Kenanga Research & Investment

Daily technical highlights – (MATRIX, MALAKOF)

kiasutrader

Publish date: Tue, 29 Jun 2021, 10:14 AM

Matrix Concepts Holdings Bhd (Trading Buy)

- MATRIX’s principal business activity is property development with related businesses comprising construction, education,hospitality and healthcare. The group’s key property projects are located in Sendayan (in Negeri Sembilan) and Kluang (inJohor).

- Despite the challenging property market, MATRIX’s bottomline has seen an increase every year for the past four years, risingfrom RM185.3m in FY17 to RM259.9m (+10% YoY) in FY March 2021.

- With unbilled locked-in property sales of RM1.02b as of end-March this year and targeted new property launches of RM1.6bfor FY22, the group is forecasted to make net earnings of RM273.0m for FY22 and RM280.7m for FY23 based on consensusestimates. This translates to undemanding forward PERs of 6.0x this year and 5.8x next year, respectively.

- MATRIX – which has been paying annual DPS ranging between 11.5-13.5 sen in the past three years – also offer attractiveprospective dividend yields of 6.6%-6.8% based on consensus DPS projections of 13.0 sen in FY22 and 13.3 sen in FY23.

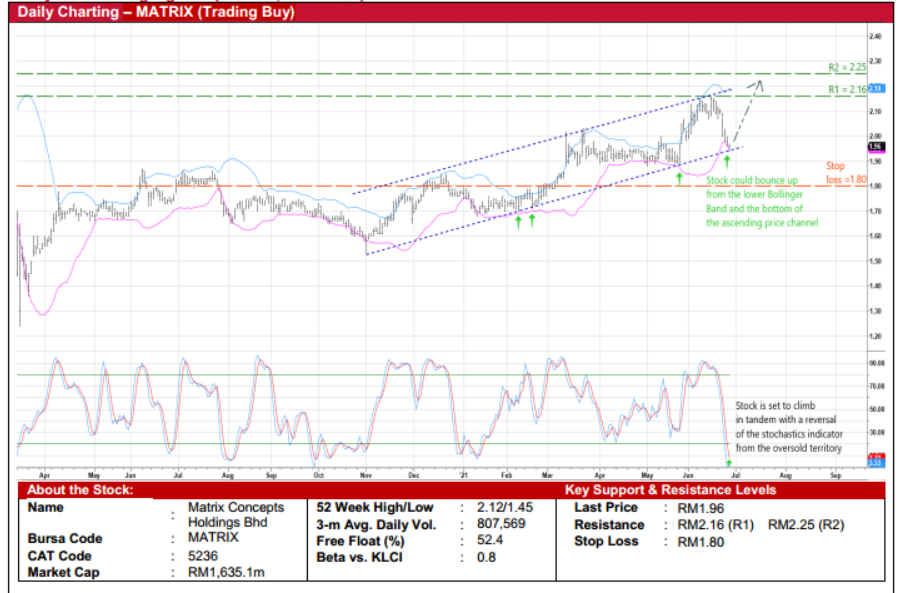

- From a charting perspective, the stock is poised to bounce up from the lower Bollinger Band and the bottom of an ascendingprice channel as a reversal in the stochastics indicator from the oversold position will likely lift the shares towards ourresistance thresholds of RM2.16 (R1; 10% upside potential) and RM2.25 (R2; 15% upside potential).

- Our stop loss price is set at RM1.80 (or 8% downside risk).

Malakoff Corporation Bhd (Trading Buy)

- MALAKOF is an independent power and water producer whose core businesses include power generation, waterdesalination, operations & maintenance and waste management & environmental services.

- After announcing net profit of RM60.4m (-32% YoY) in 1Q ended March 2021, consensus is projecting the group to make netearnings of RM301.1m in FY21 and RM321.8m in FY22, which translates to forward PERs of 13.1x this year and 12.3x nextyear, respectively.

- Its appealing prospective FY21-22 dividend yields of 6.4%-6.8% – based on consensus DPS forecasts of 5.2 sen for FY21and 5.5 sen for FY22 – could cushion the stock’s downside risk amid the prevailing weak market backdrop.

- On the chart, the share price correction from a recent high of RM0.89 in early June presents a timely opportunity for investorsto ride on an anticipated technical rebound.

- Given the positive stochastics signal (with the %K line on the verge of crossing above the %D line in the oversold area) andthe recent appearance of dragonfly doji candlestick, the stock could climb towards our resistance thresholds of RM0.89 (R1;10% upside potential) and RM0.95 (R2; 17% upside potential).

- We have placed our stop loss price at RM0.74 (or 9% downside risk from the last traded price of RM0.81).

Source: Kenanga Research - 29 Jun 2021

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

More articles on Kenanga Research & Investment

Bond Weekly Outlook - MGS/GII likely to rise amid ongoing US economic resilience

Created by kiasutrader | Nov 22, 2024

Discussions

Be the first to like this. Showing 0 of 0 comments