Daily technical highlights – (TEXCYCL, SERBADK)

kiasutrader

Publish date: Thu, 14 Oct 2021, 10:30 AM

Tex Cycle Technology Bhd (Trading Buy)

• TEXCYCL operates in the waste management industry via 4 business units, namely: (i) Recovery and Recycling of Waste, (ii) Renewable Energy, (iii) Manufacturing, and (iv) Solar Energy.

• Going forward, TEXCYCL will be focussing to grow its Renewable Energy business unit.

• For the most recent quarter ended June 2021, the group registered a net profit of RM0.7m, taking its 1HFY21’s bottom-line to RM2.7m (+800% YoY), a decent set of results considering the dampened economic conditions in the first half of the year.

• Chart-wise, after dropping from a high of RM0.555 (in mid-August 2020) to a low of RM0.375 (at the beginning of October 2020), the stock has been treading sideways for approximately 9 months. Thereafter, the stock hit a new high of RM0.575 (in end-July 2021) before declining 20% subsequently to close at RM0.46 yesterday.

• From a technical viewpoint, after piercing above the 200-day EMA following a 7% jump in the share price yesterday, the ongoing momentum may lift the stock to stage a rally ahead.

• In addition, with the Parabolic SAR indicator just starting to plot its first uptrend signal, the stock could climb to challenge our resistance targets of RM0.52 (R1) and RM0.55 (R2), which represent upside potentials of 13% and 20%, respectively.

• Our stop loss price is pegged at RM0.41 (or 11% downside risk).

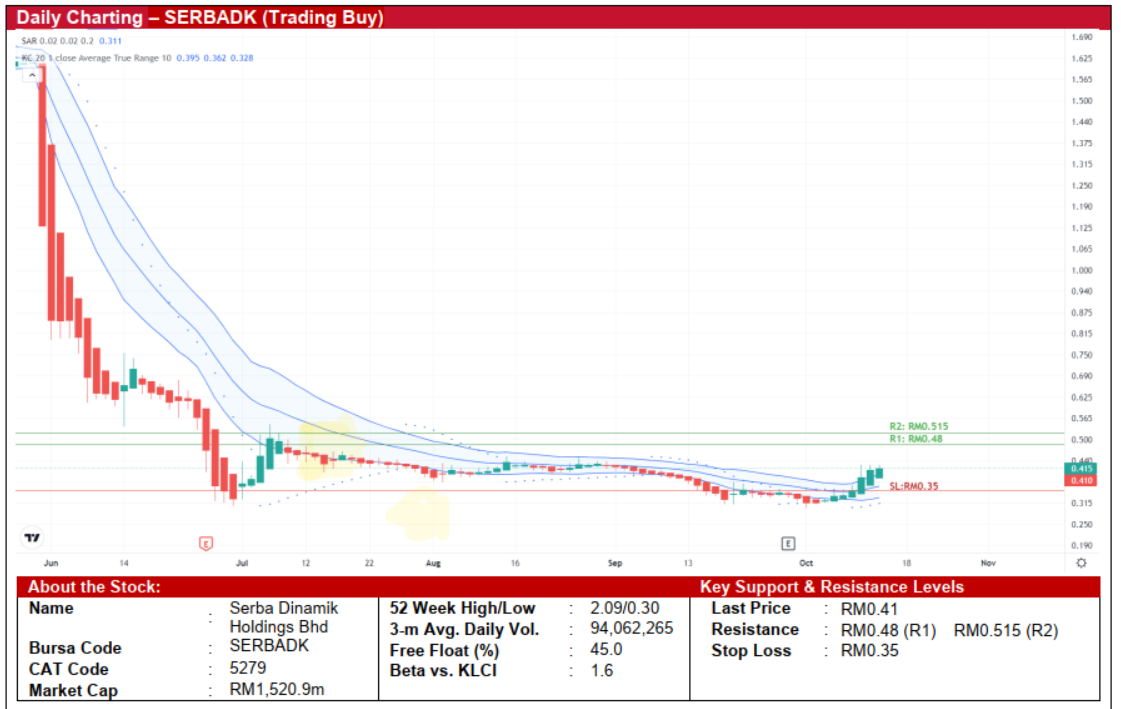

Serba Dinamik Holdings Bhd (Trading Buy)

• Chart-wise, SERBADK’s share price has plunged from a high of RM1.61 (at the end of May 2021) to a low of RM0.305 (in end-June 2021), representing a retracement of 81%.

• Since then, the stock has been treading sideways while bouncing off its trough to close at RM0.41 yesterday, representing an increase of 34% from the lowest level.

• The share price is currently on the edge of staging a technical breakout based on the following technical signals: (i) the emergence of green-body Heikin-Ashi candles with no lower shadow, which indicates upward bias, (ii) the stock is currently trading above the upper-band of the Keltner Channel, and (iii) the Parabolic SAR indicator is trending upwards.

• With that, from a technical standpoint, the stock could climb to test our resistance thresholds of RM0.48 (R1; 17% upside potential) and RM0.515 (R2; 26% upside potential).

• We have placed our stop loss price at RM0.35 (translating to a downside risk of 15%).

• Business-wise, SERBADK is an integrated oil and gas (O&G) services provider that offers 4 main services, namely: (i) Operations & Maintenance, (ii) Engineering, Procurement, Construction & Commissioning, (iii) Information & Communication Technology, and (iv) Education & Training.

• From a fundamental perspective, the group reported its lowest quarterly net profit of RM13.8m in the 6QFY21 amidst uncertainties arising from some ongoing accounting issues.

• In response, SERBADK has recently announced a restructuring of their management team in order to further streamline its operations while meeting shareholders’ mandate.

Source: Kenanga Research - 14 Oct 2021

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

More articles on Kenanga Research & Investment

Created by kiasutrader | Nov 22, 2024