enterprises in China –comes with profit guarantees of USD2.0m for FY January 2022 and USD2.5m for FY January 2023.

• Its earnings track record – with bottomline rising annually from RM3.1m in FY15 to RM18.6m in FY19 – was interrupted byproperty, plant and equipment write-off (amounted to RM11.7m) last year, which led to a reported net profit of RM1.4m for the13-month period ended January 2021. A timing breakdown of the results revealed that the group was profitable with netearnings of RM5.7m for the quarter ended December 2020 and RM0.8m for the month ended January 2021.

• The group is financially strong with net cash position of RM40.9m (or 6.5 sen per share) as of end-January 2021.

• On the chart, after tumbling from a high of RM0.945 on 22 February this year to a low of RM0.58 three months later, atechnical rebound could be underway following the price reversal from its recent trough amid steady buying interest.

• Our positive stance is driven by the bullish technical signals triggered by: (i) the DMI Plus crossing over the DMI Minus, and(ii) the rising momentum indicator after climbing above the zero line.

• Riding on the renewed strength, the stock could advance towards our resistance thresholds of RM0.77 (R1; 16% upsidepotential) and RM0.84 (R2; 26% upside potential).

• We have set our stop loss price at RM0.57 (or 14% downside risk from the last traded price of RM0.665).

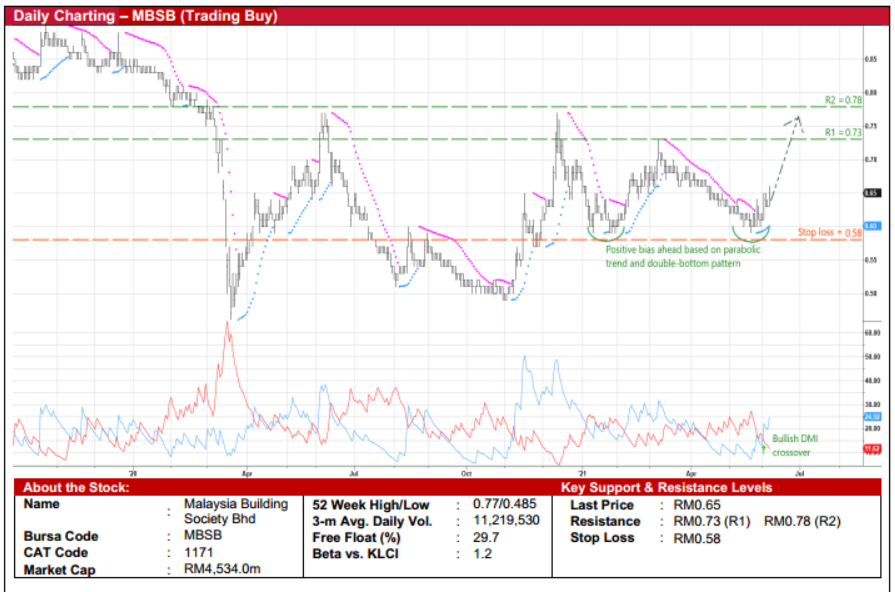

Malaysia Building Society Bhd (Trading Buy)

• MBSB offers a wide range of financial products and services through three key channels, namely consumer banking,business banking and trade financing.

• After posting net profit of RM269.3m (-62% YoY) in FY December 2020, consensus is currently projecting MBSB to makehigher net earnings of RM719.5m in FY21 and RM802.5m in FY22.

• Based on the group’s latest book value per share of RM1.23 as of end-March 2021, the stock is currently trading at P/BVmultiple of 0.53x.

• From a technical perspective, MBSB shares have recently bounced off a double-bottom pattern, which may then pave theway for the stock to shift higher ahead.

• An upward movement in the share price is now anticipated in view of the positive technical signals generated by the bullishparabolic trend and the DMI Plus crossing over the DMI Minus.

• This could then propel the stock – which was up 4% on strong volume yesterday – towards our resistance thresholds ofRM0.73 (R1; 12% upside potential) and RM0.78 (R2; 20% upside potential).

• Our stop loss price is pegged at RM0.58 (or 11% downside risk).

Source: Kenanga Research - 9 Jun 2021

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

More articles on Kenanga Research & Investment

Created by kiasutrader | Nov 22, 2024