Daily technical highlights – (RGTBHD, MFLOUR)

kiasutrader

Publish date: Tue, 27 Jul 2021, 09:34 AM

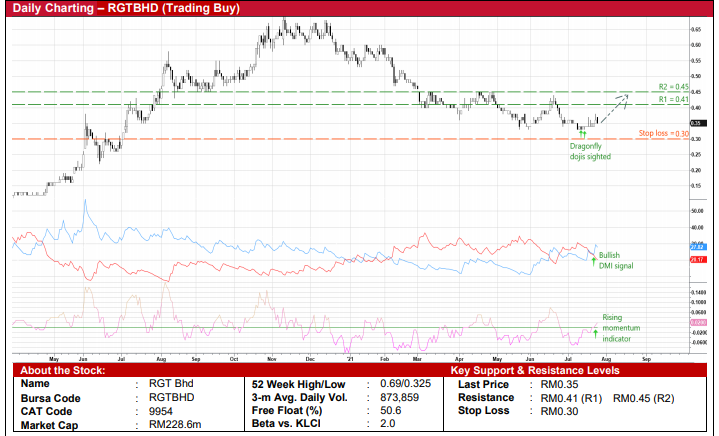

RGT Bhd (Trading Buy)

• As an integrated, one-stop solution manufacturer of hygiene care and air care products – such as soap, sanitizer and fragrance dispensers – RGTBHD offers exposure to the growing demand for these products which are widely used to prevent and control the spread of the Covid-19 virus.

• Capturing the high demand, the group registered net profit of RM3.0m (+396% YoY) on the back of revenue of RM32.3m (+110% YoY) in 3Q ended March 2021. This brought YTD net earnings to RM11.4m (+301% YoY) and revenue to RM119.4m (+133% YoY) for the 9-month period.

• To cater to the strong overseas orders (especially from US and Europe, which collectively accounts for 80%-90% of overall sales), RGTBHD is in the midst of constructing a new 100,000 sq ft manufacturing cum warehouse facility. Scheduled to commence operations in early 2022, it will raise the annual production capacity by 2.5 times to approximately RM500m worth of hygiene care products.

• In addition, the group is financially healthy with net cash holdings of RM36.6m (or 5.6 sen per share) as of end-March 2021.

• Technically speaking, RGTBHD’s share price is poised to stage a trend reversal after sliding from a high of RM0.69 in November last year to RM0.35 currently.

• This follows the recent bullish technical signals triggered by: (i) the DMI Plus crossing over DMI Minus, (ii) the momentum indicator which is on the increase after cutting above zero, and (iii) the appearance of dragonfly doji candlesticks.

• An anticipated price increase could lift the stock towards our resistance thresholds of RM0.41 (R1; 17% upside potential) and RM0.45 (R2; 29% upside potential).

• Our stop loss price is pegged at RM0.30 (or 14% downside risk).

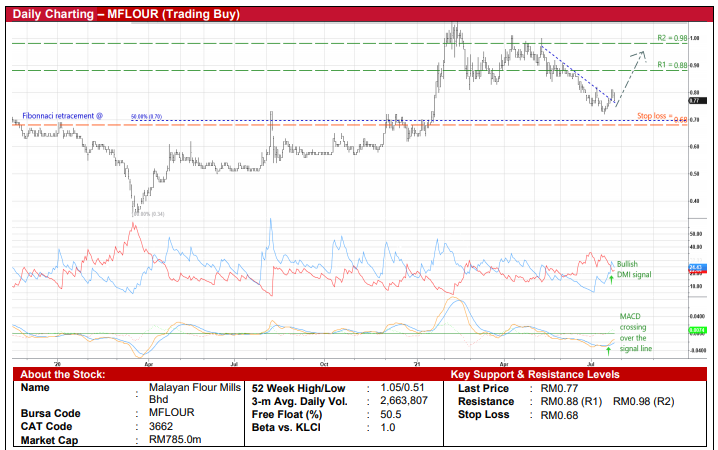

Malayan Flour Mills Bhd (Trading Buy)

• A technical rebound could be on the cards for MFLOUR shares following a price correction of 23% from a recent high of RM1.00 in early May this year.

• On the chart, after overcoming a descending trendline recently, the stock is expected to continue its upward trajectory as the DMI Plus crosses over the DMI Minus while the MACD line cuts above the signal line.

• With that, the share price could advance further to challenge our resistance targets of RM0.88 (R1; 14% upside potential) and RM0.98 (R2; 27% upside potential).

• We have placed our stop loss price at RM0.68 (representing a 12% downside risk).

• Fundamentally speaking, MFLOUR – which is involved in the flour & grains trading and poultry integration businesses – has posted a turnaround with net profit of RM17.7m in 1QFY21 (from a net loss of RM16.8m in 1QFY20), lifted primarily by better margins in the flour business amid lower wheat costs and higher selling prices.

• Going forward, consensus is forecasting the group to make net profit of RM65.1m for FY December 2021 and RM105.0m for FY December 2022, which translate to forward PERs of 12.1x this year and 7.5x next year, respectively

Source: Kenanga Research - 27 Jul 2021

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

More articles on Kenanga Research & Investment

Created by kiasutrader | Nov 22, 2024