Daily technical highlights – (AXIATA, TAKAFUL)

kiasutrader

Publish date: Fri, 24 Dec 2021, 09:11 AM

Axiata Group Bhd (Trading Buy)

• AXIATA shares will probably show an upward bias ahead as the stock has traditionally registered a positive performance in the month of December.

• This has been the case in nine of the last 10 years (including the most recent six years) with an average monthly return of +4.9% since 2011. For history to repeat itself, its share price – which ended at RM3.69 yesterday – has to climb above the end-November close of RM3.90 by next Friday.

• On the chart, an ensuing technical rebound is anticipated following the stochastic indicator’s reversal from an oversold area with the stock set to rise from the lower range of an ascending price channel.

• With that, AXIATA’s share price could shift higher towards our resistance thresholds of RM4.05 (R1; 10% upside potential) and RM4.25 (R2; 15% upside potential).

• We have placed our stop loss price level at RM3.34 (or a 9% downside risk).

• A leading telecommunications group in Asia focusing on digital telco, digital businesses and infrastructure, the group reported a net profit of RM702.9m (+13% YoY) in 9MFY21.

• Going forward, consensus is projecting AXIATA to post net earnings of RM1,210m for FY December 2021 and RM1,408m for FY December 2022. This translates to forward PERs of 28.0x this year and 24.0x next year, respectively.

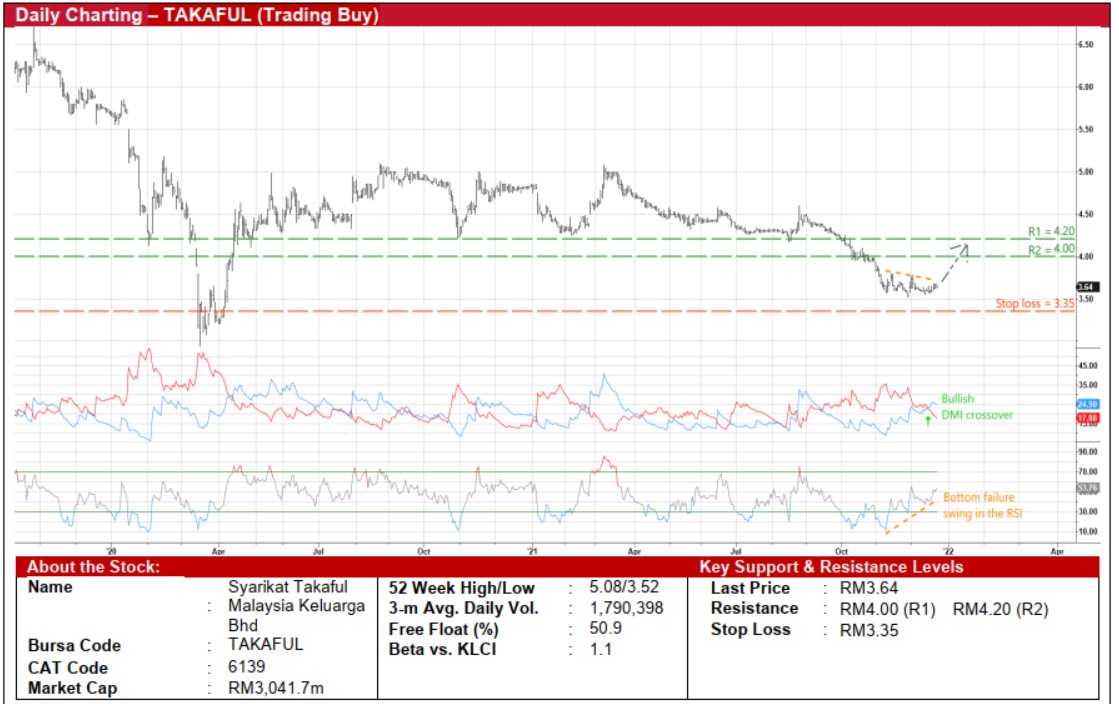

Syarikat Takaful Malaysia Keluarga Bhd (Trading Buy)

• After sliding from this year’s high of RM5.08 in early March to a trough of RM3.52 in end-November (its lowest level since early April last year), a technical rebound may be forthcoming for TAKAFUL shares.

• From a charting standpoint, its share price – which ended at RM3.64 yesterday – will likely shift up ahead following: (i) the bullish crossover by the DMI Plus above the DMI Minus indicator; and (ii) the occurrence of a bottom failure swing in the RSI indicator (which plotted higher lows in the oversold area while the price was weakening).

• On the way up, the stock could climb towards our resistance thresholds of RM4.00 (R1; 10% upside potential) and RM4.20 (R2; 15% upside potential).

• Our stop loss price level is pegged at RM3.35 (or an 8% downside risk).

• Fundamentally speaking, TAKAFUL – which has two licenced entities to manage the Family Takaful business and the General Takaful business – has shown a resilient financial performance with its 9MFY21’s net earnings coming in at RM255.3m (-2% YoY) amid the pandemic-related business disruptions.

• Moving forward, the group is projected to post net profit of RM357.9m for FY December 2021 and RM367.2m for FY December 2022 based on consensus expectations.

• The stock is currently trading at P/BV multiple of 1.7x based on its BV per share of RM2.10 as of end-September this year.

• In addition, an interim DPS of 12 sen has been declared – with the shares to trade ex-dividend on 29 December 2021 while payment date is fixed on 17 January 2022 – which implies a dividend yield of 3.3%.

Source: Kenanga Research - 24 Dec 2021

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

More articles on Kenanga Research & Investment

Created by kiasutrader | Nov 22, 2024