Kenanga Research & Investment

Daily technical highlights – (SOLUTN, SCOMNET)

kiasutrader

Publish date: Wed, 23 Jun 2021, 10:03 AM

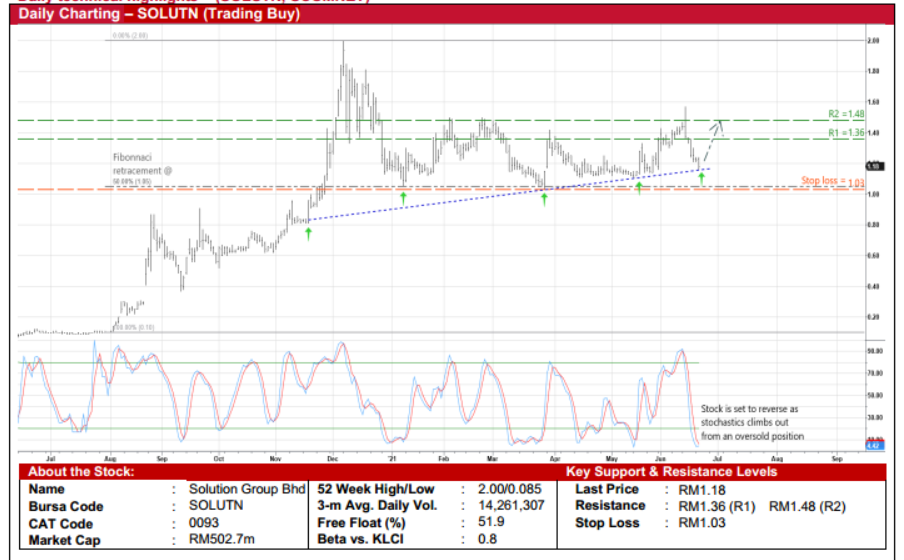

Solution Group Bhd (Trading Buy)

- A vaccine play, SOLUTN is set to supply 3.5m doses of Covid-19 vaccine starting from July this year under an agreementpreviously signed with the government, as Malaysia plans to accelerate the vaccination programme to bring the Covid-19pandemic under control as quickly as possible.

- This follows last Thursday’s conditional approval given by the Drug Control Authority for the product registration of the singledose Convidecia Covid-19 vaccine produced by China’s CanSino Biologics, which has earlier authorised and granted theexclusive right to SOLUTN to register, manufacture (by providing fill-and-finish services) and commercialise the vaccine in Malaysia.

- Via the collaboration, CanSino will also be using SOLUTN’s fill-and-finish facility as the regional hub to market and distributethe COVID-19 vaccine in the ASEAN countries except Indonesia.

- The venture marks the group’s diversification into the bio-pharmaceutical related business, complementing its existingbusiness segments, namely engineering equipment, industrial automation, biotechnology, industrial lubricants, metalfabrication & assembly and solar energy.

- The group – which posted a marginal net loss of RM1.7m in 1QFY21 – is in a financially healthy position with net cashholdings & short-term investments of RM39.5m (or 9.3 sen per share) as of end-March 2021.

- Technically speaking, after bouncing off an ascending trendline and the 50% Fibonacci retracement level on numerousoccasions since November last year, the share price uptrend remains intact.

- With the stochastics indicator about to climb out from an oversold area, the stock is expected to advance towards ourresistance thresholds of RM1.36 (R1; 15% upside potential) and RM1.48 (R2; 25% upside potential).

- We have pegged our stop loss price at RM1.03 (or 13% downside risk from yesterday’s close of RM1.18).

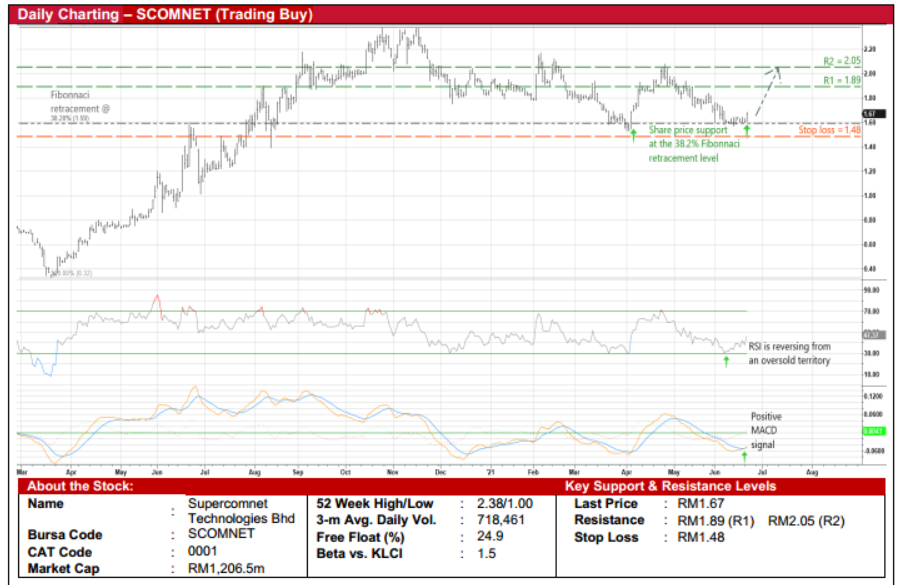

Supercomnet Technologies Bhd (Trading Buy)

- SCOMNET is in the business of manufacturing and assembling advanced high technology wires and cables for the medicaldevices, electrical appliances, consumer electronics and automotive markets.

- The group, which announced net profit of RM23.5m (+21% YoY) in FY December 2020, has seen its bottomline increasingevery year since FY17, translating to a robust 3-year CAGR of 115.3%.

- With the earnings growth momentum extending into 1QFY21 – as net profit jumped 19% YoY to RM4.9m – consensus isprojecting SCOMNET to make net earnings of RM30.0m for FY21 and RM48.0m for FY22. This implies forward PERs of40.2x this year and 25.1x next year, respectively.

- Financially steady, the group has zero borrowings with a cash surplus of RM51.8m (or 7.2 sen per share) as of end-March2021.

- On the chart, following a share price correction from a high of RM2.08 in late April this year, the stock has subsequentlybounced off the 38.2% Fibonacci retracement level to pave the way for the shares to shift higher ahead.

- With the RSI indicator already emerging from an oversold position and the MACD line crossing over the signal line in anoversold area, a technical rebound is anticipated.

- Riding on the positive momentum, the stock will probably climb towards our resistance thresholds of RM1.89 (R1; 13% upsidepotential) and RM2.05 (R2; 23% upside potential).

- Our stop loss price is set at RM1.48 (representing a 11% downside risk).

Source: Kenanga Research - 23 Jun 2021

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

More articles on Kenanga Research & Investment

Bond Weekly Outlook - MGS/GII likely to rise amid ongoing US economic resilience

Created by kiasutrader | Nov 22, 2024

Discussions

Be the first to like this. Showing 0 of 0 comments