Daily technical highlights – (MI, ELSOFT)

kiasutrader

Publish date: Thu, 29 Jul 2021, 10:12 AM

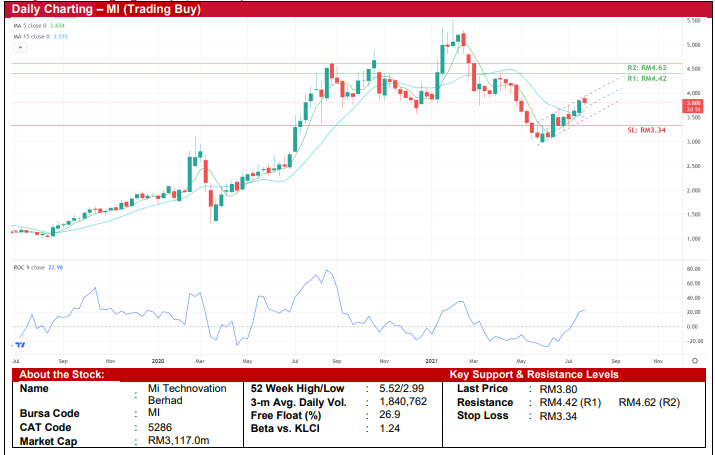

Mi Technovation Berhad (Trading Buy)

• MI operates in the semiconductor industry with two business units, namely: (i) Semiconductor Equipment Business Unit, and (ii) Semiconductor Material Business Unit.

• The top notable competitive strengths of MI are: (i) its wealth of knowledge in terms of technical expertise by undertaking various R&D projects to develop state-of-the-art semiconductors, (ii) its ability to capitalise on the growing demand in the semiconductor industry, and (iii) a diversified customer base.

• The group’s 1QFY21 revenue increased to RM54.2m (+54% QoQ) while its net income was down to RM3.5m (-66% QoQ) mainly due to higher operating expenses.

• Despite the slow 1QFY21 performance, consensus has projected MI to post a net profit of RM73.8m in FY December 21 and RM95.5m in FY December 22. This translates to forward PERs of 42.2x and 32.6x, respectively.

• Looking at the long-term chart, MI’s share price has plunged from a high of RM5.52 (at the beginning of February 2021) to as low as RM2.99 (at the end of May 2021), representing a retracement of 46%.

• Since then, buying interest has picked up with the increasing ROC trend as the shares climbed to close at RM3.80 yesterday.

• Following which, a technical rebound may be underway as the shorter-term moving average has crossed above the longerterm moving average, indicating a likely upward price momentum.

• With that, the stock could advance to challenge our resistance targets of RM4.42 (R1; 16% upside potential) and RM4.62 (R2; 22% upside potential).

• Our stop loss price is set at RM3.34 (or 12% downside risk from yesterday’s close of RM3.80).

Elsoft Research Berhad (Trading Buy)

• From a technical perspective, the shorter-term moving average has just cut above the longer-term moving average, which indicates that ELSOFT’s share price is set to ride on an upward trajectory following the formation of higher lows since March 2020.

• In addition, with the Parabolic SAR indicator trending upwards, the stock could climb to challenge our resistance targets of RM0.985 (R1) and RM1.08 (R2), which represents upside potentials of 17% and 28%, respectively.

• On the downside, we have pegged our stop loss at RM0.73, which represents a downside risk of 14%.

• Business-wise, ELSOFT is engaged in the research, design & development of test and burn-in systems and application specific embedded systems.

• ELSOFT reported a revenue of RM3.9m (-9.3% QoQ) while its net income increased to RM0.4m (+300% QoQ) in 1QFY21 due to reduced expenses and a positive profit contribution from its associate company.

• Going forward, consensus has estimated ELSOFT to post a net profit of RM7.9m in FY December 21 and RM22.3m in FY December 22. This translates to forward PERs of 71.9x and 25.6x, respectively.

Source: Kenanga Research - 29 Jul 2021

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

More articles on Kenanga Research & Investment

Created by kiasutrader | Nov 22, 2024