Daily technical highlights – (GLOMAC, NWP)

kiasutrader

Publish date: Thu, 15 Jul 2021, 10:14 AM

Glomac Bhd (Trading Buy)

• GLOMAC’s business activity encompasses property development, property investment, construction, property management and car park management. Its key property development projects are located in Sungai Buloh and Rawang.

• Amid the challenging property market, the group’s 3QFY21 revenue increased to RM99.3m (+34% QoQ) while its net income decreased to RM11.6m (-4% QoQ), taking YTD net profit to RM24.9m (-2% YoY).

• Consensus is expecting GLOMAC to post a net profit of RM40.2m in FY April 22 and RM55.3m in FY April 23. This translates to forward PERs of 6.0x and 4.4x, respectively. The stock offers dividend yields of 4.8%-7.9% based on consensus DPS forecasts of 2.5 sen for FY22 and 1.5 sen for FY23.

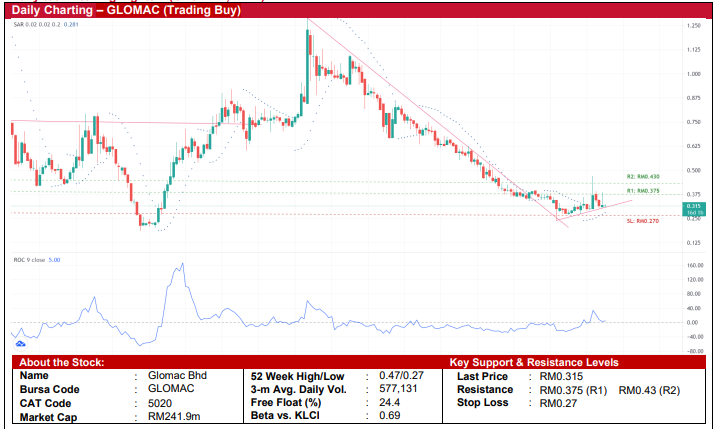

• Looking at the long-term chart, GLOMAC’s share price has plunged from a high of RM1.29 (at the beginning of May 2013) to as low as RM0.24 (at the beginning of March 2020), representing a retracement of 81%.

• Since then, buying interest has picked up as the shares climbed to overcome a multi-year downward sloping trendline, closing at RM0.315 yesterday.

• Following which, a technical rebound may be underway as the Parabolic SAR indicator is trending up while the ROC indicator has crossed above the zero line.

• With that, the stock could advance to challenge our resistance targets of RM0.375 (R1; 19% upside potential) and RM0.43 (R2; 37% upside potential).

• Our stop loss price is set at its 52- week low of RM0.27 (or 14% downside risk from yesterday’s close of RM0.315).

NWP Holdings Berhad (Trading Buy)

• From a technical perspective, NWP’s share price has recently cut above the 50-day Moving Average, which indicates the stock is in an upward trajectory following the plotting of higher lows since May this year.

• And with the MACD indicator displaying rising momentum after crossing above the signal line, we believe the share price could challenge our resistance thresholds of RM0.265 (R1) and RM0.28 (R2), which represent upside potentials of 23% and 30%, respectively.

• On the downside, we have pegged our stop loss price at RM0.17, which represents a downside risk of 21%.

• Fundamentally, NWP is involved in the wood-based business comprising the manufacturing of wood molding, priming timber & laminated timber and trading of sawn timber.

• While the group is currently loss-making (with a marginal net loss of RM3.5m in the quarter ended February 2021), as the global economy gradually recovers post the Covid-19 pandemic and with increasing consumer confidence, NWP will be in a position to capitalize on the pent-up demand for its wood-related products going forward.

Source: Kenanga Research - 15 Jul 2021

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

More articles on Kenanga Research & Investment

Created by kiasutrader | Nov 22, 2024