Daily technical highlights – (HTPADU, MMSV)

kiasutrader

Publish date: Tue, 24 Aug 2021, 09:31 AM

Heitech Padu Bhd (Trading Buy)

• As an information technology (IT) systems provider that specialises in development and maintenance of information & communication technology (ICT) systems and infrastructure for public and private sectors, HTPADU is a proxy to the fastgrowing demand for data centres.

• HTPADU has entered into two separate agreements (in early March and mid-August this year) with Regal Orion Sdn Bhd (whose owners are Japanese IT specialist investors) to build: (i) a world class, Tier IV, next generation green data centre at an unused portion of land owned by HTPADU in Shah Alam (with Phase 1 scheduled to be ready in 2024), whereby the group would be entitled to a net profit share of 20% once the business operation commences, and (ii) a world premium, Tier IV, next generation green mega data centre facilities (with a total of 4,064 racks available for rent upon completion) in Labu, Negeri Sembilan to be constructed over a 15-month period at an estimated contract price of RM350m.

• In terms of recent earnings performance, HTPADU made net profit of RM11.0m (+48% YoY) in FY December 2020 and remained profitable with a slight net earnings of RM0.1m (-89% YoY) in 1QFY21 mainly due to the completion of several jobs.

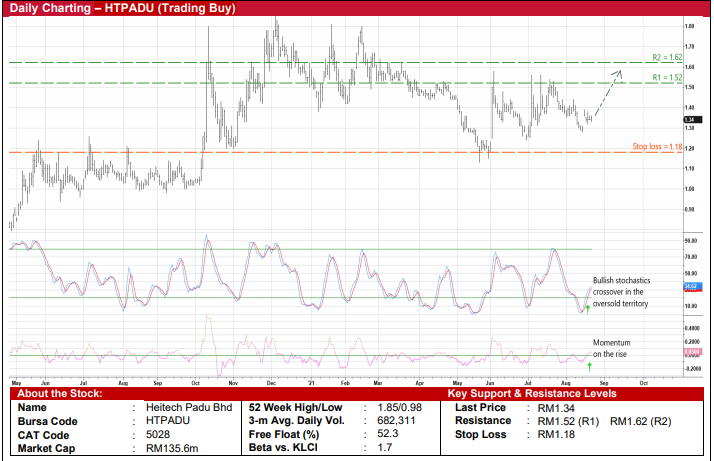

• On the chart, after sliding from a recent high of RM1.54 in mid-July to as low as RM1.28 in mid-August, the stock jumped 9% to a high of RM1.39 last Tuesday.

• The share price rebound is expected to continue following the positive technical signals triggered recently by the stochastics crossover in an oversold area and momentum indicator cutting above the zero-line.

• Riding on the renewed buying interest, HTPADU shares could advance towards our resistance thresholds of RM1.52 (R1; 13% upside potential) and RM1.62 (R2; 21% upside potential).

• We have set our stop loss price at RM1.18 (or 12% downside risk from the last traded price of RM1.34)

MMS Ventures Bhd (Trading Buy)

• Following a share price pullback from a recent high of RM1.18 on 11 August to RM0.925 currently, a technical rebound could be on the cards for MMSV shares.

• In particular, our trading system – which is built on a simple moving average (SMA) indicator to generate buy alerts when the share price crosses above the SMA line – is anticipating that the stock will likely shift higher ahead. Based on an exit rule of either an 8% profit or 9% stop loss (whichever comes first) from the trigger levels, the back-tested results showed that the trading system has correctly predicted 26 out of the 33 buy signals that were triggered since 2015 as profitable trades (representing a hit rate of 79%).

• On the back of the latest buy alert that appeared last Wednesday, the trading system is forecasting that MMSV’s share price could climb to RM1.05 or higher going forward. On the chart, we have pegged our resistance thresholds at RM1.05 (R1; 14% upside potential) and RM1.14 (R2; 23% upside potential).

• Our stop loss price is set at RM0.83 (or 10% downside risk).

• From a fundamental standpoint, MMSV – as a manufacturer of high-tech automation system (such as inspection and testing machines) with a customer base operating in the LED (for applications in smart phones and automotive), semiconductor and OEM/ODM segments – offers exposure to the high growth technology sector.

• The group posted net profit of RM1.4m (+231% YoY) in 1QFY21 with a debt-free balance sheet that is backed by cash & quoted investments of RM38.8m (or 19.6 sen per share) as of end-March 2021.

Source: Kenanga Research - 24 Aug 2021

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

More articles on Kenanga Research & Investment

Created by kiasutrader | Nov 22, 2024