Daily technical highlights – (GDEX, MYNEWS)

kiasutrader

Publish date: Thu, 13 Jan 2022, 09:03 AM

GDEX Bhd (Trading Buy)

• GDEX offers a comprehensive spectrum of logistical-related products and services such as: (i) domestic express carrier, (ii) international express carrier, (iii) customized logistic solutions, and (iv) logistics services.

• GDEX is able to leverage on its economies of scale to serve a wide array of customers as they have a network of 410 stations located at strategic areas.

• Going forward, the group plans to grow its revenue further by providing postal services for various e-commerce businesses.

• For the latest reporting period ended September 2021, GDEX posted a higher net profit of RM9.5m (+48.4% QoQ) mainly lifted by lower operating expenses.

• Consensus is forecasting GDEX to register a net profit of RM30.0m in FY June 2022 and RM32.9m in FY June 2023, which translate to forward PERs of 53.9x this year and 49.2x next year, respectively.

• Chart-wise, after sliding from a high of RM0.545 (in the beginning of November 2020) to a low of RM0.275 (in end-December 2021), a trend reversal may be on the horizon as the shorter term moving average has crossed above the longer term moving average.

• With the MACD line crossing above the signal line too, the stock could climb to challenge our resistance thresholds of RM0.34 (R1: 17% upside potential) and RM0.36 (R2: 24% upside potential).

• We have pegged our stop loss at RM0.25, which represents a downside risk of 14%.

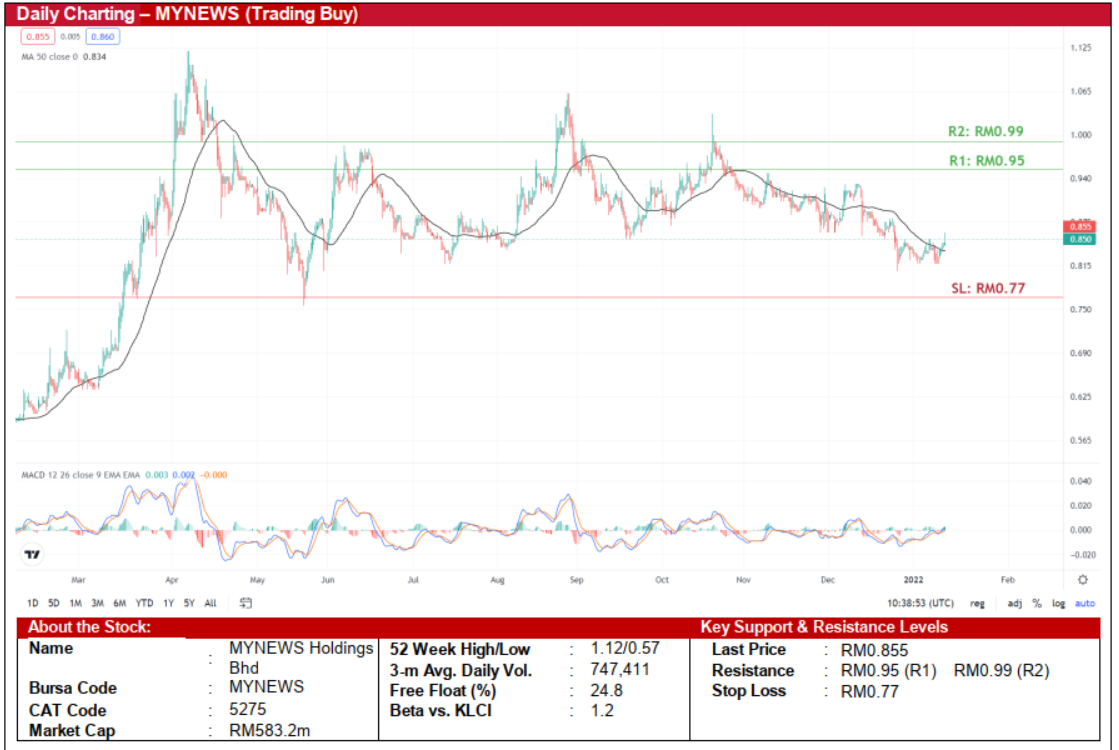

MYNEWS Holdings Bhd (Trading Buy)

• MYNEWS shares may be on the way to tread higher following the price crossover above the 50-day Moving Average.

• In addition, with the MACD line remaining above the signal line, the stock could advance to challenge our resistance thresholds of RM0.95 (R1) and RM0.99 (R2), which represent upside potentials of 11% and 16%, respectively.

• Our stop loss level has been set at RM0.77, which translates to a downside risk of 10%.

• MYNEWS is an established homegrown chain of convenience stores with outlets across Malaysia.

• In its most recent 4QFY21, MYNEWS’ top-line came in at RM104.0m (+10.7% QoQ) while its net loss narrowed QoQ to RM8.9m (versus a net loss of RM14.9m in 3QFY21), taking its full-year FY October 2021’s net loss to RM43.0m (versus a net loss of RM9.2m in FY October 2020).

• Consensus is projecting MYNEWS to return to profitability in FY October 2022 with a net income of RM17.4m before rising further to RM29.6m in FY October 2023. This translates to forward PERs of 33.5x this year and 19.7x next year, respectively.

Source: Kenanga Research - 13 Jan 2022

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

More articles on Kenanga Research & Investment

Created by kiasutrader | Nov 22, 2024