Daily technical highlights – (SERSOL, SCGBHD)

kiasutrader

Publish date: Tue, 11 Jan 2022, 11:19 AM

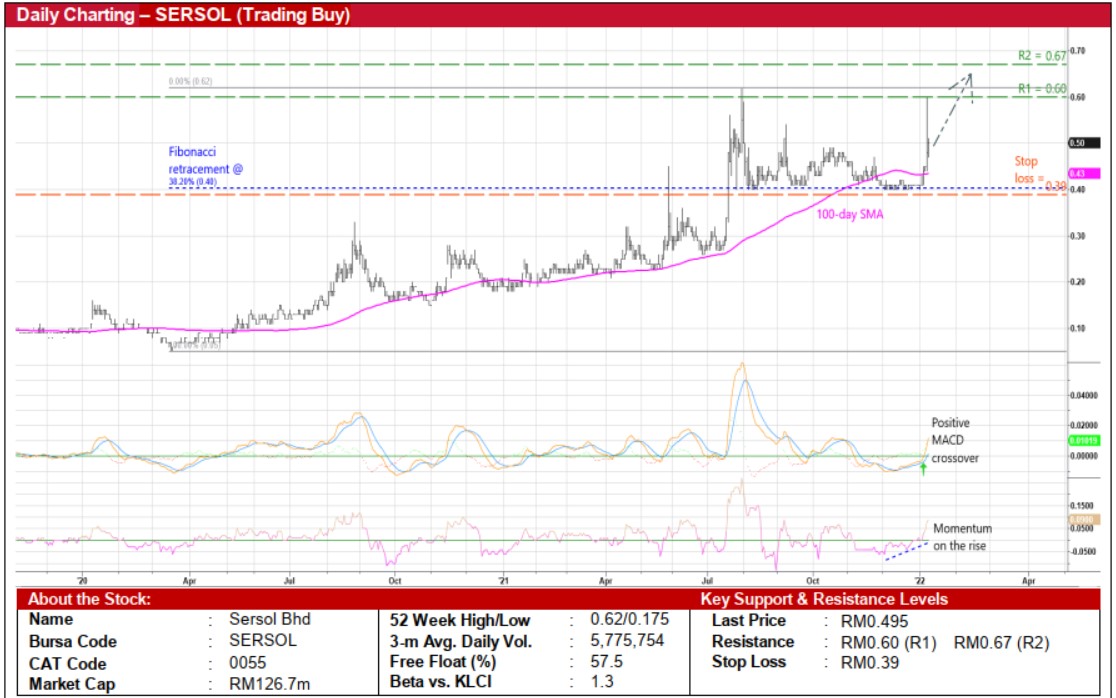

Sersol Bhd (Trading Buy)

• The prevailing share price weakness of SERSOL – which had spiked up to a high of RM0.60 last Friday before pulling back to close at RM0.495 yesterday – presents a trading buy opportunity as its technical outlook remains positive at this juncture.

• After bouncing off from the 38.2% Fibonacci retracement line to overcome the 100-day SMA, coupled with the MACD crossing over the signal line (in the oversold area) and the momentum indicator on the rise (above the zero-line), the stock will likely resume its upward trajectory ahead.

• On the way up, SERSOL shares could climb to challenge our resistance targets of RM0.60 (R1; 21% upside potential) and RM0.67 (R2; 35% upside potential).

• Our stop loss price level is set at RM0.39 (or a 21% downside risk).

• Fundamental-wise, the group is involved in the coating business, namely plastic & metal coatings (for the electronic & electrical industry), wood coatings and decorative coatings.

• SERSOL made a minute net loss of RM0.1m in 3QFY21 (versus a breakeven position in the same quarter the previous year), taking its 9MFY21’s net profit to RM0.1m (versus a net loss of RM0.2m during the same period last year).

• With a debt-free balance sheet, the group is financially stable, backed by cash holdings of RM10.3m (or 4.0 sen per share) as of end-September 2021.

Southern Cable Group Bhd (Trading Buy)

• The probable formation of a double-bottom reversal pattern could pave the way for SCGBHD shares to shift higher going forward after tumbling from a high of RM0.55 in end-October last year.

• An upward swing in the share price is anticipated following the DMI Plus crossover above the DMI Minus and the MACD cutting above the signal line in an oversold territory.

• Riding on the renewed strength, the stock could climb towards our resistance thresholds of RM0.47 (R1) and RM0.52 (R2). This translates to upside potentials of 13% and 25%, respectively.

• We have placed our stop loss price level at RM0.37 (or an 11% downside risk from yesterday’s close of RM0.415).

• Meanwhile, SCGBHD (which was listed on the ACE Market in mid-October 2020) has transferred its listing status to the Main Market on 28 October last year. This is expected to boost the investability of its shares to a wider pool of investors.

• As a manufacturer of cables and wires that are used for power distribution and transmission, communications as well as control and instrumentation applications, SCGBHD is a proxy to the increased infrastructure spending (including 5G network rollouts) by utility players such as Tenaga Nasional, Telekom Malaysia and Petronas.

• In the most recent quarter ended September 2021, the group made net profit of RM1.4m (-81% YoY), taking its 9MFY21’s bottomline to RM8.1m (-51% YoY) as its underlying performance was dragged down by business disruptions arising from the Covid-19-related movement restrictions and higher raw material costs.

• Forward earnings will be underpinned by an existing order book of RM550m to be recognized over the coming two years.

Source: Kenanga Research - 11 Jan 2022

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

More articles on Kenanga Research & Investment

Created by kiasutrader | Nov 22, 2024