Kenanga Research & Investment

Daily technical highlights – (PESTECH, LYC)

kiasutrader

Publish date: Wed, 28 Jul 2021, 06:11 PM

Pestech International Bhd (Trading Buy)

- PESTECH’s share price could stage a price reversal soon following its slide from a high of RM1.43 in mid-February this year to RM0.875 currently.

- According to our trading system, which is built on the RSI indicator to trigger buy signals when the RSI value crosses above the pre-set oversold level, the stock is anticipated to shift higher going forward. Based on an exit rule of either a 13% profit or 10% stop loss (whichever comes first) from the trigger levels, the back-tested results showed that 13 of the 16 alerts generated by the trading system since 2015 were profitable trades (i.e. it has correctly predicted the ensuing share price gains of at least 13%), which represents an accuracy rate of 81%.

- With the emergence of the latest buy signal in end-June this year, our trading system is now predicting that PESTECH shares will probably advance to at least RM1.01. On the chart, we reckon the stock could climb towards our resistance thresholds of RM1.01 (R1; 15% upside potential) and RM1.11 (R2; 27% upside potential).

- Our stop loss price is set at RM0.77 (or 12% downside risk).

- In terms of profitability, PESTECH – an integrated electrical power technology company with businesses in power transmission infrastructure, power generation & rail electrification, transmission assets and power products & embedded system software – reported net earnings of RM37.5m (-5% YoY) for the 9-month period ended March 2021.

- Going forward, our fundamental research team is projecting the group to make net profit of RM59.5m in FY June 2021 and RM75.7m in FY June 2022, which translate to undemanding forward PERs of 11.1x this year and 8.8x next year, respectively

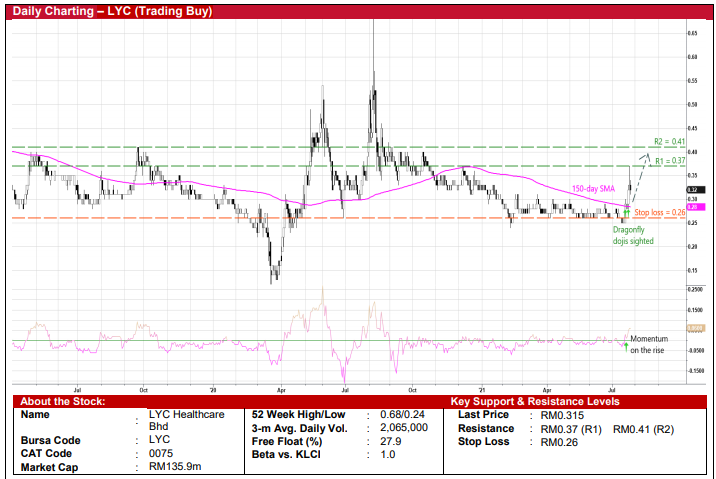

LYC Healthcare Bhd (Trading Buy)

- LYC shares saw price action lately when the stock jumped as much as 30% in two days to a high of RM0.37 on Monday before retracing to close at RM0.315 yesterday in tandem with the broad market weakness.

- From a technical perspective, the share price is expected to ride on an upward trajectory after overcoming the key 150-day SMA line, which is backed further by the rising momentum indicator and the appearance of bullish dragonfly doji candlesticks.

- A resumption of the buying interest could lift LYC’s share price to challenge our resistance hurdles of RM0.37 (R1; 17% upside potential) and RM0.41 (R2; 30% upside potential).

- We have set our stop loss price at RM0.26 (or 17% downside risk from its last traded price of RM0.315).

- Business-wise, LYC is involved in the resilient healthcare industry, providing mother and child care related services such as postnatal & postpartum care and confinement care.

- The group has also diversified into other healthcare segments such as senior living homes, family clinic, childcare services, cosmetic & aesthetic and fertility services. It has ventured into Singapore too via the acquisitions of two companies that operate medical centres.

- While currently loss-making, the group has narrowed its quarterly net loss to RM1.7m in 4QFY21 (from -RM4.6m in 3QFY21), taking full-year net loss to RM11.7m in FY March 2021, as its underlying performance was hit mainly by impairment losses and higher depreciation charges as well as business disruptions arising from the Covid-19 pandemic.

Source: Kenanga Research - 28 Jul 2021

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

Market Buzz

More articles on Kenanga Research & Investment

Bond Weekly Outlook - MGS/GII likely to rise amid ongoing US economic resilience

Created by kiasutrader | Nov 22, 2024

Discussions

Be the first to like this. Showing 0 of 0 comments