Daily technical highlights – (OMESTI, MSM)

kiasutrader

Publish date: Wed, 14 Jul 2021, 09:58 AM

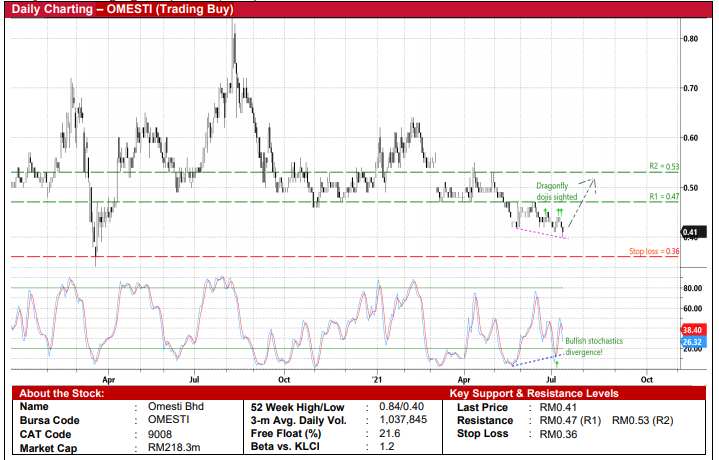

Omesti Bhd (Trading Buy)

• OMESTI comprises a grouping of ICT companies with business activities that are focused on the development and delivery of solutions to assist clients achieve their digital transformation strategies.

• Within the group, OMESTI has a 30:70 joint investment vehicle with CRIF (a global company specialising in credit bureau & business information and credit solutions), which has been granted a credit reporting agency (CRA) licence by the Ministry of Finance in end-June last year. There are presently only seven private CRAs registered to provide credit scoring (including analytics) services for financial institutions, corporations and SMEs in Malaysia.

• This business venture could attract added interest going forward following the impending listing of CTOS Digital Bhd (the market leader of credit reporting industry in the country) on Bursa Malaysia next Monday, which is due to set a market valuation reference post listing.

• From a technical perspective, the stock’s ongoing price correction from a recent high of RM0.64 in early February this year to a 15-month low of RM0.41 currently offers a trading buy opportunity.

• In essence, a technical rebound is anticipated in view of the bullish divergence pattern after the stochastics indicator formed two rising bottoms in the oversold area while the share price continued to drift lower.

• The recent appearance of the bullish dragonfly doji candlesticks also signals a probable upward bias in the stock price ahead.

• Riding on the positive momentum, OMESTI shares could advance towards our resistance thresholds of RM0.47 (R1; 15% upside potential) and RM0.53 (R2; 29% upside potential).

• Our stop loss price is pegged at RM0.36 (or 12% downside risk).

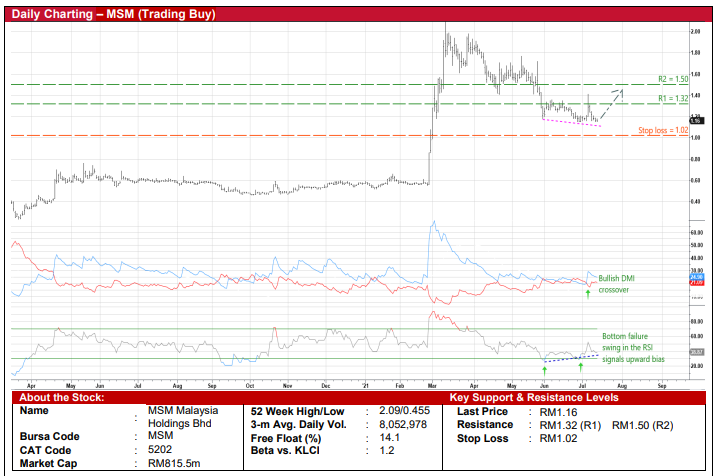

MSM Malaysia Holdings Bhd (Trading Buy)

• MSM’s share price may be due for a technical rebound after pulling back 44% from a peak of RM2.09 in March this year.

• On the chart, the occurrence of a bottom failure swing in the RSI indicator (which has plotted a second trough that was higher than the prior low and climbed out from the oversold territory subsequently while the stock was still falling) signals a probable trend reversal ahead.

• In addition, the bullish crossover by the DMI Plus above the DMI Minus indicators implies that the share price will probably shift higher going forward.

• With that, the stock could rise to challenge our resistance targets of RM1.32 (R1; 14% upside potential) and RM1.50 (R2; 29% upside potential).

• We have pegged our stop loss price at RM1.02 (or 12% downside risk).

• On the fundamental front, MSM – which is involved the business of sugar refining, sales and marketing of refined sugar and trading of sugar – saw a turnaround when it reported net profit of RM31.2m in 1QFY21 (versus 1QFY20’s net loss of RM34.7m), lifted by higher selling prices for export sales and improved margins.

• Going forward, consensus is projecting the group to make net profit of RM118.7m for FY December 2021 and RM124.8m for FY December 2022, which translate to forward PERs of 6.9x this year and 6.5x next year, respectively

Source: Kenanga Research - 14 Jul 2021

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

More articles on Kenanga Research & Investment

Created by kiasutrader | Nov 22, 2024