Daily technical highlights – (JAG, PESTECH)

kiasutrader

Publish date: Wed, 19 Jan 2022, 09:13 AM

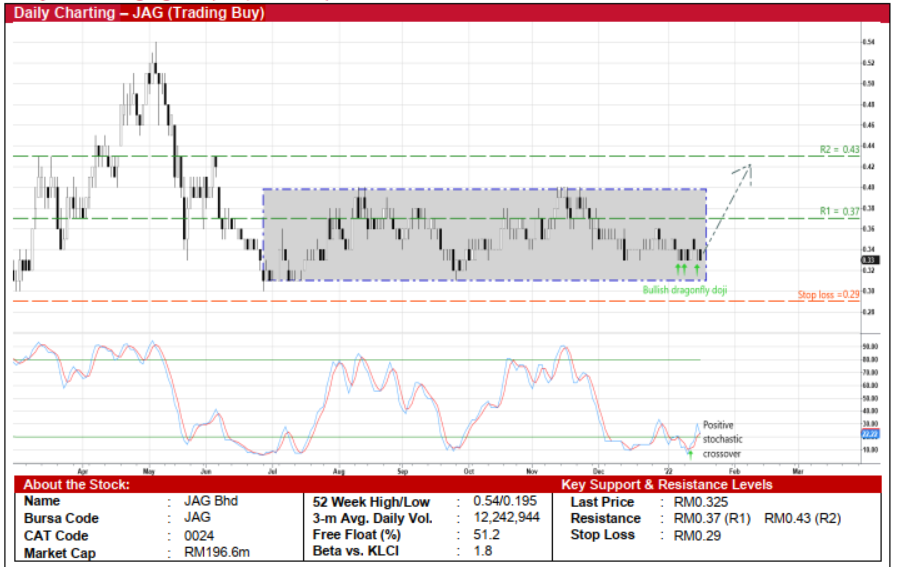

JAG Bhd (Trading Buy)

• JAG’s share price – which has been locked inside a rectangle formation since end-June last year and is presently trading near the bottom of the trading range – could shift higher going forward.

• The positive technical outlook is triggered by: (i) a reversal by the stochastic indicator from an oversold position as the % K line cuts above the %D line; and (ii) the recent appearance of several bullish dragonfly doji candlesticks.

• On the way up, the stock will probably climb towards our immediate resistance target of RM0.37 (R1). Following which, a likely breakout from the rectangle pattern could propel the shares to challenge our next resistance threshold of RM0.43 (R2). This represents upside potentials of 14% and 32%, respectively.

• Our stop loss price level is pegged at RM0.29 (or an 11% downside risk).

• Fundamentally, JAG is one of Malaysia’s leading total waste management services providers by market share with a niche in the recovery and recycling business of e-waste (electrical & electronic wastes). In addition, the group is involved in coin operated laundry services, property development & software solutions.

• JAG – which sources for scheduled waste from local semiconductor manufacturers, process and/or convert the collected scheduled waste into valuable commodities (such as copper, tin, silver and gold) for resale in the export markets – offers exposure to the prevailing elevated commodity prices.

• On account of a consistent stream of quarterly net profit of RM5.4m (+252% YoY) in 1QFY21, RM4.6m (+110% YoY) in 2QFY21 and RM4.6m (+87% YoY) in 3QFY21, the group posted 9MFY21’s net earnings of RM14.6m (up 136% YoY).

• JAG is also sitting on net cash position of RM18.6m (or 3.1 sen per share) as of end-September last year.

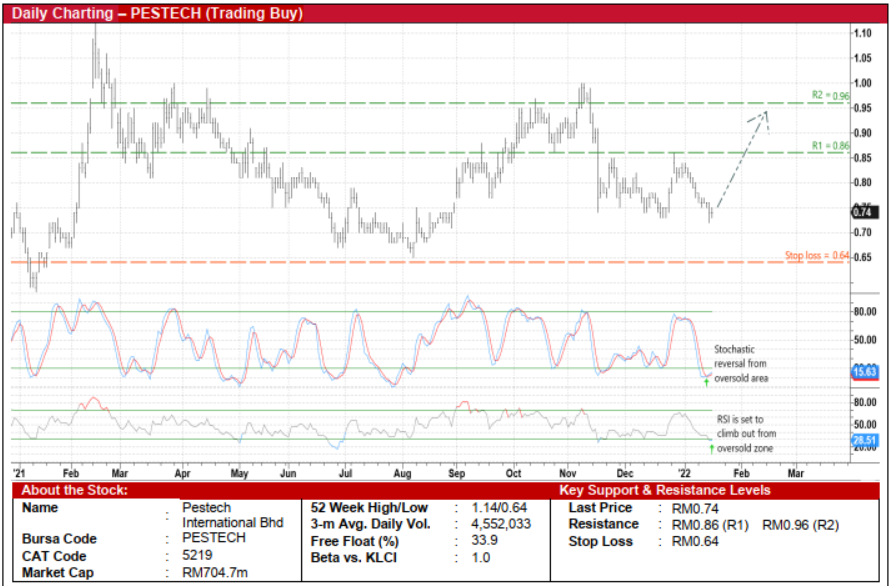

Pestech International Bhd (Trading Buy)

• A technical rebound could be in the offing for PESTECH shares after tumbling from a recent high of RM1.02 in the first half of November last year to close at RM0.74 on Monday.

• An upward shift in the share price is now anticipated as both the stochastic and RSI indicators are in the midst of reversing from their oversold positions.

• With that, the stock may be on its way to scale towards our resistance thresholds of RM0.86 (R1; 16% upside potential) and RM0.96 (R2; 30% upside potential).

• We have set our stop loss price level at RM0.64 (or a 14% downside risk).

• PESTECH is an integrated electrical power technology company with core businesses in electrical system, transmission line & power cables, infrastructure asset management, power generation, rail electrification & signalling and power distribution & smart grid.

• After reporting net profit of RM66.2m (+29% YoY) in FY June 2021, the group’s bottomline came in at RM11.9m (-21% YoY) in 1QFY22.

• Going forward, based on our fundamental research team’s forecasts, PESTECH is projected to log rising net earnings of RM75.7m in FY June 2022 and RM87.0m in FY June 2023. This translates to undemanding forward PERs of 9.3x and 8.1x, respectively.

• In terms of recent corporate developments, in late December last year, PESTECH has secured a contract worth RM743m to design, supply, install, test and commission for Automated People Mover and associated works (including Operation & Maintenance Services) at KL International Airport.

Source: Kenanga Research - 19 Jan 2022

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

More articles on Kenanga Research & Investment

Created by kiasutrader | Nov 22, 2024