Daily technical highlights – (TUNEPRO, ASTRO)

kiasutrader

Publish date: Thu, 01 Jul 2021, 10:10 AM

Tune Protect Group Bhd (Trading Buy)

• TUNEPRO provides underwriting and reinsurance services, offering a wide range of non-life insurance plans (fire insurance, motor insurance, travel insurance, sports coverage, theft coverage etc) that meets the needs of customers.

• In the first half of this year, TUNEPRO announced a “3-Year Strategic Plan” that is aimed at growing the business by focusing on: (i) building an insurance company that everyone loves, (ii) leveraging on AirAsia’s online ecosystem, and (iii) positioning itself as an ASEAN-based insurance company.

• We believe this plan, coupled with its new product offerings (PRO-Health Medical & Health2Go) launched this year, would contribute to their bottom-line going forward.

• This comes as TUNEPRO’s 1QFY21 revenue decreased to RM177.4m (-4.0% QoQ) while reporting a net loss of RM15.4m (vs a net profit of RM2.5m in the preceding quarter).

• Chart-wise, the 30-day Moving Average line has been providing a steady support since the beginning of June 2021 for the share price, which closed at RM0.415 yesterday. Its downside risk is also cushioned by an upward sloping trendline that stretches back to March last year.

• The A/D indicator has been rising since the beginning of March, signaling that the stock is currently in an uptrend.

• As such, we believe that TUNEPRO’s share price will likely ascend to challenge our resistance thresholds of RM0.48 (R1, 16% upside potential) and RM0.51 (R2, 23% upside potential).

• We have placed our stop loss price at RM0.36 (13% downside risk).

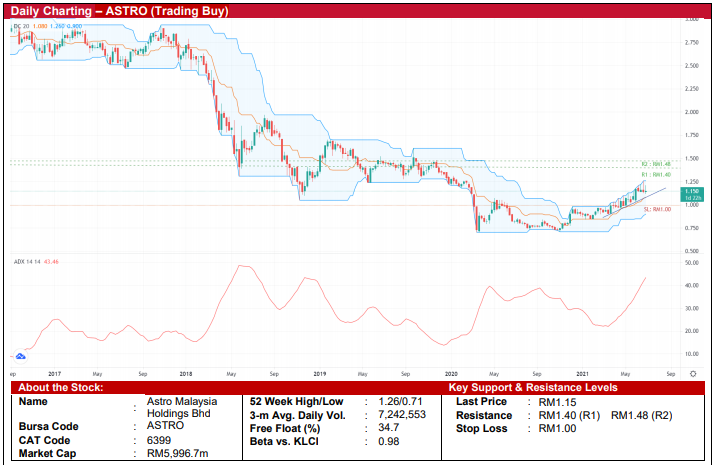

Astro Malaysia Holdings Bhd (Trading Buy)

• From a technical perspective, ASTRO’s share price has been treading above the middle band of the Donchian Channel since the beginning of December 2020, which indicates steady buying support for the stock.

• In addition, the existence of a short-term ascending trendline and the rising ADX line suggest that the stock’s uptrend (+25% YTD) is intact.

• Riding on the positive momentum, we set our resistance targets at RM1.40 (R1) and RM1.48 (R2), which represent upside potentials of 22% and 29%, respectively.

• On the downside, we have pegged our stop loss price at RM1.00, which represents a downside risk of 13.0%.

• ASTRO’s management has been steering the group in the right direction, making strategic moves to enhance the business fundamentals over the long-term.

• The introduction of Disney+ channel in 2QCY21 and the recent announcement of a partnership with Netflix to further expand their choice of programmes will increase their customer base and improve earnings outlook.

• After posting net profit of RM142.7m (+95.7% YoY) in 1Q ended Apr 2021, consensus is expecting ASTRO to make net profit of RM549.8m in FY22 and RM580.3m in FY23. This translates to forward PERs of 10.9x and 10.3x, respectively.

• The stock also offers attractive prospective dividend yields of 6.61%-6.87% based on consensus DPS projections of 7.6 sen in FY22 and 7.9 sen in FY23

Source: Kenanga Research - 1 Jul 2021

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

Market Buzz

More articles on Kenanga Research & Investment

Created by kiasutrader | Nov 22, 2024