Daily technical highlights – (MTAG, KSSC)

kiasutrader

Publish date: Wed, 06 Oct 2021, 09:22 AM

MTAG Group Bhd (Trading Buy)

• After recovering from a recent low of RM0.595 in mid-July this year, MTAG’s share price could be on the way to extend its positive trajectory ahead.

• An upward shift in the stock is anticipated now as the momentum indicator is rising (following a crossover of the zero-line) while the appearance of dragonfly doji candlesticks points to a bullish bias.

• On the way up, the shares will probably climb towards our resistance thresholds of RM0.74 (R1; 14% upside potential) and RM0.80 (R2; 23% upside potential).

• Our stop loss price is set at RM0.57 (which represents a 12% downside risk from yesterday’s close of RM0.65).

• Fundamentally, as one of the leading labels and stickers printing and materials converting specialists, MTAG is an indirect proxy to the fast-growing electronics manufacturing services (EMS) industry in Malaysia, serving a diversified clientele from various industries including the likes of VS Industry and ATA IMS.

• In spite of the business disruptions arising from various movement restrictions imposed by the government to curb the Covid- 19 outbreak, the group posted net profit of RM7.1m (+41% YoY) in the final quarter ended June 2021, taking FY June 21’s full-year earnings to RM33.6m (+11% YoY) as overall performance was driven mainly by stronger sales.

• Going forward, based on consensus estimates, MTAG is projected to make net profit of RM36.5m in FY June 2022 and RM41.5m in FY June 2023, which translate to forward PERs of 12.1x and 10.7x, respectively.

• Backed by a debt-free balance sheet with cash holdings of RM120.0m (17.6 sen per share or slightly more than one-quarter of the existing share price) as of end-June this year, consensus is expecting MTAG to declare DPS of 3.2 sen in FY22 and 3.8 sen in FY23, implying attractive dividend yields of 4.9%-5.8%, respectively.

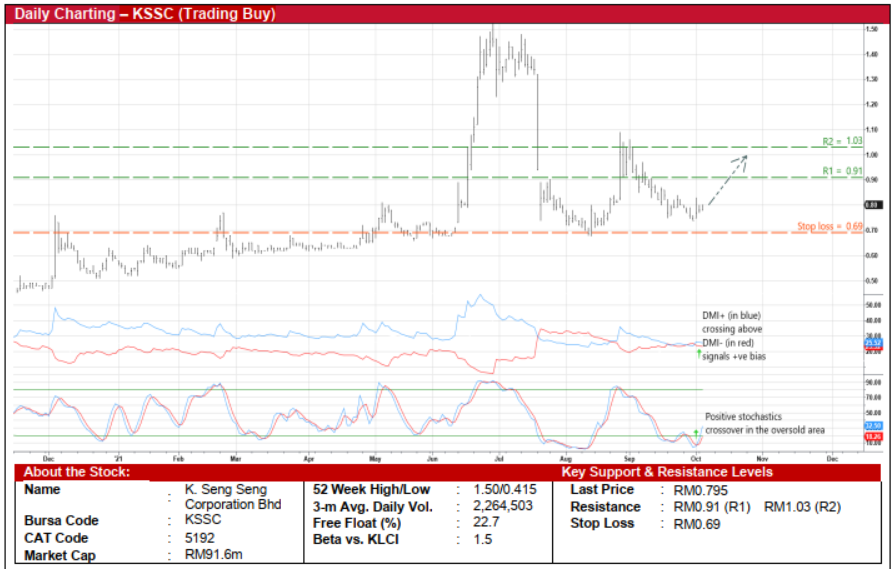

K. Seng Seng Corporation Bhd (Trading Buy)

• Following a price pullback from a recent high of RM1.08 in late August this year to as low as RM0.74 last Thursday, KSSC shares – which jumped 2.6% to finish at RM0.795 yesterday – are showing initial signs of a technical rebound.

• With the DMI Plus rising above the DMI Minus indicator and the stochastics’ %K line crossing over the %D line in the oversold zone, the stock is expected to find renewed strength to shift higher ahead.

• Riding on the upward momentum, KSSC’s share price will probably advance towards our resistance targets of RM0.91 (R1) and RM1.03, which represent upside potentials of 14% and 30%, respectively.

• We have placed our stop loss price at RM0.69 (or a 13% downside risk).

• Business-wise, the group is involved in the manufacturing and processing of secondary stainless steel and stainless steel related products (such as stainless steel tubes and pipes), trading of industrial hardware (including marine hardware and consumables) and engineering works, fabrication & installation of glove dipping line and trading of glove dipping line parts.

• For the second quarter ended June 2021, its bottomline returned to the black with net profit of RM4.1m (versus net loss of RM0.6m previously), bringing 1HFY21’s net profit to RM5.6m (from net loss of RM1.1m previously) as overall performance was boosted by higher sales and better operating margins.

Source: Kenanga Research - 6 Oct 2021

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

Market Buzz

More articles on Kenanga Research & Investment

Created by kiasutrader | Aug 26, 2024

Created by kiasutrader | Aug 26, 2024

.png)