Daily technical highlights – (SAMCHEM, CCK)

kiasutrader

Publish date: Wed, 25 Aug 2021, 10:11 AM

Samchem Holdings Bhd (Trading Buy)

• A leading regional industrial chemicals and lubricants distributor, SAMCHEM supplies approximately 500 different petrochemicals and services to more than 7,000 clients from industries such as automotive, paints & inks, oil & gas and agriculture across the region (mainly in Malaysia, Indonesia, Vietnam and Singapore).

• After posting a 71% YoY net profit jump to RM40.7m in FY December 2020, the group saw continued robust earnings momentum with its sequential quarterly net profit coming in at RM19.0m (+338% YoY / +5% QoQ) in 1QFY21 and RM19.2m (+120% YoY / +2% QoQ) in 2QFY21.

• Annualizing the 1HFY21’s performance, SAMCHEM’s estimated full-year net earnings works out to be RM76.4m, which implies an undemanding forward PER of 5.3x only.

• Future business growth will be driven by the group’s plan to build a warehouse in Pulau Indah, Selangor, which is expected to double its storage capacity in the Klang Valley when it commences operations next year.

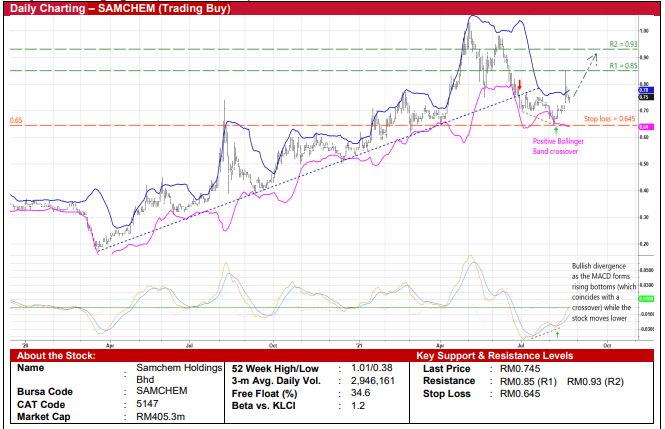

• From a technical viewpoint, following an interruption (in end-June) in the stock’s 15½-month steady climb along an ascending trendline, its subsequent share price correction of 22% from a recent high of RM0.96 to RM0.745 currently offers a timely trading buy opportunity.

• On the chart, SAMCHEM shares could be resuming the upward trajectory based on the bullish technical signals triggered by: (i) the share price crossing back above the lower Bollinger Band, and (ii) the existence of a bullish divergence pattern, which shows the MACD indicator rising from an oversold position while the price is weakening.

• On the way up, the stock will probably advance towards our resistance thresholds of RM0.85 (R1; 14% upside potential) and RM0.93 (R2; 25% upside potential).

• Our stop loss price is placed at RM0.645 (which translates to a downside risk of 13%).

CCK Consolidated Bhd (Trading Buy)

• After sliding from a recent high of RM0.76 in mid-April this year to RM0.595 currently, CCK shares will likely stage a technical rebound soon.

• The positive technical view is affirmed by our trading system, which is built on a Bollinger Band indicator to trigger buy signals when the share price crosses back above the lower band. Using an exit rule of either an 18% profit or 8% stop loss (whichever comes first) from the trigger levels, the back-tested results showed that 21 of the 24 buy alerts that were generated by the trading system since 2015 were profitable trades (i.e. it has correctly predicted the ensuing share price appreciations of 18% or more). This translates to a hit rate of 88%.

• With the appearance of the latest buy alerts (on 15 July and yesterday), the trading system is signalling that CCK’s share price could climb to RM0.70 or higher going forward. We have placed our resistance thresholds at RM0.70 (R1; 18% upside potential) and RM0.77 (R2; 29% upside potential).

• Our stop loss level is set at RM0.51 (or 14% downside risk from the last traded price of RM0.595).

• Business-wise, CCK’s fundamentals are relatively resilient as the group sells basic food items such as fresh dressed chicken & chicken parts, frozen products, table eggs, fresh fruits and vegetables, in addition to operating a chain of retail stores.

• After reporting net profit of RM37.5m (+13% YoY) in FY December 2020, which was followed by net earnings of RM6.1m (- 25% YoY) in 1QFY21, consensus is forecasting CCK’s bottomline to come in at RM34.2m for FY21 and RM38.3m for FY22. This translates to forward PERs of 10.9x this year and 9.7x next year, respectively.

Source: Kenanga Research - 25 Aug 2021

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

Market Buzz

More articles on Kenanga Research & Investment

Created by kiasutrader | Nov 22, 2024