Daily technical highlights – (MAHSING, ESCERAM)

kiasutrader

Publish date: Tue, 30 Nov 2021, 09:10 AM

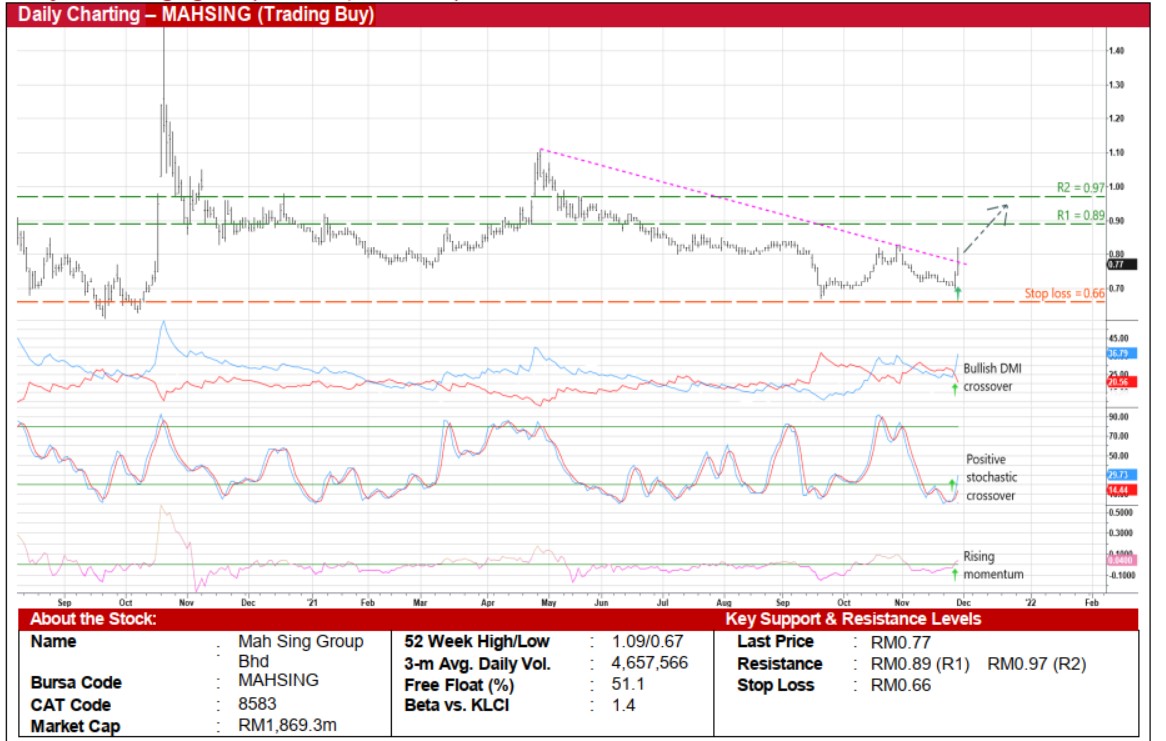

Mah Sing Group Bhd (Trading Buy)

• From a peak of RM1.44 on 20 October last year, MAHSING’s share price has plunged to a low of RM0.67 on 21 September this year before bouncing up subsequently to close at RM0.77 yesterday.

• As the shares hover slightly above the previous price level (of RM0.71) just before the group first revealed its plan in mid October last year to venture into the manufacturing and trading of gloves, the revival of buying interest in glove shares since last Friday could lift the stock price ahead.

• MAHSING’s gloves manufacturing business – which has commenced operations in May this year – is expected to contribute positively to the group’s earnings when the plant (with an annual production capacity of 3.68b pieces) is fully completed by this year-end.

• While its existing businesses (in property development and plastics manufacturing) led the group to post net profit of RM80.7m (+94% YoY) in 1HFY21, consensus is forecasting MAHSING to make RM149.3m in FY December 2021 and RM210.9m in FY December 2022. This translates to forward PERs of 12.5x this year and 8.9x next year, respectively.

• From a technical perspective, the share price could get a lift following the bullish signals triggered by: (i) the DMI Plus crossing over the DMI Minus, (ii) the stochastic %K line cutting above the %D line in the oversold area, and (iii) the rising momentum indicator after climbing above zero.

• On the way up, the stock will probably advance towards our resistance thresholds of RM0.89 (R1; 16% upside potential) and RM0.97 (R2; 26% upside potential).

• Our stop loss price level is pegged at RM0.66 (representing a 14% downside risk).

ES Ceramics Technology Bhd (Trading Buy)

• Following a jump of 13.6% over the past two market days amid strong trading volume to close at RM0.46 yesterday, ESCERAM shares are in the midst of testing the 100-day SMA.

• And a technical breakout may be forthcoming as the share price is expected to shift higher based on the positive signals arising from: (i) the stochastic %K line crossing over the %D line in the oversold area, and (iii) the increasing momentum indicator after cutting above the zero-line.

• With that, the stock could climb towards our resistance thresholds of RM0.54 (R1; 17% upside potential) and RM0.60 (R2; 30% upside potential).

• We have set our stop-loss price level at RM0.39 (representing a 15% downside risk).

• On the fundamental front, after posting a net profit jump to RM30.2m in FY May 2021 (from RM2.3m in the prior year), ESCERAM – which is in the business of manufacturing of hand formers or glove moulds – saw continued strong earnings momentum when the group reported net earnings of RM9.4m in 1QFY22 (versus 1QFY21’s net profit of RM3.2m).

• Financially steady, ESCERAM’s balance sheet is backed by a net cash position of RM68.3m (translating to 13.5 sen per share or almost one-third of its existing share price) as of end-August 2021.

Source: Kenanga Research - 30 Nov 2021

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

More articles on Kenanga Research & Investment

Created by kiasutrader | Nov 22, 2024