Daily technical highlights – (MSM, JHM)

kiasutrader

Publish date: Tue, 17 Aug 2021, 09:18 AM

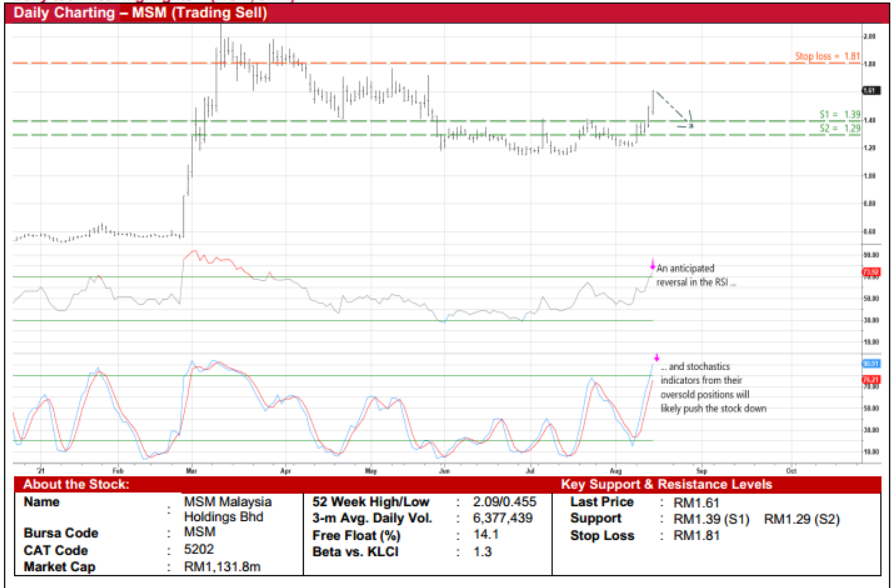

MSM Malaysia Holdings Bhd (Trading Sell)

• Against a wobbly market backdrop, we recommend Trading Sell / Take Profit on MSM shares following the sharp price rally,rising in the last five trading days from RM1.22 to end at a high of RM1.61 yesterday.

• The stock has now jumped 39% since we issued our previous Trading Buy call on 14 July this year to overshoot our technicaltarget prices of RM1.32 (R1) and RM1.50 (R2).

• From a technical perspective, a price correction could be on the horizon after the run-up as both the RSI and stochasticsindicators are set to reverse from their oversold positions.

• With that, the stock could pull back towards our support thresholds of RM1.39 (S1) and RM1.29 (S2), which representdownside potentials of 14% and 20%, respectively.

• Our stop loss price is pegged at RM1.81 (implying an upside risk of 12%).

• On the earnings front, after announcing net profit of RM31.2m in 1QFY21 (versus 1QFY20’s net loss of RM34.7m),consensus is forecasting that MSM – which is involved the business of sugar refining, sales and marketing of refined sugarand trading of sugar – will post net earnings of RM119.1m for FY December 2021 and RM126.5m for FY December 2022.

• Following the share price surge, based on consensus expectations, the stock is currently trading at forward PERs of 9.5x thisyear and 8.9x next year, respectively

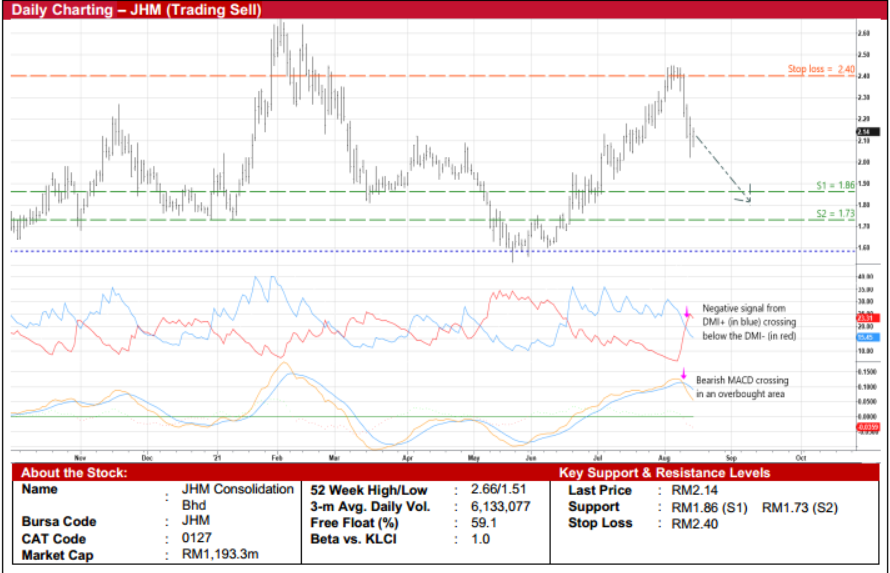

JHM Consolidation Bhd (Trading Sell)

• JHM’s strong share price performance, which touched a high of RM2.45 in early August before retracing to close at RM2.14yesterday, prompts us to recommend Trading Sell / Take Profit on its shares.

• This comes as the stock (up 26% since 15 June this year when we previously made our Trading Buy recommendation) hasalready surpassed both our technical target prices of RM1.92 (R1) and RM2.08 (R2).

• On the chart, the stock will probably show further weakness based on the bearish technical signals arising from: (i) the DMIPlus crossing below the DMI Minus, and (ii) the MACD line cutting under the signal line in an overbought area.

• An anticipated share price pullback could push down JHM shares to test our support lines of RM1.86 (S1; 13% downsidepotential) and RM1.73 (S2; 19% downside potential).

• We have set our stop loss price at RM2.40 (representing an upside risk of 12%).

• Fundamentally, after posting net profit of RM9.0m (+70% YoY) in 1QFY21, consensus is forecasting JHM – whose businessoperation comprises 2 key segments, namely electronics business unit and mechanical business unit – to make net earningsof RM42.8m in FY December 2021 and RM52.0m in FY December 2022.

• Valuation-wise, this translates to prospective PERs of 27.9x this year and 22.9x next year respectively, with the 1-yearforward PER currently hovering at 1.5 SD above its historical mean valuation.

Source: Kenanga Research - 17 Aug 2021

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

More articles on Kenanga Research & Investment

Created by kiasutrader | Nov 22, 2024